This article first appeared in Personal Wealth, The Edge Malaysia Weekly on May 4, 2020 - May 10, 2020

The issuance rate of the entire bitcoin network is halved every four years and whenever this happens, the cryptocurrency experiences a bull run. But this time around, the digital asset exchange (DAX) operators in Malaysia are advising investors not to hold their breath, considering the current market conditions.

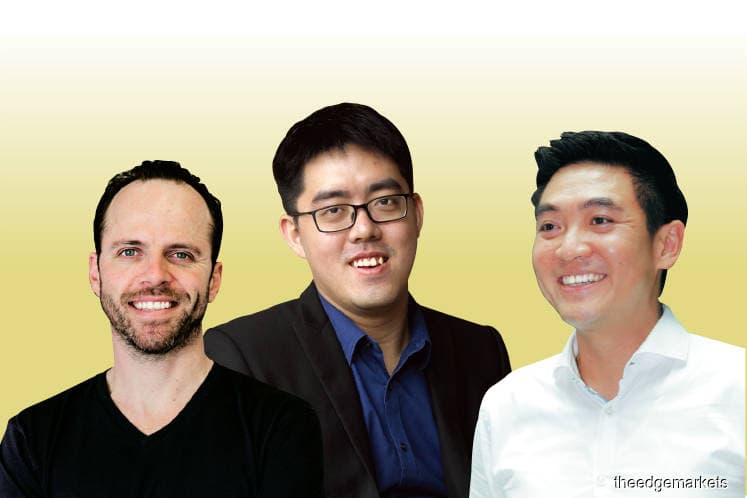

This quadrennial phenomenon known as “halving” will see the block rewards (the number of bitcoins you get if you successfully mine a block of the cryptocurrency) fall from 12.5 to 6.25 BTC. After the last two halvings (in 2016 and 2012), bitcoin saw short drops in price followed by a prolonged bull run that lasted between 6 and 12 months, says Sinegy Marketplace co-founder Daniel Chan.

“However, investors need to realise that there is a difference between the last halving and this one [which will take place this month]. There is currently a pandemic. The cash-strapped smaller miners may be forced to close their operations. Larger, more institutional miners are usually more prepared for the risks associated with the halving, so they will most likely survive and carry on the production of bitcoins and support prices,” he adds.

“This is based on what we saw previously, when options and futures contracts for cryptocurrencies did not exist. Now that these derivatives are available, cryptocurrency prices may be affected differently from how they used to be. Smaller miners may be able to survive by using the derivatives to hedge their positions or they may have chosen to shut down earlier due to the pandemic-related difficulties. No one can say for sure.”

The cryptocurrency market has definitely become more volatile because of the availability of options and futures contracts, says Sinegy co-founder Kelvyn Chuah. Previously, one could only trade digital assets at spot prices. But today, cryptocurrency players can trade larger amounts with even small amounts of capital because they can leverage their positions by up to 100 times. These derivatives are also being used by some retail investors.

Going forward, investors should adjust their expectations of what will happen during this halving, says Tokenize Xchange founder and CEO Hong Qi Yu. “This will be the first and perhaps only halving to occur in the middle of a pandemic. It is definitely new ground for all participants. I don’t think anyone can accurately predict what will happen next.”

Moving into the second half of the year, investors should be cautious and not rely on historical prices to determine whether they should increase their allocation to cryptocurrencies, says Sinegy market research and compliance officer John Sidoli. “We are in a period of global asset price deflation. We do not want to send a message to investors that they will be okay if they want to buy digital assets because a lot of factors are in play right now.

“They would be better off being conservative in their strategy and managing risks properly, and not putting their faith in historical patterns. The bull run may not happen a third time in a row.”

But that does not mean investors should avoid cryptocurrencies completely, even in the current landscape of attractive stock prices. Hong points out that equities depend heavily on the companies’ earnings or future earnings. At this juncture, the majority of companies look to be earning way less than what they did last year. Hence, the upside potential may be limited, he says.

