This article first appeared in The Edge Malaysia Weekly on February 24, 2020 - March 1, 2020

LIKE the common saying that middle children in a family are not given as much as attention as their older and younger siblings, the same woes have long been felt by the country’s middle-income group, known as M40, or the middle 40% income earners.

For clarity, the Department of Statistics Malaysia’s Household Income and Basic Amenities Survey conducted in 2016 (an updated version of this survey based on 2019 data is expected to be released in April) defines an M40 household as one that has a median monthly household income of RM6,275, while the Bottom 40% (B40) households have a median monthly household income of RM3,000 and the Top 20% (T20), RM13,148.

Grievances that the M40 are not getting enough attention from the government are not new, as some felt that Budget 2020 did not adequately address the needs of the M40.

A letter to the editor, posted on Malaysiakini by a middle-income earner, described this group as “too poor to enjoy a comfortable life, and too rich to be entitled to subsidies”.

This can be seen, for example, in the various government initiatives to help the B40 that the M40 do not qualify for. These include the Bantuan Sara Hidup (BSH), which is a cash aid for households with a monthly income of RM4,000 or less, and PeKa B40, which is aimed at sustaining the healthcare needs of the B40, focusing on non-communicable diseases.

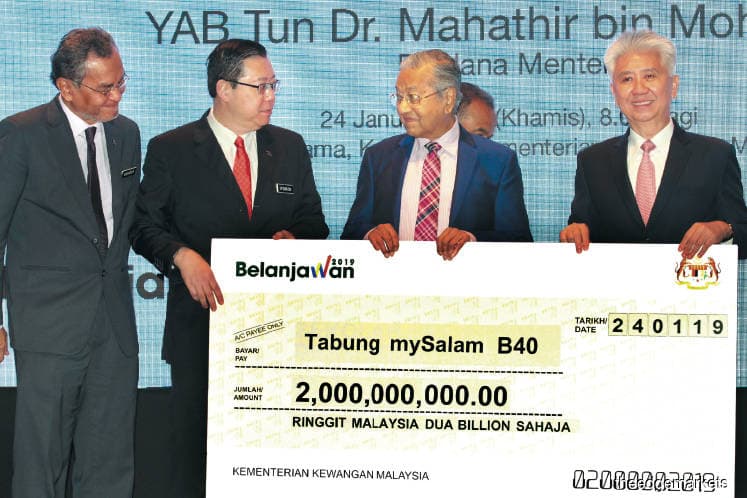

The national health protection scheme, mySalam, which provides free takaful, was initially open to only B40 earners in the BSH system, but was recently extended to M40 earners who make up to RM100,000 a year and are not BSH registrants. The one-time cash payout for them upon diagnosis of one of 45 critical illnesses is lower, however, at RM4,000 — compared with RM8,000 for the B40 in the BSH system.

On the other side of the coin, the M40 do not exactly have the means to enjoy the perks of the lifestyle of T20 households, such as after-school private tutoring and overseas vacations. In its Feb 13 piece “Are Both the B40 and M40 Poor?”, Khazanah Research Institute finds that a high proportion of the M40 group have “remarkably similar consumption patterns to the top end of the B40”.

Measures to help the M40

With the government set to unveil an economic stimulus package to mitigate the effects of the Covid-19 outbreak next week, which is expected to help the sectors most affected by the virus, a pertinent question is whether the stimulus could offer anything for the M40. Already, there have been calls by the Malaysian Trades Union Congress for the government to set up a RM10 billion revolving fund for B40 and M40 workers affected by the outbreak.

According to Sunway University Business School economics professor Dr Yeah Kim Leng, the stimulus could help the M40 in the form of tax relief on local tour and hospitality spending for households that pay income taxes.

“This measure would encourage Malaysians to spend their holidays in the country and prop up the tourism sector, which has been hit by the Covid-19 outbreak,” he says.

He adds that, to raise disposable income and support consumption spending, a one-time cash handout, similar to the B40’s BSH, could be considered for the M40.

“A more targeted measure would be to provide wage credits to employers and employees in the affected sectors so that business closures and retrenchments can be averted. A widely suggested measure is a voluntary reduction in employees’ EPF contribution that will put more cash in the hands of those who opt to spend more,” says Yeah.

During the SARS outbreak in 2003, the government had introduced a voluntary reduction in employees’ EPF contribution from 11% to 9%, and announced a half-month bonus for government servants to boost consumption. Bank Negara Malaysia also cut the overnight policy rate by 50 basis points to stimulate private consumption.

Lee Heng Guie, executive director at the Associated Chinese Chambers of Commerce and Industry of Malaysia’s Socio-Economic Research Centre (SERC), says the economic stabilisation package will be targeted more at badly affected industries such as those in the tourism-related services sector, including aviation, hotels and restaurants.

