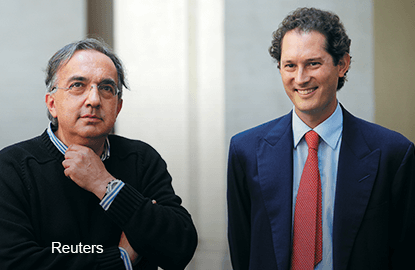

EVERYONE in the auto industry knows Sergio Marchionne’s views about consolidation. For years, the Italo-Canadian executive who welded former laggards Fiat and Chrysler into a coherent whole has shouted from the rooftops that the only way to ensure long-term viability for manufacturers like his is to crunch them together and take out capacity.

Yet Marchionne’s public campaign wouldn’t be happening without the backing of John Elkann, the 39-year-old Agnelli family scion who leads Exor SpA the investment group that owns a controlling stake in Fiat Chrysler. The soft-spoken Elkann may not project the stylish swagger of his grandfather, Italian business legend Gianni Agnelli, who once crashed a Ferrari going 120mph (193kph) into a meat truck on the Corniche above Monte Carlo. It would be a mistake, though, to underestimate his resolve.

Exor’s aggressive bid for PartnerRe Ltd may offer a glimpse of what General Motors Corp (GM) and others can expect as Marchionne ratchets up his coercive charm offensive. For the first time in his career, which began with a stint at General Electric Co and a seat on Fiat’s board at 21, Elkann is pursuing a big unsolicited takeover — and trying to derail an agreed deal between the reinsurer and Axis Capital with an all-cash US$6.8 billion (RM25.7 billion) offer.

GM’s leadership, which rebuffed an approach Marchionne made in March about a potential tie-up, would be unwise to think that’s the end of it. True, Fiat Chrysler, with a market capitalisation of just US$20 billion, is a lot smaller than US$58 billion GM. It’s also less profitable and has US$9 billion of net debt. But Marchionne’s thesis, bluntly articulated in his manifesto-cum-investor presentation in April titled “Confession of a capital junkie,” is nearly irrefutable. As one large GM investor put it to me: “The guy is totally right.”

Marchionne’s basic argument is that there is too much capital being deployed by too many carmakers. The time to act is while the car business is booming — US annualised sales hit a decade high in May — not during one of its inevitable cyclical troughs. Even now, the return on investment by mainstream carmakers is barely 8%, below their cost of capital, according to Marchionne. This results in valuations — around four times earnings before interest, taxes, depreciation and amortisation (Ebitda) — for the whole sector that are lower than for most other industries.

By sharing research and development, power-train, transmission and engine portfolios, Marchionne argues, Fiat Chrysler could squeeze out as much as US$5 billion in savings in a merger with a rival, a process that would boost returns on capital above 12%, and warrant a valuation of around seven times Ebitda. Though deals in the industry have tried to capture these benefits (think Daimler’s ephemeral ownership of Chrysler), they failed because “it is ultimately a matter of leadership style and capability,” says Marchionne.

The subtext, of course, is that Marchionne is a different class of leader. Fiat’s extraordinary turnaround and integration of Chrysler suggests that may be true. At any rate it’s easy to see why Elkann and the 70-odd other members of his extended family who have their wealth tied up in Exor have confidence in the man. Since 2009, when Marchionne nabbed Chrysler out of bankruptcy, Exor’s stock price has surged from just under €6 (RM25.23) a share to €45, valuing his family’s 51.4% stake at around €5.6 billion today.

The experience convinced Elkann — an admirer of Warren Buffett and Jorge Paulo Lemann, the aggressive Brazilian entrepreneur behind 3G Capital — that the car industry needs to continue consolidating. As he wrote in his 2014 letter to Exor shareholders: “Hopefully, this will be driven by reason and common sense rather than by crisis and will take into account the importance of identity and culture, as we have done, avoiding the all too typical divisive trappings of a takeover and creating instead a shared transnational culture.”

As much as that sounds like a pitch for GM to absorb Fiat, the Agnellis aren’t looking to sell out. Cars are their bloodline. In a no-premium all-stock merger with GM, the Agnellis would, of course, see their 29.2% stake in Fiat Chrysler diluted, to around 7.5% of the merged entity. That would still make the Agnellis the largest shareholder, ahead of the healthcare trust of the United Automobile Workers.

The benefits of owning a smaller piece of a larger canvas on which to apply Marchionne’s brushwork would be sizable. Max Warburton, an analyst at Bernstein Research who sparred with Marchionne over his treatise on capital, suggests a combination could credibly promise cost savings of US$10 billion. “These kinds of numbers are not insane, at least in theory,” he wrote.

The net present value of those synergies could be worth something close to US$60 billion for shareholders, with the Agnelli family’s stake alone reaching almost US$5 billion, nearly equal to the value of its current interest in Exor.

Getting GM to play ball is understandably proving tricky: a reverse takeover by Marchionne is hardly at the top of GM chief executive Mary Barra’s to-do list. But the logic for a transaction is sound. Marchionne, who turned 63 last week, isn’t getting any younger. And Elkann is developing an appreciation for the art of the deal. Don’t discount Exor’s determination. — Reuters

This article first appeared in The Edge Financial Daily, on July 1, 2015.