This article first appeared in The Edge Malaysia Weekly, on April 11 - 17, 2016.

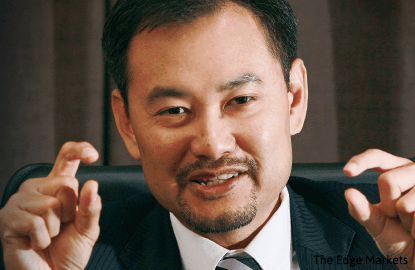

Soft-spoken, gentle-mannered, well-dressed and likeable — these are some of the words used to describe 1Malaysia Development Bhd’s (1MDB) former CEO Datuk Shahrol Azral Ibrahim Halmi, who has been thrust into the limelight after a damning report by the Public Accounts Committee (PAC) blamed him for the mismanagement at 1MDB.

“Before the whole 1MDB issue became a hot topic, we would often see Shahrol around Pemandu (the Performance Management and Delivery Unit). He carried himself well, not just with his fashionable, tailored suits and branded bags but also the way he spoke to people,” says a source who worked with Shahrol at the unit.

After four years at 1MDB, Shahrol, in March 2013, joined Pemandu as a director. His position at Pemandu, however, was not widely publicised and he kept a low profile.

“It was only after 1MDB became a hot topic in late-2014 that Shahrol became more reclusive. Some say it was a deliberate move to distance himself from Pemandu. Prior to that, he would often buy us coffee and mix with us. Of course, he wouldn’t respond to any questions about 1MDB, although it was often raised,” adds another source.

It seems unthinkable that the character described is allegedly responsible for racking up over RM50 billion in debt at 1MDB. In the best-case scenario, 1MDB’s predicament is a result of negligence and mismanagement.

But that does not seem to match Shahrol’s track record before he joined 1MDB in 2009. He was a consultant with Accenture for over 13 years. At the age of 35, he would leave Accenture as an executive partner and managing director to join 1MDB.

In other words, Shahrol appears to be a competent manager — on his résumé at least. Furthermore, he has had ample experience working with the government.

His experience ranges from IT transformation and IT integration to complex system implementation involving large government-linked entities and all manner of financial institutions. Shahrol oversaw transformation programmes at the Employees Provident Fund that spanned several years, as well as the planning and execution of the merger of Sime Darby, Guthrie and Golden Hope.

Unfortunately, all that means little now.

The PAC report is far too damning. What remains to be seen is how he will defend himself when the investigators come a-knocking on his door.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.