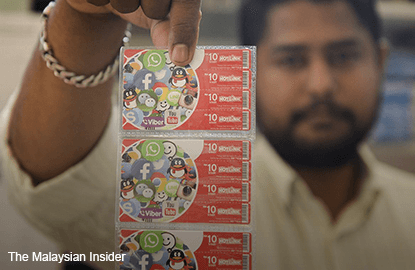

(Oct 20): PKR has expressed doubt over Putrajaya’s decision to revert mobile prepaid reload cards to pre-goods and services tax (GST) prices, saying that the government had previously made many promises but the people were still burdened with the tax.

Its strategic director, Sim Tze Tzin, said the government would not be able to resolve this issue, adding that the people’s confidence in the government was eroding because of the many broken promises.

“This is really not fair to the low-income earners, retirees and the young who believed in the government’s promises,” he said in a statement today.

“Since April until now, seven months have passed, three ministers have come and gone but the solution has yet to be found. This proves the failure of the Umno-Barisan Nasional government.”

Deputy Finance Minister Datuk Johari Abdul Ghani was reported as saying in Utusan Malaysia yesterday that the Customs Department would announce that mobile prepaid top-up cards would revert to the pre-GST prices on November 1.

He said the department and the Malaysian Communication and Multimedia Commission (MCMC) were in talks to ensure that consumers no longer paid the GST for mobile prepaid cards.

Sim said this announcement has brought up many questions, urging Putrajaya to reveal the mechanism to revert the prices to pre-GST days.

“His (Johari’s) statement is full of contradictions,” the Bayan Baru MP said.

“First of all, during the times of the SST (sales and services tax), telcos absorbed the 6% tax but has refused to do the same with the 6% GST. Last June, the former minister Datuk Seri Shabery Cheek said the government was powerless to force telcos to absorb the GST. And he admitted that the GST will be imposed on top-up cards.

“The other point is that, the government has refused to list prepaid mobile cards under zero-rated as the GST collected from this would bring in some RM850 million in revenue for them annually,” Sim said, adding that Shabery had also said that tax exemptions should not be given in this as it would undermine investor confidence in the GST.

“The latest announcement is that when consumers buy RM10, they will get RM10 worth in value. This would mean consumers would not be imposed with the GST,” Sim said.

“So the question is who is absorbing the RM850 million in lost tax revenue? This is a RM850 million question. Will the money fall from the sky?” – The Malaysian Insider