“Cryptocurrencies, on the other hand, are still at an early stage. If financial markets continue to behave irrationally, the low market capitalisation risk-on assets should have more upside. This should be a motivating factor to access cryptocurrencies right now,” says Hong.

Chuah thinks people should continue to pay attention to cryptocurrencies because the asset class is still fairly new, having been around for slightly more than a decade. Investors can expect further growth as there will be newer ways to play into these investments and they can now use trading strategies such as arbitrage to generate returns, he says.

Bitcoin arbitrage is the process of buying these digital coins on one exchange and selling them on another that offers higher prices. This is made possible because each exchange has a different selling price for the cryptocurrency. Foreign exchange traders adopt a similar strategy for fiat currencies.

With the introduction of futures contracts for cryptocurrencies, investors can easily hedge their positions in a declining market by shorting bitcoin, that is, selling the digital coins first and buying them back later. Chuah points out that the derivatives in this market are different from those on the foreign exchange market because, among other things, there are no central parties controlling the digital assets. This creates a more level playing field for all participants, he says.

“When I used to do foreign equities arbitrage for banks, it was a game reserved for institutions. First, because banks would always use a favourable exchange rate on foreign transactions,” says Chuah.

“Second, the conversion of ordinary shares to American Depository Receipts is only possible through the depository banks, for a fee. This fee will only be favourably discounted for sizeable institutions. These limitations do not exist in the cryptocurrency world.”

Foreign equities arbitrage refers to the practice of simultaneously buying and selling a foreign security on two different exchanges, taking advantage of the price inefficiencies that occur due to factors such as timing and exchange rates.

Circumventing panic

The cryptocurrency community was on cloud nine at the end of last year. According to Luno co-founder and CEO Marcus Swanepoel, the anticipation of the halving had led many to think 2020 would be one of bitcoin’s best years.

“We did see the price start to move up a lot at the end of the year. Throughout my years in the industry, I think that was the most excitement I had ever seen among retail and sophisticated investors, institutional players as well as the media,” he says.

At the time, before fears of a pandemic took hold, bitcoin prices were moving in the expected direction.

Chuah was also positive about the performance of the cryptocurrency market at the beginning of this year. He was expecting bitcoin to reach US$11,000 each in March and gradually trade higher for the rest of the year. He says some of his trader friends were even betting that bitcoin would reach US$20,000 by June.

“All was good before the pandemic dawned on everybody. I have traded through many anomalies in my career. I was in New York during the dotcom bust, the Sept 11 terrorist attacks and the 2008 global financial crisis. Nothing has prepared me for this black swan event,” says Chuah.

In February, bitcoin traders were still holding out hope (based on past experience) that the asset class would be spared. “I remember when equity markets were going off, bitcoin was still doing okay,” he says.

However, everything changed the following month. On March 12, at the peak of the equities sell-off, the entire cryptocurrency market lost more than US$90 billion in market capitalisation when bitcoin’s value plunged 40% in a single day.

“I remember waking up the next day and looking at one of the futures trading platforms. There were no buy orders available. All had been taken up. It was a very shocking experience,” says Chuah.

According to CoinGecko data, the lowest price for bitcoin this year was recorded on March 17, when it dropped to US$5,032.50 each — a 35% decline year to date. A few days before that, it had briefly plunged below US$4,000 before rebounding.

Hong says the crash in crude oil prices, which hit an 18-year low of US$20 per barrel at end-March, also impacted the cryptocurrency’s performance. “Everyone I spoke to was bullish earlier in the year. We all talked about how bitcoin was still in a bear market and there was nowhere to go but up.

“In March, crude oil prices crashed and equity prices came tumbling down. Margin calls needed to be paid, so everyone had to liquidate their bitcoin holdings. It was a nightmare! That week was worse than what happened in 2018, when bitcoin slowly declined to US$3,000 apiece because the sharp drop happened in less than an hour.

