This article first appeared in The Edge Malaysia Weekly, on October 5 - October 11, 2015.

It is difficult to predict with accuracy where the FBM KLCI will stand before the annual New Year’s eve countdown. In fact, not many market observers are confident Malaysia’s benchmark index will surpass the 1,752.27 points at which it started the year. As one local head of equities research says, “You can kiss the 1,800-point dream goodbye.”

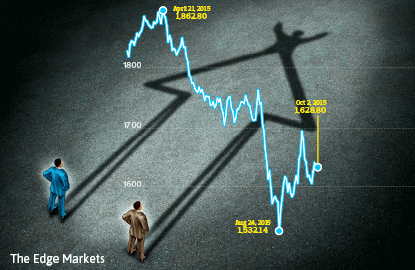

The FBM KLCI has shed 10.6% from its peak of 1,892.65 points in July 2014 and 7.56% year to date. It has seen a quiet recovery from its end-August low and is finding steady support at the 1,600-point level but analysts say equities in Malaysia have yet to go through the floor. Nagging economic concerns, unresolved domestic political issues and the prospect of weaker corporate earnings are making investors cautious, which could drag the stock market down further.

Chief on the list of market irritants is the US Federal Reserve’s indecision about its interest rate policy. Talk of when the Fed will raise rates — the last time was in June 2006 — is old and the effects have probably already been priced in by investors. But stock markets inherently react adversely to uncertainties. Analysts tell The Edge that conversations on the US interest rate policy still dominate decisions about foreign fund flow to emerging markets, causing volatility.

“Markets want to know when it (US interest rate hike) will happen, how much the increase will be and how long things will take to normalise. Once there is clarity, you will see a reversal of the current trend. Stocks will not be weighed on sentiment but fundamentals. Almost immediately, you will see the market rebounding as funds reassess their positions,” says Areca Capital Sdn Bhd CEO Danny Wong.

Without the catalyst of certainty in the US interest rate policy, Choo Swee Kee, executive director at TA Investment Management Bhd, expects the FBM KLCI to remain depressed, dropping to the 1,500-point level before recovering “sometime in November”.

Saturna Capital president Monem Salam believes the FBM KLCI could bottom at 1,450 to 1,500 points, which is close to this year’s low of 1,532.14 points recorded on Aug 25, before the usual year-end window dressing by funds and a general “seller’s fatigue” prompt investors to jump back into the market. “Things will look better in the fourth quarter. But the index wouldn’t go that much higher from where it is now,” he cautions.

In the meantime, the FBM KLCI is struggling to gain traction due to factors like the low ringgit, depressed commodity prices and an economic slowdown in China, which is one of Malaysia’s most significant trade partners and the world’s top consumer of commodities.

When crude palm oil (CPO) saw a mini-rally and touched RM2,460 a tonne — its highest since June 2014 — last Tuesday, investors were seen chasing the shares of oil palm planters. The FBM KLCI’s top gainers during the week consistently featured plantation stocks, like IOI Corp Bhd, Sime Darby Bhd, Genting Plantations Bhd and Kuala Lumpur Kepong Bhd — an indication that a recovery in commodity prices will prop up the stock market.

Also capping the upside potential of the local bourse as the year draws to a close is the anticipation of flat, if not weaker, corporate earnings.

M&A Securities head of research Rosnani Rasul points out: “We have had a 1,660-point target for the FBM KLCI since July. If you want to see how the index will perform, you can look at the stocks with large market capitalisation — the planters, the oil and gas players and the banks. As for commodity-related sectors, the current weak commodity prices are hurting them.

“For the banks, their net interest margin is very thin. Competition for deposits is stiff and cooling measures in the property sector have affected housing loan performance. I don’t expect them to surprise on the upside. When banks don’t perform, the FBM KLCI doesn’t perform. They comprise 40% of the index.”

While most emerging markets face the same economic realities, local analysts argue that the perceived inability of the Malaysian government to put an end to the long-drawn 1Malaysia Development Bhd (1MDB) saga is denting investor confidence and punishing the equity market.

Says Saturna Capital’s Salam, “It is not a matter of whether someone is guilty or not here. The ‘yes’ or ‘no’ answer is irrelevant. It is a perception problem. The market is asking what we are doing about what happened. Take the Volkswagen scandal. The shares dropped 30% in one day. What do you do about it? You fire the CEO, you come up with an action plan to address the problem. That changes perception and you can see a recovery.”

A bank-backed research analyst, who has a “seemingly high” year-end target of 1,740 points for the FBM KLCI, argues that an improvement in the political situation in Malaysia will elevate the drab local stock market. “It doesn’t take much to move the market. Catalysts … would have to include the resolution of certain domestic issues. First checkpoint: The power asset sale [by 1MDB], the outcome of which will be known sometime this month and, more importantly, the pricing, which could go some way to assuaging corporate governance concerns or exacerbating conditions if deemed undesirable.

“If we start to see clarity in this, among other things, foreign funds may be encouraged to come back in, with the ringgit being at its currently depressed level,” he says.

The near-term outlook for the FBM KLCI may not be bright but the good news is that things are not expected to get uglier. “The long-term story is still positive. All that is happening is just noise. In five years, people will know where the US interest rate is, government perception issues will be resolved by another election. Prospects for the Malaysian market are still solid and now is a good time to get your shopping list ready,” advises Salam.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.