This article first appeared in The Edge Malaysia Weekly, on November 16 - November 22, 2015.

WHEN the economic climate turns harsher, consumers may cut back on spending but certainly not on toilet rolls and diapers.

Hence, the earnings of NTPM Holdings Bhd, a leading manufacturer of tissues and personal care products, are expected to be resilient, or at least less affected by any slowdown in the economy.

NTPM’s consistent performance in the past 12 years says it all.

After a challenging year, the Penang-based company is expecting better results in the current financial year ending April 30, 2016 (FY2016). Its profit was dragged by higher fuel, labour and electricity costs in FY2015.

NTPM’s net profit jumped 84.5% to RM12.92 million in the first financial quarter ended July 31, 2015 (1QFY2016), compared with 1QFY2015, although its quarterly revenue grew at a much slower pace to RM143.4 million from RM132.24 million a year ago.

The 1QFY2016 profit is equivalent to about 30% of the full-year profit of FY2015.

In FY2015, NTPM’s net profit slipped to RM42.64 million from RM53.89 million in the preceding year while its revenue was almost flat at RM547.51 million, compared with RM541.4 million a year ago.

The drop in FY2015 earnings interrupted the steady profit climb in the past three financial years. Subsequently, NTPM’s (fundamental: 1.30, valuation: 0.50) share price headed south. The stock fell from a high of 90 sen in June last year to a low of 60 sen in early January.

Nonetheless, its share price has regained some lost ground in the past few months to close at 79 sen last Thursday. It has gone up 25% year to date, trading at a price-earnings ratio of 18.4 times.

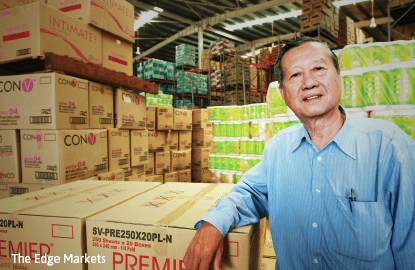

Managing director and founder Lee See Jin tells The Edge in an interview that NTPM’s impressive quarterly earnings were driven by the improved margin of its tissue products and growth in the personal care products segment — a division the company intends to expand further in the current financial year.

“While our paper products segment is enjoying steady growth, we are looking at increasing revenue contribution from our personal care products, which currently stands at 30%, with the launch of new products such as wet tissues and baby wipes in May this year,” says Lee, 76, who founded the company in 1975.

The group’s personal care products include baby and adult diapers (Diapex), feminine hygiene products (Intimate) and cotton products and wet and baby wipes (Premier).

However, Lee, who has been in the paper industry for almost four decades, acknowledges that it would not be plain sailing either as the depreciation of the ringgit would add to its input costs because its personal care products have relatively high imported content.

“Most of our personal care products are for local consumption. Because of the weak ringgit, the cost of imported raw materials has gone up,” he says. However, he notes that the paper products division’s exports will help mitigate the impact of the weaker local currency.

“About 33% of our paper products are exported. Our products are now more competitive with the weaker ringgit.”

Paper products are still a major contributor to NTPM’s earnings accounting for about 70%. The company produces tissues, paper towels and serviettes under the brands Premier, Cutie, Royal Gold, ConV and Budget.

To sustain NTPM’s profit margin, Lee insists on sticking to the traditional business model — eliminate the middle man in the distribution chain. “We don’t believe in using agencies for our distribution. We use our own trucks with our own people to deal with our customers, which range from hypermarkets to small-town convenience stores. This also adds a personal touch to our business.”

He believes the company made a wise decision three years ago, which was to embark on an expansion programme, including investing RM80 million in manufacturing facilities in Vietnam. This has laid the foundation for future growth.

“Looking at the weak ringgit and the uncertainties in the market now, we believe it was a wise decision to grow our business then, and in the next two years, we will not be incurring any large capital expenditure. We will only be setting aside RM20 million a year for the upkeep of our machinery,” he says.

Locally, NTPM has two paper product plants — in Nibong Tebal, Penang, and Bentong, Pahang. Including the Vietnam plant, it has an annual capacity of about 110,000 tonnes of tissue paper.

The company’s three personal care product factories are in Nibong Tebal and Parit Buntar in Perak.

According to Lee, NTPM aims to increase its presence in Indochina, using Vietnam as its launch pad. “Our focus in the next two years will be on having a greater presence in Indochina, particularly Vietnam, as we believe there is a lot of potential, not to mention the ease of doing business there ... we have already invested around RM80 million in the tissue paper plant in Ho Chi Minh City.”

While pursuing growth, NTPM is also environmentally-conscious. At present, 70% of its raw materials are recyclable waste and the remaining 30%, pulp.

“Using recyclable waste for our paper production helps us save on the cost of disposing of it and at the same time, we are doing our part in preserving the environment. In fact, we are exploring other uses for the waste. We will make an announcement when there is substantial development in this area,” says Lee.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.