He says: “The welfare of employees regardless of income level should be protected to ease economic pain. Some wage and employment protection measures can be considered, such as double-deduction on employees’ salary expenses to assist employers through this difficult period and help affected companies retain staff and prevent lay-offs.

“The reduction in toll rates as well as the timely payment of BSH are handy during this time for the low and middle income.”

A simpler way to help the M40 could be tax breaks that would leave them with a larger take-home pay. But, with taxpayers making up only 15% of the 14.9 million Malaysian workforce, are tax breaks the answer as part of the stimulus?

Dr Veerinderjeet Singh, president of the Malaysian Institute of Certified Public Accountants, says: “The answer is not tax [for stimulus]; the answer is really in terms of targeted benefits. For the M40, I think the issue is availability of discounts and attractive rates; businesses should be targeting that group because that group does travel, and so does the T20.

“So, if businesses give good rates, that might spur them; but, giving them a tax relief may not help, because they are not necessarily the group that is suffering a cash crunch.”

SERC’s Lee believes the priority of the fiscal stimulus will be the B40, given that it is the most vulnerable and affected group of households that will need social safety protection in an economic downturn.

“In this case, the B40 will be given the much-needed financial assistance and fiscal support. The M40 households’ plight will be taken care of when there are measures and initiatives to raise disposable income, ease the cost of living, increase the construction of more affordable housing, allow for the provision of medical healthcare [and so on],” he says.

A longer-term perspective

Looking at the issue from a broader and longer-term perspective, a lot more needs to be done to help the M40.

Malaysian Institute of Economic Research senior research fellow Dr Shankaran Nambiar says the government has taken steps to aid the M40, but they have not been radical.

“I have long been advocating that healthcare financing and affordable housing policies be reviewed, since these are two areas that could be a drain on household expenditure. There has to be a greater shift to public transport in the interests of reducing household expenditure on transport, and also for environmental reasons,” he says.

Institute for Democracy and Economic Affairs research manager of its economics and business unit Lau Zheng Zhou does not believe that stimulus is the solution for the M40.

Lau says: “The M40 stands to gain from stable employment and income as well as investment in public infrastructure, although it is understood that more needs to be done structurally to ensure income grows faster than the cost of living. Stimulus should be directed at the B40 instead.

“The M40 should call for structural reform to the economy to boost income growth rather than expect goodies. Countries that have done well in boosting their middle-income group are those that perform better on education, strong product market regulation and fair competition. This shows that short-term stimulus is not the answer for boosting M40 more permanently; it’s about structural reform.”

In terms of tax breaks that could aid the M40 in the longer term, Baker Tilly Malaysia managing partner and Asia-Pacific leader for tax services Anand Chelliah says higher thresholds for EPF contribution relief and life insurance relief could be considered.

“Perhaps medical coverage-related measures and tax deduction for interest on housing loans to support the M40 efforts on home ownership are worth considering,” he says.

EY Asean and Malaysia tax leader Amarjeet Singh says the government should consider broadening and reducing the number of income tax bands.

“Broader income tax bands would encourage individuals to improve their earning capabilities through productivity increases and self-development, as they would be able to enjoy the fruits of their labour, thereby improving our efforts to become a high-income nation.

“The additional take-home income would also allow individuals to increase their consumption of goods and services. This is particularly true for the M40 group, which faces increased tax rates for relatively small increases in their income levels.

“For example, a taxpayer increasing his or her chargeable income from RM50,000 to RM70,000 per year is subject to a 6 percentage point increase in income tax (from 8% to 14%) on the additional RM20,000; whereas a taxpayer increasing his or her chargeable income from RM1 million to RM2 million per year is subject to only a two percentage point increase in income tax on the difference.

“So, while the high-income earner in this example pays significantly more tax, the change in income levels affects the lower-income earner more significantly,” he says.

Amarjeet adds that the government should consider streamlining income tax reliefs for individuals.

“Currently, there are more than 20 different forms of reliefs or deductions, many of which are focused on incurring an expense or cost and then claiming the relief.

“The government should consider streamlining some of these expense-based reliefs to allow more flexibility in household spending and increase the amounts of automatic reliefs available to resident taxpayers such as individual relief, spouse relief and child relief,” he says.

It is undoubtedly an uphill task for the government to alleviate the woes of the M40, while maintaining fiscal discipline. But if the country is indeed to move from a low-skill, labour-intensive economy to a knowledge-based one in the next decade, as part of the Shared Prosperity Vision 2030, the livelihood of the group that will be at the core of that move can no longer be ignored.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.