FOR a second straight year, Malaysia is tabling a slightly smaller national budget than the year before. The Budget 2017 allocation of RM260.8 billion is below Budget 2016’s RM265.2 billion and Budget 2015’s RM271.94 billion. Despite lower than expected tax collection in the first half of 2016, the government is committed to deliver on its promise to reduce the fiscal deficit to 3% of GDP in 2017, and achieve 3.1% this year.

“The government will continue to consolidate its fiscal position in 2017 while promoting economic growth and implementing rakyat-centric programmes and projects. Public sector reforms will be accelerated to further strengthen fiscal management and improve public service delivery,” the Economic Report 2016/17 read, adding that measures to “enhance revenue and optimise expenditure” would strengthen its fiscal position.

While the headline 3% fiscal deficit target is a reduction from 3.1% in 2016 and 3.2% in 2015, the absolute amount that the government is budgeting to spend — in excess of its income — is expected to be larger at RM40.3 billion in 2017, compared with RM38.7 billion in 2016 and RM37.19 billion in 2015.

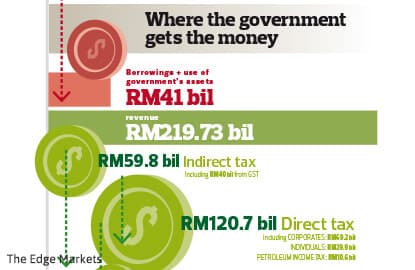

In fact, operating expenditure (OpEx) — which is the amount needed to upkeep operations — is budgeted at RM219.73 billion for 2017, up from RM212.6 billion in 2016 and RM219.1 billion in 2015, and amounts to 97.8% of projected 2017 government revenue. OpEx has stayed above 95% of government revenue since 2008, leaving little choice but to borrow to fund development expenditure (DevEx) to help grow the economy.

While Malaysia tries to increase the more productive DevEx, the actual amount being spent is at least 10% smaller than initially budgeted in 2013 to 2015. In 2017, the budgeted amount is RM46 billion, just above the RM45 billion revised estimate for 2016 and RM40.8 billion actually spent in 2015 (RM48.5 billion budgeted).

To be fair, actual OpEx was also smaller than budgeted in 2015 — a reverse of what happened in 2010 to 2014 when two supplementary budgets to ask for more money to spend a year became common place.

But greater reforms need to be made to have wider fiscal flexibility to cater to the country’s changing demographics.

As it is, emoluments and retirement charges (pension obligation) of RM99.19 billion alone is 45.1% of government revenue in 2017, staying above the 40% mark since 2014, compared with 30% in 2007. Another 13.1% of government revenue goes to debt service charges that have ballooned to RM28.87 billion in 2017 from RM12.9 billion (9.2% of government revenue) in 2007. Collectively, these three items already add up to 58.2% of government revenue.

“Debt service charges, which must be served before all other commitments … remain manageable at 12.9% of OpEx (in 2016),” the report read. Yet government debt had escalated to RM655.75 billion in 2Q2016 (excluding RM178 billion quasi-government debt as at 1Q2016) from RM266.7 billion in 2007.

So far, the OpEx that is being reduced year on year are subsidies and social assistance and grants to statutory bodies.

The need to substantially cut OpEx is necessary for Malaysia to lift DevEx as well as build up its coffers to expand its capability to provide safety nets to the lower and middle income groups that will be aging in the coming years.

As the government asks the rakyat to spend more wisely and rein in debt, Malaysia too needs to reduce its budget deficit that has reached RM40.34 billion in 2017 — equivalent to the net worth of Tan Sri Robert Kuok (US$10 billion according to Forbes 2016 billionaires list), Malaysia’s wealthiest individual.

Between 1997 and 2017, the amount Malaysia would have spent in excess of its revenue (budget deficit) would total RM554 billion — almost the size of the combined net worth of Bill Gates and Warren Buffett — and two times the combined net worth of Malaysia’s top 50 billionaires on the Forbes 2016 list. It is also more than the combined net worth of Hong Kong billionaire Li Ka-Shing, Wanda Group Wang Jianlin (China’s richest individual), Alibaba’s Jack Ma and Facebook’s Mark Zuckerberg.

That RM554 billion is also enough to buy seven Malayan Banking Bhd or 50% of Alibaba Group Holdings Ltd — assets that generate returns. It is heartening to see that Malaysia has, thus far, not tabled a supplementary budget asking for more money to spend for 2016. In March this year, it asked for RM5.99 billion extra for 2015 expense. If no extra money is asked for 2016, it would be the first time in six years. Will the government commit to not spending more than budgeted?

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.