“I wouldn’t say that I did not panic like the rest of them. I do have quite a huge exposure personally, both in spot and derivatives. But at least, I had factored in this possibility before it happened. I just did not expect it to happen so fast. A lot of my friends faced losses of up to six digits. Some lost half of their portfolio value.”

However, Hong clarifies that most Malaysian investors should not be as affected since derivatives are not offered by any party in the country. “Investors exchanging cryptocurrencies on any of the platforms in Malaysia are only trading spot, so they do not have to face margin calls,” he says.

“The prices may look terrible on paper, but they still have the asset in hand. In the long run, the price will recover its intrinsic value. So, I believe Malaysian investors are largely safe from the recent volatility.”

Tokenize, Sinegy and Luno cannot stop Malaysians from panic selling. As operators, their obligation is to ensure market fairness, says Hong. He points out that a lot of cryptocurrency investors globally were upset when one of the largest cryptocurrency derivative exchanges went into maintenance mode during the panic-selling period.

“A lot of sophisticated investors, who were using different exchanges for their arbitrage strategy, were using that platform to hedge their positions. They were understandably angry. Some, especially the larger institutional investors, lost millions. That is why it is important for investors to consider regulated exchanges over unregulated ones. We could not allow this to happen,” says Hong.

In Malaysia, DAX operators are required to have adequate arrangements and processes to manage excessive market volatility. This may include circuit breakers, price limits and trading halts. Very few DAX operators around the world have circuit breakers in place. Players such as Huobi only introduced this after the big sell-off in March.

In traditional markets, circuit breakers are key levels and mechanisms designed to shield investors against the harsh effects of a massive price plunge and market sell-off. The circuit breakers are automatically triggered to temporarily halt trading when prices hit a predetermined level.

“When this happens, the entire platform will automatically come to a halt for about 10 minutes. We will give everyone a chance to look for updates during this period and basically re-evaluate their decisions. If they find new information that changes their view, they can remove their sell orders and step out of the market,” says Chuah.

Be conservative and consider diversifying

Cryptocurrencies have always been seen as an asset class with little to no correlation to traditional assets such as equities and bonds. This narrative, however, was recently tested when bitcoin prices fell in tandem with other asset classes.

“The narrative has always been there, that bitcoin is digital gold and less correlated to the capital markets. I think this is incorrect. With the exception of stablecoins such as USDT, in truth, there is an increasingly strong correlation between digital assets and traditional risk assets such as US equities,” says Sinegy’s Sidoli.

This has to do with market sentiment. “If the market is gloomy and central banks are throwing everything but the kitchen sink into the markets, it means that almost all asset prices are moving in unison. In these types of situations, everyone wants to sell before the next guy does,” he adds.

“On top of it all, people need to liquidate to serve margin calls. So, making an allocation to digital assets is a risk decision and must be done on the basis of reaping the rewards, not from the perspective of hedging a portfolio against a financial crisis.”

Luno’s Swanepoel does not agree. He thinks it is far too early to infer that digital assets are closely correlated to traditional assets. He points out that when calculating correlations, one should take a longer-term view rather than simply focusing on recent data points.

“For every week of correlation that one can find, I am sure they can find 20 weeks that are not correlated. While there have been some correlated actions between bitcoin and other asset classes recently, I think we need more data before we can conclude anything,” says Swanepoel.

“Remember, this is bitcoin’s first financial crisis of any sort. Gold, which is known to be a less correlated asset class, also experienced a dip recently because people wanted to liquidate to serve margin calls. After a couple of weeks or months, gold will start to decouple and move on its own.”

Reiterating his point, he points out that most of the data recorded over the last decade suggest that digital assets are largely not correlated to financial markets. “We should look at more data to determine whether digital assets will behave like gold. While we cannot say for certain that it has decoupled, bitcoin is showing early signs of decoupling and may still be a really great asset to invest in. Note that the cryptocurrency market recovers a lot faster than other markets,” says Swanepoel.

He adds that the recent volatile environment was mainly due to the behaviour of larger institutional investors and sophisticated traders. “The retail investors on our app say they are in this for the long haul and not liquidating to close any positions.”

