(Sept 10): Off-budget spending by Putrajaya has gone up by 86.8% since 2009, more than what is officially earmarked in the annual budget, which is risky as MPs and the public have almost no oversight on how that money is spent, said a federal lawmaker.

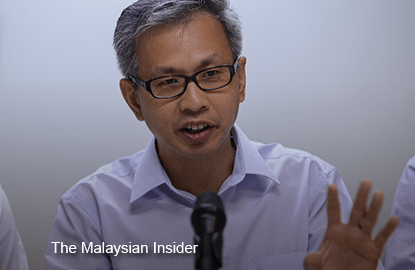

Petaling Jaya Utara MP Tony Pua said that official government spending in the annual budget had only gone up by 25% from 2009 (RM206.6 billion) to 2013 (RM249.7 billion).

But in the same period, off-budget spending, or money that is spent but is not part of the official budget, has increased by 86.8%, from RM84.3 billion to RM157.5 billion in the same period, Pua said.

The off-budget spending that MPs have been able to find out are classified as “contingent liabilities”, Pua said on the sidelines of a dialogue on the Open Budget Survey 2015 in Kuala Lumpur.

An example of this is money borrowed by a government-linked company from the market to implement a strategic, public-interest project such as the Mass Rapid Transport (MRT) system.

The borrowings are guaranteed by the government, so the public ends up paying it if the company defaults on them, he said.

“It is still government spending by other means, even if it is not stated in the budget.”

Pua’s statement comes as Putrajaya is soliciting input from the public for its 2016 budget which is expected to be tabled in Parliament next month.

The loans by GLCs could be construed as government spending, said financial analyst Teh Chi Chang, as these firms would never have been able to raise the money they needed had they not been guaranteed by the government.

“The government is liable to pay the money if the company defaults,” said Teh, another panellist at the dialogue organised by the Institute of Democracy and Economic Affairs (Ideas).

Teh has authored a book on how the Barisan Nasional crafts the national budget titled “Umno-nomics: The Dark Side of the Budget”.

Pua said the reason Putrajaya spends money off-budget is so that it can avoid adding to the national debt, which would spook international credit rating agencies.

Putrajaya has taken pains to keep on the good side of the three main credit ratings agencies, Standard & Poor’s, Moody’s and Fitch.

In June, government officials had courted Fitch Ratings after reports emerged that the agency was thinking of downgrading Malaysia’s ratings due to the RM42 billion debt chalked up by state-owned investment arm 1Malaysia Development Berhad (1MDB).

“So the budget document that we see every year is full of asset purchases for ministries and salaries for staff. But the real substantive stuff is not in the budget,” said Pua.

Racking up contingent liabilities is risky, said Pua, and European governments have devised ways to incorporate this type of spending in official budgets so as to effectively monitor them.

“One reason why Greece has found itself in so much trouble is because of all the contingent liabilities the country had,” said Pua.

Although MPs have managed to track down the government’s contingent liabilities, other forms of off-budget spending, such as letters of guarantee, are harder to track, he said. – The Malaysian Insider