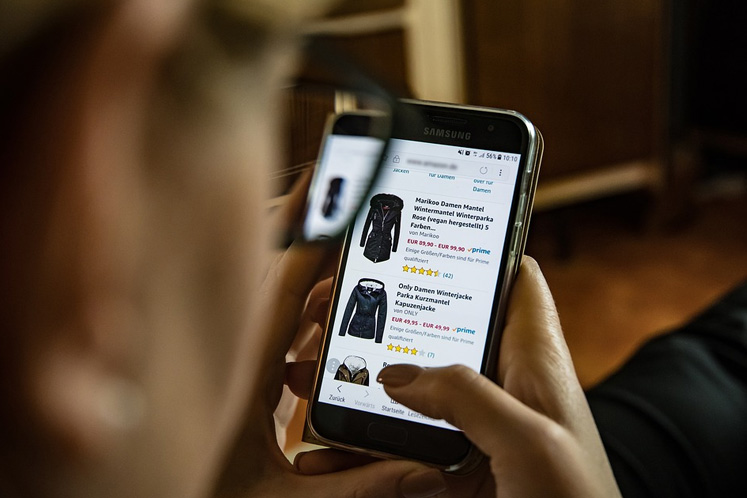

KUALA LUMPUR (April 8): The digital service tax set to be implemented from Jan 1, 2020 has been fixed at a rate of 6% per annum, with the annual threshold being RM500,000.

Deputy Finance Minister Datuk Amiruddin Hamzah said this when tabling the Service Tax (Amendment) 2019 Bill in the Dewan Rakyat to introduce the tax on foreign registered persons providing digital services to consumers in the country.

“The digital tax is to provide a level playing field among local and foreign companies, as well as between online and offline service providers,” said Amiruddin.

The Bill was later approved by lawmakers setting the stage for Malaysia to be the second South East Asian nation to introduce a digital tax after Singapore.

Under the Bill, tax defaulters can be fined up to RM50,000, imprisoned for a term of up to three years, or both, upon conviction.

The proposed law is applicable to any person, of whatever nationality or citizenship, beyond the geographical limits and the territorial waters of Malaysia, if the person is a foreign service provider.

The Bill defines a foreign service provider as any person who is outside of Malaysia providing any digital service to a consumer. It includes any person who is outside Malaysia operating an online platform for buying and selling goods or providing services (whether or not such person provides any digital service).

Digital service, meanwhile is defined as any service that is delivered or subscribed over the Internet and other electronic network and which cannot be obtained without the use of information technology and where the delivery of the service is essentially automated.

The Dewan Rakyat today also passed four other amendment Bills tabled by the Ministry of Finance.

They are the Free Zones (Amendment) Bill, Customs (Amendment) Bill, Excise (Amendment) Bill and Sales Tax (Amendment) Bill.

Under the Free Zones (Amendment) Bill, Pangkor Island in Perak will join Langkawi, Labuan and Tioman as duty-free zones.

There is also amendment for 18 clauses including provision of more deterrent penalties to prevent the misuse and manipulation of facilities and Customs procedures in the free zone.

The Bill also seeks to amend Section 10A of the Free Zone Act 1990 to require every person to preserve for a period of seven years all documents and records relating to the activity of importation, exportation or manufacturing of goods in the free zone.

The Customs (Amendment) Bill, meanwhile, is mainly aimed at improving Customs procedures relating to, among others, the payment of Customs duty, surcharge, penalty and fee.

The Bill underlines that for assets seized by the Customs Department, maintenance fee can be claimed from the asset owner.

It should be noted that among assets that have been previously brought under the custody of the Customs Department was the mega yacht Equanimity owned by controversial businessman Low Taek Jho.

The custody was later given to the High Court, with the Government bearing RM14.22 million in costs for maintenance, repairs, fuel, legal fees, and insurance between August 2018 and end-March this year.

For the Excise (Amendment) 2019 Bill, the main purpose of the amendment is to improve excise procedures relating to the payment of excise duty, obligation to keep records and warehousing of imported goods.

"The amendment also seeks to strengthen the enforcement powers of the officers of excise and to increase the amount of penalty for offences under the Excise Act 1976," the bill read.

The Sales Tax (Amendment) 2019 Bill seeks to make 10 amendments, which include providing clarity to the meaning of the term ‘manufacture’ involving petroleum products and to empower the director general to approve sales tax deduction applications.