This article first appeared in Personal Wealth, The Edge Malaysia Weekly on November 20, 2017 - November 26, 2017

Life insurance is an essential part of financial planning. However, few make provisions to ensure that their beneficiaries can manage the wealth they will inherit.

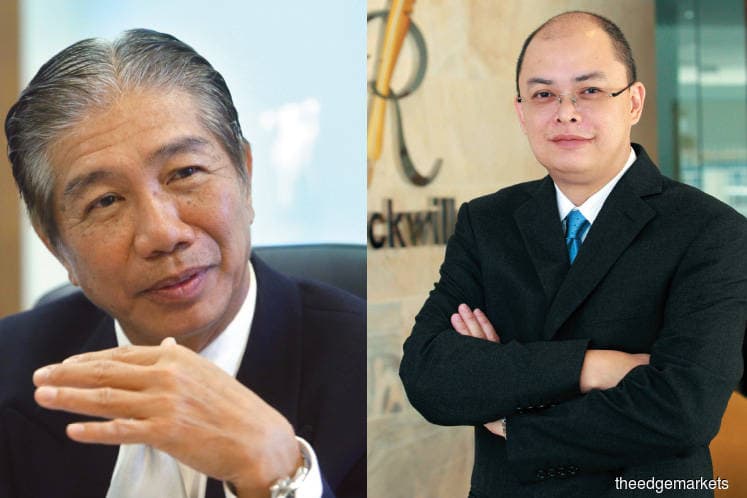

“Insurance is the most expensive asset for the man in the street. Everyone wants protection. That is why we plan for the future,” says Rockwills International Group managing director Saw Leong Aun.

For many, their life insurance policy is their greatest asset and is the only protection for their next of kin in the event of their death or total and permanent disability. However, this is incomplete without an insurance trust, says Rockwills.

An insurance trust works just like a private trust, but the asset assigned to it is an insurance policy. A private trust is a financial structure set up to transfer the legal ownership of an individual’s assets to trustees who will hold, manage and distribute the assets to the individual’s beneficiaries, often upon death. The trust document appoints a trustee to administer the assets held by the trust and provides the terms under which they should be administered.

It is important to note that a life insurance trust is an irrevocable and non-amendable facility. It is set in stone as the primary purpose of the trust is to help beneficiaries who are minors or persons unable to manage proper financial dealings.

The trust deed designates the beneficiaries and details the terms by which they will receive benefits from the trust. “For example, if I suffer a stroke — which can extend from partial to total permanent disability — or fall into a coma, it puts a severe strain on my family members, especially if I am the sole breadwinner. I am not dead. So, on top of their daily financial needs, there is also the question of my medical care,” says Saw.

“If I don’t protect that fund [the lump sum payout from the insurance policy] and I am in a coma, who will be authorised to manage that money? In some cases, if the wife is paralysed or in a coma, the husband may take the money and refuse to take care of the wife. So, via an insurance trust, I make it easy for the people who have to care for me to deal with the living expenses and fund my treatments.”

More security with a trust structure

If the data on spending habits following a windfall are anything to go by, the trust mechanism is probably the only instrument to protect the future of your loved ones, says Rockwills deputy CEO Azhar Iskandar Hew.

According to a 2014 survey conducted by the US-based National Endowment for Financial Education, it was found that up to 70% of individuals who come into the sudden possession of money — whether from winning a lottery, an inheritance, an insurance settlement or a pension payout — will deplete the funds in a matter of years. Last December, the Employees Provident Fund was reported as saying that many of its contributors use up their savings within three to five years of tapping their retirement fund.

A trust structure will also prevent situations where third parties try to take advantage of the sudden windfall, says Saw. “For example, I have two young daughters and I am their living parent as my wife has passed away. There may be people who will try to get close to them for the money they will inherit from my life insurance.

“So, when I set up a trust, I can specify that in the event something happens to me, my daughters will only receive money for their living expenses. I can also specify that they will only receive 10% a year from the trust after they graduate.