That is why he feels the hypothesis of correlation requires further investigation. “We may have a better sense of it three months down the road,” says Swanepoel.

Historically, bitcoin prices have affected the price of other cryptocurrencies, or altcoins, as well. Will investors see any of the altcoins such as ether, Ripple and Litecoin deviate from this pattern?

Sinegy chief operating officer Edgar Gasper says that apart from stablecoins, the performance of which depends on the assets they are backed by, altcoins in the space of smart contracts could deviate from bitcoin’s performance. “Before the pandemic, there was a lot of focus on the Decentralised Finance (DeFi) space. Now, things have shifted because everyone is more focused on getting back to cash or primary digital assets such as bitcoin. Once they are in the mood to diversify again, I think many will look at altcoins related to the DeFi space.”

DeFi is a blockchain-enabled ecosystem that, among others, allows users to borrow, lend, trade and make transactions in digital currencies without the need to go through regulatory authorities. Altcoins related to this space include ether, USDx, Augur and Dai.

Hong thinks that ether, which has been the second largest cryptocurrency by market capitalisation since it rose to popularity in 2017, is another interesting digital asset to look at. He says ether still has the highest number of developers and source code community contributors in the cryptocurrency industry to date.

“I am looking forward to Ethereum 2.0, which may cause the price to rise and excitement to come into the space. But I am no longer sure whether it will happen this year, given everything that has happened recently,” says Hong.

Ethereum 2.0 is a significant system-wide upgrade. It is expected to be rolled out in stages, starting from June and to be completed by 2022. As at April 28, ether was trading at US$195.80, a 40% increase from the start of the year.

Hong says that unfortunately, no matter how good altcoins are right now, there is still evidence that most of the bigger names are very correlated with bitcoin. “I have been looking at the price movements closely over the past two years. So far, I have not seen any of the altcoins deviate from bitcoin’s price performance. I hope to see a meaningful deviation soon.”

As the cryptocurrency market continues to be volatile, Sinegy’s Chuah reminds retail investors not to allocate more than 5% of their portfolios to digital assets. “Market players such as ourselves monitor the market around the clock. So, of course we have a bigger allocation. This is not advisable for the masses. A good conservative strategy to adopt is dollar cost averaging. If investors follow this, I don’t think they will ever get badly burnt,” he says.

What’s next for the DAX operators?

All three digital asset exchange (DAX) operators in Malaysia are now fully operational. Luno was the first to receive full approval from the Securities Commission Malaysia (SC) in October last year. This was followed by Sinegy Marketplace on April 1 and Tokenize Xchange on April 3.

The three DAX operators are now focusing on onboarding new users and streamlining their Know Your Customer processes. On top of developing new apps and creating friendlier user interfaces, they are also looking to host more educational programmes for their users.

“We wanted to host more physical classes and educational events. However, because of the pandemic, we will have to use webinars and other alternatives,” says Tokenize founder and CEO Hong Qi Yu.

One of the DAX operators has expressed interest in applying to be an initial exchange offering platform operator. This follows the release of the SC’s Guidelines on Digital Assets, which will come into force in the second half of the year. The operator says, however, it will do so by forming a consortium with players who are not in the DAX space.

More difficulty for miners

Just like gold, bitcoin has to be mined. Mining is the validation of transactions that take place on each bitcoin block. The mining process, which generates additional bitcoin, is done using computer hardware that calculates complex mathematical equations. When these equations are solved, the digital asset is generated, granting miners a certain amount of block reward.

The process may be similar among other main altcoins. However, some coins such as Ripple, Stellar and EOS cannot be mined because, among others, they have reached their maximum supply.

Most miners are still focused on mining bitcoin as it is still the digital asset with the largest market capitalisation. However, they are finding it increasingly difficult to yield enough returns relative to their operational cost as the upcoming halving will greatly challenge their profitability.

