This article first appeared in Personal Wealth, The Edge Malaysia Weekly, on Feb 8 - 14, 2016.

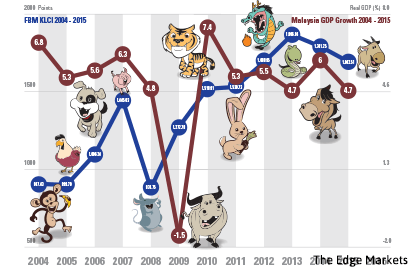

In the spirit of the Lunar Year of the Fire Monkey, Personal Wealth looks back on the last 12 years, highlighting the key events that helped shape today’s global economic and investing landscape.

2008

Earth Rat

The Year of the Rat nibbled voraciously at all the gains achieved in the previous years, marking the start of the global financial crisis, the worst recession the world had seen since World War II. It saw the US government bailout of banks, the collapse of Lehman Brothers and takeover of AIG and Merrill Lynch. This disaster ultimately cost the US government an eye-watering US$700 billion in federal rescue aid package called the Trouble Asset Relief Program (TARP). Barack Obama beat John McCain to become the US’ first black president.

Japan’s economy tanked, but it was not the losses suffered by their financial institutions that affected the economy — it was the fall in international trade, especially with its main importer, the US, which was experiencing recession. The crisis exposed Japan’s economic Achilles’ heel, its inability to overcome deflation and failure to sustain itself on strong domestic demand.

Back home, the ruling Barisan Nasional coalition experienced its worst result in 50 years during the March 8 general election, losing five states — Selangor, Perak, Penang, Kedah and Kelantan — to the Opposition. It was dubbed a political tsunami and then prime minister Datuk Seri Abdullah Ahmad Badawi agreed to take responsibility for the result and step down.

This was not the last of the embarrassments of the ruling coalition. MCA president Datuk Seri Dr Chua Soi Lek resigned from all posts including health minister following a sex tape scandal. And the International Court of Justice ended a 29-year territorial dispute between Malaysia and Singapore by awarding Pulau Batu Puteh (Pedra Branca) to Singapore and Middle Rocks to Malaysia.

It was also a time of unrest. In November, India’s financial centre and movie capital, Mumbai, was held hostage for three days by members of Lashkar-e-Taiba, a Pakistani Islamic militant organisation. The militants carried out a series of 12 coordinated shooting and bombing attacks, killing 164 people and wounding at least 308. This attack was dubbed the 9/11 of India.

Nature dealt double tragedies in 2008. Cyclone Nargis devastated Myanmar and an earthquake flattened schools and villages in Sichuan, China. The death toll was about 225,000 lives — about the same as those lost in the Indian Ocean tsunami of 2004.

Fears of contagion from the global financial crisis abounded. In November, the Malaysian government introduced a RM7 billion stimulus package to enhance domestic growth and improve market confidence. It was to be funded by savings on subsidies, coming from falling global oil prices. Valued at 1% of GDP, it was to provide funding for several infrastructure projects, including building low and medium-cost houses; upgrading police stations, living quarters and army camps; maintaining public amenities such as roads, schools and hospitals; and building and upgrading roads in rural areas.

Malaysia’s GDP growth fell to below the psychological 5% level to 4.8% and inflation rose to 5.4% from 2% the year before. The ringgit ended the year stronger at 3.45 against the US dollar.

Although the first half of Malaysia’s domestic market was minimally affected by the global financial crisis, Bank Negara’s 2008 annual report revealed that Malaysia’s economy was expected to experience the full impact of the global downturn in 2009. At this stage, the ringgit was at 3.45 to the US dollar. The benchmark KLCI ended the year almost 40% lower at 876.75 points.

By end-2008, the world GDP fell from 5.2% to 3.1% and the median inflation rate for advanced economies was recorded at 3.8%, while the inflation rate for emerging and developing economies was 10.4%.

2009

Earth Ox

The Ox, a sign of equilibrium and tenacity, brought some stability back to the market. The Obama Administration provided massive stimulus packages and incentives such as the Cash for Clunkers Program to resuscitate the flailing US economy. Other significant events were Fiat buying a stake in Chrysler, General Motors plunging in and out of bankruptcy and Wall Street once again running business as usual — healthy profits and hefty bonuses. Posting modest growth in the third quarter, the US seemed to emerge from the recession.

