This article first appeared in The Edge Malaysia Weekly on April 1, 2019 - April 7, 2019

INVESTORS should have a clearer picture this year on MFRS 9’s impact on banks’ loan loss provisions (LLP) and on potential volatility, says an expert on the accounting standard.

MFRS 9, which came into effect on Jan 1 last year, changes the way banks book provisions on financial assets like loans and bonds. It required banks to make provisions in anticipation of future potential losses, as opposed to the previous practice under MFRS 139 of making provisions only when losses are incurred.

“Last year was a transition year for banks. For the eight Malaysian banks, the rise in LLP ranged from as low as 34% to as high as about 80% on the first day of MFRS 9 adoption, or what is known as Day 1. But this was adjusted in the opening retained earnings and it did not hit their P&L (profit and loss). Any movement in the impairment allowances after that [Day 1], however, was reflected in the P&L.

“Hence, investors cannot compare LLP in the banks’ P&L last year to 2017’s ... it was done on a different basis, and a chunk of it was taken in the retained earnings. This year, however, investors will be able to properly gauge the implications of MFRS 9 on a bank’s LLP,” says Elaine Ng, a partner at PwC, who advises lenders on MFRS 9 implementation.

The Day 1 impact on LLP varied from bank to bank, depending on their loan composition, customer risk profiles and regulatory reserve buffers, among others.

Last year, most banks reported sizeably lower provisions in their income statements, which helped lift profitability.

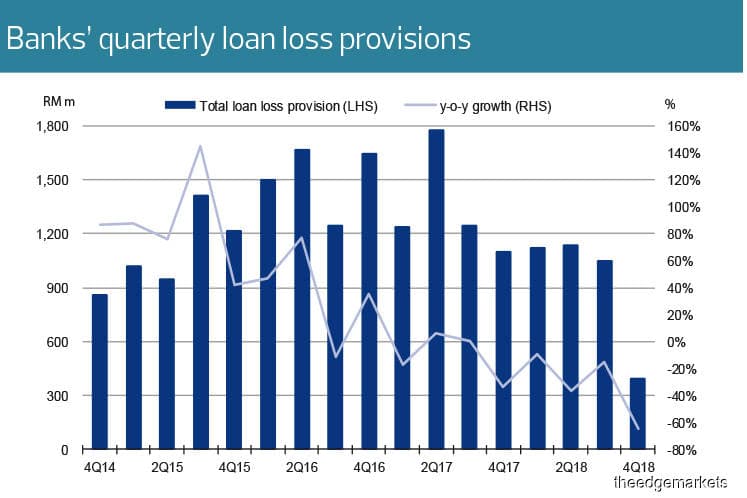

CIMB Research, in a March 15 report, said it expects to see an increase in LLP for the banking sector this year. “We forecast a 14.9% increase in banks’ LLP in 2019 due to the lower base at end-2018, following an 18.6% decline in 2018.”

The research house noted that 4Q2018’s LLP of RM390.5 million was the second-lowest since it first started compiling quarterly financial information on banks in 2000. As a matter of comparison, the LLP in 4Q2018 was only 30.4% of the average quarterly LLP of RM1.29 billion in the past eight quarters.

“We believe that the low LLP of RM390.5 million in 4Q2018 is not sustainable going forward as this was pushed down by high write-backs and recoveries by most banks. We think that the sector’s LLP would revert back to the normalised level of between RM1 billion and RM1.1 billion in the next few quarters.”

Analysts expect banks’ asset quality, which improved last year, to deteriorate slightly this year. The industry’s gross impaired loan (GIL) ratio declined to 1.45% as at end-December from 1.53% a year ago.

“We project the industry’s GIL ratio to increase to 1.8% by end-December 2019. We think the risks to banks’ asset quality this year would come from the real-estate (for the exposures to developers) and oil and gas segments,” says CIMB Research.

Volatility?

Loans currently fall under any one of three stages under the banks’ respective expected credit loss (ECL) model under MFRS 9. Generally, loans that are performing and just originated fall under Stage 1 — where banks have to make provisions on the basis of projected losses over 12 months. Loans are constantly being assessed and will fall into Stage 2 if there is a deterioration in credit quality. Loans in Stage 3 are non-performing.

For loans in Stages 2 and 3, the bank will have to recognise ECL over the expected life of the loan.

“There could be some volatility in LLP this year, depending on the movement of the Stage 1, Stage 2 accounts,” says Ng. However, banks should not face too much volatility if their ECL models are robust, she adds.

According to Ng, banks had focused mainly on the quantitative aspects of MFRS 9 last year. This year and the next, there is likely to be an increased focus on the governance aspects of their models.

“I think we will be talking about model governance, model monitoring ... the whole governance process. And, also the ongoing validation and model refinement [as] there are a lot of assumptions built in the ECL model, so those are the things that banks will focus on this year.”

Bank Negara Malaysia conducted a thematic review on the banks’ implementation of MFRS 9 last year to ascertain the adequacy of oversight and controls, methodology and models used to estimate ECL and system capabilities.

“Overall, banking institutions transitioned reasonably smoothly to the new accounting standard, helped by their regulatory reserves which mitigated the impact of additional provisions. Banking institutions also generally demonstrated robust implementation approaches, although improvements in certain aspects of implementation were required for some,” the central bank said in its Financial Stability and Payment Systems Report 2018 released last week.

In the report, Bank Negara also revealed that it had conducted a hypothetical portfolio evaluation (HPE) exercise in October 2018 to ascertain the degree of variability in banks’ provisioning levels. Under this exercise, nine banks were provided with a hypothetical portfolio of mortgage and corporate exposures and were required to estimate ECL provisions based on their internal models and methodologies.

“[Bank Negara] is currently engaging with individual banking institutions and external auditors to finalise the assessment of the HPE exercise. Findings from both the thematic review and the HPE exercise will be used to determine whether a regulatory response is needed to ensure that the MFRS 9 is implemented in line with its intended outcomes,” it said.

International Financial Reporting Standard 9 — MFRS 9 is the Malaysia equivalent — was designed to address the “too little too late” criticism that followed the 2008/09 global financial crisis that banks were not able to account for losses until they were incurred, even when it was apparent that they were coming.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.