This article first appeared in The Edge Malaysia Weekly on June 3, 2019 - June 9, 2019

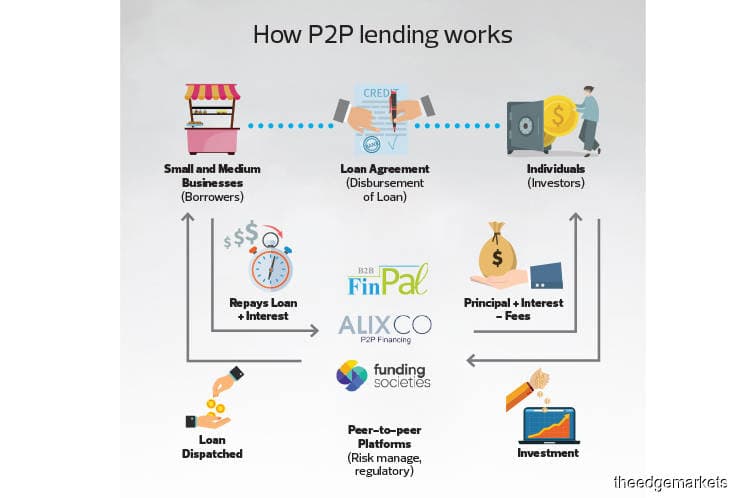

ONE of the key challenges facing most regulators is maintaining the right balance between consumer protection and enabling innovation by peer-to-peer (P2P) financing and equity crowdfunding (ECF) operators to better serve users in the digital era. Most industry players say the Securities Commission Malaysia has done well in this regard and should continue to engage with the platform operators to understand their challenges and work together to overcome them where possible. Here’s what they say.

Funding Societies Malaysia co-founder and CEO Wong Kah Meng:

The regulators have played a crucial role in educating small and medium enterprises (SMEs) and investors on P2P financing, helping to address the common misconception that P2P financing is akin to borrowing from loan sharks or some kind of Ponzi scheme. Nevertheless, there is still much to be done with regard to raising awareness and educating SMEs and investors on the benefits of such financing.

Being the latest alternative form of funding in Malaysia, the level of education and awareness of ECF and P2P financing has grown notably over the past three years. But there is still room for improvement. Most start-ups, micro-enterprises and SMEs are still not aware that they can raise funds through ECF and P2P financing without hassle.

There are also investors who are in the dark about ECF and P2P financing platforms and perceive them as Ponzi schemes or scams.

Funding Societies has been playing its role in this area and will continue to focus on raising awareness of ECF and P2P financing via industry events.

FBM Crowdtech Sdn Bhd chief investment officer André Betker:

When we started out, industry growth was sluggish and the situation was tough. Most people had not heard of these new forms of financing.

I see tremendous potential for raising awareness of ECF and P2P financing among the public and companies looking for funds. Many people are still not aware of this industry and the tremendous benefits it brings.

A key challenge is raising awareness among ordinary investors so that they can benefit from this new form of investing while helping Malaysian businesses grow.

B2B Finpal Sdn Bhd chief technology officer Chua Chin Hang:

The main challenge is competing with banks as they are also focusing on the SME sector. What P2P players need to do is focus on educating the public on P2P financing and how it can work alongside banking facilities to meet your financial needs.

Most of the time, SMEs only look at the cost of financing without considering the opportunities. This is where our team come in — helping them to look at their financial gap and working with them to grow their business.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.