The European debt crisis, however, was just getting started. The crises erupted in late 2009 as a group of 10 central and eastern European banks requested for a bailout owing to overly high government structural deficits and accelerating levels of debt.

The 26-year civil war finally came to an end in the island nation of Sri Lanka as the leader of the Liberation Tigers of Tamil Eelam, Velupillai Prabhakaran, was killed by Sri Lankan authorities. The war claimed the lives of more than 70,000 people.

Michael Jackson, the King of Pop, was pronounced dead of cardiac arrest after falling victim to a legal cocktail of prescription pills. While the world kept vigil, battles were waged, from the place of his burial to the custody of his children. Later that year, US$2 million was hauled in from the auction of his possessions.

The H1N1 flu virus caused a worldwide pandemic in 2009. The pathogen infected people in Asia, Europe and the US. A research team led by the US Centers for Disease Control and Prevention (CDC) estimated the global death toll from the pandemic at upwards of 284,000.

Datuk Seri Najib Razak became the sixth Malaysian prime minister. The year also witnessed a rise in religious sensitivity in the country. The uproar over the use of the word “Allah” drove the publisher of The Herald to file a writ of summons and statement of claim in the Kuala Lumpur High Court to seek the use of the word “Allah” in the publication. Although the High Court had declared that the use of the word “Allah” was allowed, the decision was eventually overturned in 2015.

Although Malaysia was in a recession, it was not impacted by a fluctuating currency or volatile capital market as it had little exposure to the financial derivatives from the subprime stocks. Also, because the US government had introduced two rescue packages totalling US$18.1 billion (RM67 billion), these helped to absorb retrenchment and offset significantly reduced exports by accelerating development expenditure.

At end-2009, Malaysia’s GDP contracted 1.5% and the domestic inflation rate fell to 0.6%, while the ringgit was 3.42 to the US dollar. This compared with a global economic contraction of 1.69%. The median inflation rate for advanced economies fell to 0.5%, while the inflation rate for emerging and developing economies was logged at 4.9%.

Despite all this, the KLCI ended the year 45% up at 1,272.75 points, which in any other year would have been considered a rally.

2010

Metal Tiger

This was the Year of the Metal Tiger, traditionally a volatile year, and it lived up to its reputation. The year kicked off with a massive earthquake measuring 7.0 that hit Haiti, killing an estimated 316,000 people. The bad news did not end there. In April, global stock markets fell after Standard & Poor’s downgraded Greece’s debt to junk, four days after the activation of the European Union-International Monetary Fund bailout worth €45 billion. This made Greece the first eurozone member to have its debt downgraded to junk, exacerbating the European sovereign debt crisis.

On May 6, there was a trillion dollar “flash crash” in the US stock market. The S&P 500, Dow Jones Industrial Average and Nasdaq Composite collapsed and rebounded very rapidly within a span of 36 minutes. It was not until five years later that a UK trader was arrested for causing the crash by manipulating the stock market.

However, not all events were bad. Extensive foreign capital flowed back to Malaysian bonds after a US$35 billion outflow during the global financial crisis. Additionally, in June, China recognised Malaysia as an approved investment destination under China’s QDII scheme, which eventually resulted in positive inflows of Chinese funds into the local capital market. There were 29 IPOs, up 107% from the preceding year, which helped raise about RM20 billion. ACE Market IPOs increased from two to six that year.

At end-2010, the Asian economies were booming, with a rise in GDP and investment opportunities in the region. Malaysia was acknowledged as one of the exporting powerhouses along with China, South Korea, Thailand and Indonesia.

The year saw an amendment to the Capital Markets and Services Act 2007 by the Securities Commission Malaysia (SC) to promote the development of the capital markets and the implementation of the Capital Market Masterplan 2 (CMP2) that was to take place in the following year.

The Malaysian economy rebounded strongly, growing at 7.4% against world growth of 4.33%, while inflation stayed low at 1.7%. The ringgit continued to appreciate against the US dollar, ending the year at 3.08. The KLCI improved 20% to end the year at 1,518.91 points.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.