This article first appeared in The Edge Malaysia Weekly, on March 7 - 13, 2016.

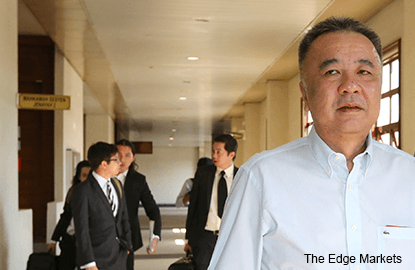

LAST week, Low Thiam Hock @ Repco Low, a well-known figure during the go-go days of the local stock market in the 1990s, was slapped with the longest-ever jail term for share price manipulation — five years — plus a fine of RM5 million.

LAST week, Low Thiam Hock @ Repco Low, a well-known figure during the go-go days of the local stock market in the 1990s, was slapped with the longest-ever jail term for share price manipulation — five years — plus a fine of RM5 million.

The 53-year-old, who is understood to be appealing the Kuala Lumpur Sessions Court’s decision and the sentence, is out on a RM1 million bail — which is in addition to the RM300,000 bail imposed on Jan 11 when he was initially found guilty of the offence he committed about 20 years ago.

Now, back to the past. In August 1995, when Low was in his mid-30s, he was appointed executive chairman of Repco Holdings Bhd, a loss-making auto parts trading company, and Choo Chin Thye was made its CEO. Teras Cemerlang Sdn Bhd was the controlling shareholder. Soon after, the company undertook a restructuring, which included acquiring a stake in Everise Capital Sdn Bhd. The latter owned 75% equity interest in Everise Ventures Sdn Bhd, which ran a 4D numbers forecast operator (NFO) for the Sandakan Turf Club with some 50 outlets in Sabah.

The restructuring was a turning point for Repco. It became a much sexier business with interests in timber, which was then a darling sector, and the NFO, which promised bright earnings prospects.

Repco’s share price surged from RM4.80 in January 1995 to an intraday high of RM140.50 in September 1997 — who wouldn’t want to own the stock?

Berjaya Sports Toto Bhd’s share price too quadrupled at the time but its jump was certainly not as impressive — from about 50 sen in early January 1997 to RM2.24 in March that year although its NFO business is much larger. Multi-Purpose Holdings Bhd, which is now known as Magnum Corp Bhd, only climbed from RM1.50 to RM2.80 in that period.

But the decline in Repco’s share price was also fast and steep. The counter plunged from its peak to RM2.98 in August 1998, when the Asian financial crisis swept through the region. In October 2000, the stock was suspended from trading on Bursa Malaysia and delisted after three years.

Punters in the investing fraternity called the company “Rampco” due to the way its stock was being ramped up. With a share base of only 14.2 million, the counter was cornered (which means the shares were in the hands of only a few and the stock had very little liquidity on the open market). This was why it easily exhibited exaggerated movements.

Many also talked of political undertones in play because while Repco was based in Sabah, other companies, such as Olympia Industries Bhd and Berjaya Sports Toto, were also involved in gaming in the state.

In late December 1995, Olympia made an announcement on the local bourse, then known as the Kuala Lumpur Stock Exchange, that the Ministry of Finance (MoF) had renewed its gaming licence effective Jan 1, 1996.

But in less than two weeks, on Jan 4, the licence was revoked. It is interesting to note that in March 1997, Olympia once again announced that the MoF had agreed to renew its gaming licence to carry out 3D, 4D and Lotto games with effect from Jan 1, 1997.

Talk at the time was that despite federal approval, the Sabah government had refused to allow Olympia back into the state in a politically motivated move.

Meanwhile, Repco’s stake in Everise Capital seemed like a money-making machine, giving the company’s management the platform to obtain loans worth RM255 million from Sime Bank Bhd (which has since become RHB Bank) and trade shares through the stockbroking unit of the bank, racking up huge losses.

There were also disputes over claims that funds were purportedly being released from Sime Bank for the settlement of trading activities.

While Repco’s gaming business was profitable, share trading led to its downfall. As a result of massive losses brought about by share trading, mounting short-term debts and no working capital, Repco defaulted on its loans and in April 1999, special administrators were appointed to it.

Sime Bank’s former CEO, Datuk Ismail Zakaria, was accused of acting beyond his authority and approving a credit facility of RM175 million to Everise Capital in October 1997. The banking executive was charged then, as were Low and Choo. But Choo was lucky that the charge against him was later dropped. By the time Ismail was acquitted in 2014, he was 71 years old.

Low was convicted under section 84(1) of the Securities Industry Act 1983 for acts calculated to create a misleading appearance with respect to the price of Repco’s shares on Dec 3, 1997. Low had bought 227,000 shares and was said to have created a misleading appearance as to the price of the shares on the stock exchange.

He was charged by the Securities Commission Malaysia (SC) in the Sessions Court on Sept 18, 1999, when he was 37. He had allegedly committed the offences when he was 35.

In the run-up to the case, documents were sent by influential politicians to the then SC chairman, Datuk Ali Abdul Kadir, stating that Low was acting under instructions to prop up share prices on the local bourse during the Asian financial crisis. These documents, sighted by The Edge, were dated October 2000.

It is interesting to note that Low’s expert witness, Professor Michael James Aitken, the founder of SMARTS Group, was the maker of a real-time market surveillance system used by Bursa Malaysia. Despite Aitken’s belief that Low had not manipulated Repco’s shares, the prosecution seems to have succeeded in its case.

Low had also stated that he had not given instructions to take up all the sellers at any price, which would indicate that he had not manipulated the shares. He also sought to question the prosecution’s lack of distinction between buyer-initiated and seller-initiated trades and said that the purchase of 227,000 shares was not intended to set or maintain Repco’s share price.

It was also part of his defence that Bursa Malaysia’s surveillance department, headed by Ku Abdul Rahman Ku Sulaiman, did not find any indication of unusual market activity regarding Repco’s shares.

There were also allegations that one of the accounts used — TE2190 — was not legitimate and raised questions as to why contract notes were not sent to the buyer of the shares.

While many will want Low to pay a hefty price for his alleged wrongdoing, some say that due to his age, he may walk away with nothing more than a fine.

Many may not sympathise with Low, especially since he was said to be behind the erratic share price movements of stocks that resulted in many retail investors getting their fingers badly burnt.

“Companies like Hwa Tai [Industries Bhd] were trading at more than RM200 a share, Repco was at more than RM140, some of the others, like PWE [Industries Bhd, which is now Pansar Bhd], Sin Heng Chan [Malaya Bhd], Zaiton Bhd [which was delisted in August 2003], were all trading at crazy valuations. When the crash happened, many were caught,” says a retail investor.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.