This may have an impact on bitcoin prices, says Tokenize Xchange founder and CEO Hong Qi Yu. “Apart from the mining hardware, the cost of the electricity required for them to mine is also breaking the bank. But this is not the first time I have seen them struggle. Back in 2016, I saw the same situation in the run-up to the halving.

“Due to the lower reward and increasingly difficult equations, the miners could only be profitable in 2017. If they have the holding power, they could survive. If not, there is not much short-term return on investment.”

To avoid the risk of shutting down, a lot of miners are now using derivatives such as futures and options contracts to meet their operating costs, according to Sinegy Marketplace co-founder Daniel Chan. “Miners typically use options contracts to lock in the price of bitcoin for the next six to eight months. The gains are then used to take care of all the operating expenses before they start to be profitable again.”

While this solves the problem of operating expenses, there is another looming issue that has been amplified by the current pandemic — hardware logistics. Chan explains that mining will only become more difficult from now on. As a result, only miners with the best next-generation hardware will win the race. With the ongoing pandemic, it is getting harder for miners to get their hands on spare parts.

“These machines break down easily because of the incredible amount of heat they generate. In fact, one in six machines break down every month. If the miners cannot get the spare parts, they cannot generate the digital asset supply. This issue will remain until the end of the pandemic,” says Chan.

He adds that larger, more sophisticated miners may have mitigated these risks early on. However, smaller miners, who are less prepared, may have to shut down completely.

“What will happen after that? It is hard to say. We could see a huge, short sell-off before a recovery. We are not sure. But investors have to bear in mind that this is one of the factors influencing the price fluctuations,” says Chan.

Beware of unregulated exchanges

The Securities Commission Malaysia (SC) has warned the public against investing in unauthorised digital asset exchanges (DAXs) following an increase in the number of queries and complaints it has received about these.

In a statement dated April 24, the SC said it had added 12 companies operating without a licence or authorisation to its watchlist. This included Remitano, a popular global DAX.

The SC reminded investors to only trade with Recognised Market Operators (RMO) that have been registered with and authorised by the regulator. It also warned investors that they would be exposed to various risks if they dealt with unlicensed or unauthorised entities, such as fraud and money laundering, and may not have access to legal recourse in the event of a dispute.

In Malaysia, there are only three RMOs in this space — Luno Malaysia, Tokenize Xchange and Sinegy Marketplace. However, the two most popular DAXs used by Malaysian investors are Remitano and Binance, according to independent research sighted by Personal Wealth.

Remitano and Binance allow Malaysians to trade peer-to-peer in ringgit, which means they can buy and sell digital assets by transferring funds directly to one another. The two DAXs are merely facilitators of the trades.

Remitano and Binance recorded total web traffic of more than 9.3 million visitors from Malaysia from January 2018 to March 2020. This is significantly higher than the number recorded by all three regulated DAXs in Malaysia, which stood at 2.5 million visitors during the same period.

Remitano recorded more than RM257.7 million in peer-to-peer trading exchange volume by Malaysians from March 2018 to February 2019. When combined with Paxful and Localbitcoins — two other popular DAXs — the total peer-to-peer trading exchange volume by Malaysians amounted to more than RM354.5 million.

As unregulated exchanges do not comply with certain regulations — especially in relation to Know Your Customer, proliferation financing, anti-money laundering and anti-terrorism financing measures — these DAXs pose significant problems to regulators. Research indicates that these unregulated platforms have become extremely popular with potential criminals due to the regulatory limitations as these platforms do not have a physical presence in Malaysia. The companies behind the platforms are often incorporated in offshore jurisdictions, with their operations and marketing activities done purely online. Remitano, for example, has an office in Seychelles.

DAXs are popular platforms for money laundering. In a Jan 15 report, analytics firm Chainanalysis found that 52% of the US$2.8 billion in bitcoin that moved between criminal entities and exchanges went to Binance and Huobi, another popular exchange. More than 300,000 individual accounts at these platforms received bitcoin from criminal sources in 2019, said the firm.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.