“So, even if someone tries to cheat them, he won’t be able to swindle all of their inheritance. And my daughters will have at least 10 years to get wiser and learn how to manage their finances. Also, if they have so much money at their disposal, they may not want to work.”

Matters could get even more complicated if there are estranged spouses or minors involved. Without a trust structure in place, the insurance settlement will be given to the living parent of minors in the absence of a legal guardian, even though the relationship may have suffered a setback after years of estrangement.

“If I am a single parent, upon my death, the insurance settlement will be given to my ex if I had not legally appointed a guardian for my children. It doesn’t matter if you are divorced, if he or she has remarried or is estranged from you and your children, your ex will still be the trustee of the money for the children. This is something that most people are not aware of. The estranged parent is still the legal guardian if no legal provision has been made to name one,” says Saw.

“[With a life insurance trust] if I have young children, I can decide how I want it disbursed, the intervals and the purpose. For example, I can assign the trustee to pay for my children’s tuition and educational expenses and after my children graduate — if there is any money left — I can give them RM1,000 a month until they gain employment. As for my spouse, I can allocate RM3,000 monthly to continue supporting the family and running the household.”

Saw says the amendments to the Financial Services Act 2013 state that the policyholder cannot be the trustee of his/her own insurance money. In the event that there is no qualified person to step in and take over, and in the absence of an insurance trust, the insurance payout will be managed by public trustee Amanah Raya Bhd. Beneficiaries will be able to claim their share of the insurance settlement when they come of age.

“Say, I have not appointed a trustee. The Act specifies that children who are above 18 can claim the money and be the trustee of it. But at 18, will these young adults, most of whom have never had so much to manage to begin with, be able to handle the sudden emotional and financial responsibility, especially after losing their parents? What if there are younger children involved? Will the older ones continue to care for them? We cannot leave these kinds of situations to chance.

By setting up an insurance trust, individuals not only get to set the terms — ensuring a steady flow of income to finance education needs and living and medical expenses — but also protect their beneficiaries from creditor claims, says Hew.

He adds that trusts are not subject to the Islamic law of inheritance (faraid), which dictates the distribution of a deceased’s estate in accordance with the Quran and the Hadith. Under the provisions of the law, the religious authorities decide how a Muslim’s estate is to be distributed (in most cases, male heirs receive double the amount received by a female heir). Parents and siblings also have claim to the assets under Islamic law.

“Say you are a Muslim. By placing your life insurance in an insurance trust, you can make sure that what you are leaving behind is somewhat equally disbursed,” says Hew.

That is because assets in a trust come under the purview of the trustee, which takes effect immediately. As the assets are no longer part of anyone’s estate, they are not subject to the faraid.

Hew advises clients to put aside some insurance money to pay off liabilities such as credit card debt, personal loans, hire-purchase loans and even loans taken to finance property investment. For example, if you are a property investor, normally you will not take the Mortgage Reducing Term Assurance (MRTA) for all of the properties. So, this actually reduces the compound interest effect on the property owned and the possibility of a lawsuit when you are no longer around or incapable.

“The insurance trust will help settle loans while waiting for the will to kick in (if any) and relay instruction of the executor to look for an appropriate buyer. That buys you a bit of a time and allows you to get a good value for your investment. Otherwise, you will have to do a forced sale, which means giving up your investment for a low price. At least with a certain amount of money, you will have a year to two to find a suitable buyer,” says Hew.

An insurance trust also allows the policyholder to extend protection to his parents, siblings or even a charity of his choice. “But if they don’t do this and follow the insurance nomination, they can only nominate their immediate family members. So, there is a limitation there,” says Hew.

Rockwills is one of many private trust companies. It has more than 8,000 private trust funds, the assets of which are valued at almost RM8 billion. The company charges a one-time fee of 0.75% for life insurance policies where the sum insured is RM1 million or less. As the sum insured increases, the fee is significantly reduced.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.