This article first appeared in Personal Wealth, The Edge Malaysia Weekly, on Feb 8 - 14, 2016.

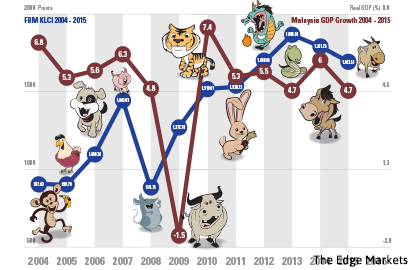

In the spirit of the Lunar Year of the Fire Monkey, Personal Wealth looks back on the last 12 years, highlighting the key events that helped shape today’s global economic and investing landscape.

2005

Wood Rooster

The rooster sounds the wake-up call, and the Year of the Wood Rooster was certainly a wake-up call to many. Oil prices continued to rise, the US Federal Reserve raised interest rates to a four-year high, pro-reform politician Angela Merkel was confirmed as the German chancellor, and Malaysia and China moved from a fixed exchange rate regime to a managed float. In July, a series of coordinated terrorist attacks in London targeting civilians brought the city to a halt and in the US, Hurricanes Katrina, Rita and Wilma wreaked devastation on New Orleans and the Gulf of Mexico. A massive earthquake measuring 7.6 on the Richter scale hit Kashmir, causing more than 87,000 deaths.

The price of crude oil, which had been hovering at US$50 per barrel in 2004, reached US$60 per barrel in June 2005 and hit a high of US$70.85. Steel prices softened, however, and in April, Indian steel tycoon Lakshmi Mittal acquired Ohio-based International Steel Group to create the world’s largest steelmaker.

Because of these “moderating influences”, the world economy expanded 4.3%, down from 5.1% the year before.

The housing market started to come off in the US. The rise in house prices peaked at 15.2% in August 2004. By September 2005, the annual increase of 3.2% represented a nine-year low. The Fed raised short-term interest rates eight times during the year to relieve emerging inflationary pressures.

In the EU, the Stability and Growth Pact, which set a 3% limit on the budget deficits of national governments was amended to give governments more time to reduce excessive deficits. This made it more difficult to enforce discipline and the pact lost credibility and set the stage for what was to come.

Bank Negara adjusted the exchange rate regime on July 21, moving from a pegged exchange rate (at 3.80 to the dollar) to a managed float. The ringgit appreciated to reach 3.746 against the US dollar before closing the year at 3.78.

To prepare for the floating rate regime, the central bank started to open up and liberalise its policies. For instance on April 1, it made changes to give greater flexibility for overseas investment, including changing the thresholds for investment abroad, extension of credit facilities to non-residents and placement of funds by residents. Residents were also allowed to open foreign currency accounts onshore and offshore without requiring the approval of the central bank. Similarly, limits on foreign currency credit facilities that could be obtained by residents were increased.

On the same day Malaysia unpegged the ringgit, the People’s Bank of China announced long-awaited currency reforms, revaluing the renminbi by 2.1% and moving it to a managed float against a basket of currencies that included the dollar, yen, euro and won.

Datuk Nicol David captured the World Open title in Hong Kong to become the first Asian woman to be ranked world No 1 in squash and Mawi, the winner of Akademi Fantasia 3, became an instant sensation.

There was such a bad haze that a state of emergency was declared in Kuala Selangor and Port Klang.

Malaysia’s real GDP expanded 5.3% despite a downturn in the global electronics industry in the first half of the year that affected its export of semiconductors. Inflation was a real concern because of the rise in international commodity prices. The annual change in the Consumer Price Index more than doubled to 3% from 1.4% the year before. Core inflation, which is CPI inflation excluding price-volatile items and price-administered items, doubled to 2% in that time.

The KLCI ended the year slightly lower at 899.79 points.

2006

Fire Dog

The Fire Dog growled viciously in 2006, setting the scene for a bad few years for the world economy. It was the year when numerous so-called sophisticated financial institutions started to realise that the Emperor had no clothes, to wit, their portfolio of subprime mortgages, artfully bundled with other more investment-worthy mortgages and given investment grade ratings by world renowned ratings agencies, were going to unravel.

Ben Bernanke replaced Alan Greenspan as the Federal Reserve chairman and the housing bubble collapsed in August that year, setting the stage for the economic malaise known today as the global financial crisis.

In April, the Iranians announced that they had enriched uranium for the first time, a significant step in making nuclear power and nuclear weapons. The United Nations Security Council (UNSC) set a deadline for Iran to halt the process of enrichment, which it ignored. Four months later, sanctions were imposed on the nation.

It was not all bad news, however. Former UN Secretary-General Kofi Annan launched the Principles for Responsible Investment (PRI) initiative convened by the United Nations Environment Program Finance Initiative and the UN Global Impact at the New York Stock Exchange in April. The initiative was an international network of investors working together to put the six principles for responsible investment into practice.

Former US vice-president Al Gore’s documentary on global warming and climate change, An Inconvenient Truth, opened in cinemas across the US in May, roughly five years after President George W Bush effectively killed the Kyoto treaty on global warming by taking the first steps towards withdrawing the US signature on the accord. It became the third top-grossing documentary of all time and forced people to sit up and take notice.

In September, the Royal Thai Army staged a coup d’état against the elected Prime Minister Thaksin Shinawatra a month before nationwide elections was scheduled. The takeover of the military government resulted in long-term economic consequences such as a drive to self-sufficient economy and economic protectionism in the country’s policies.

In November, America’s mid-term elections were held. The Republicans lost control of both houses of Congress, turning Bush into a lame-duck president overnight. The elections were seen as a repudiation of an unpopular war in Iraq. The following month, former Iraqi leader Saddam Hussein was hanged in Northern Baghdad for crimes against humanity after being sentenced to death by an Iraqi court in November over the killing of 148 Shias in the 1980s.

This was also the year China and India saw extraordinary economic growth. The Indian stock market hit new heights; the run-by-Indian-expatriate Mittal Steel took over Europe’s biggest steelmaker, Arcelor. The new share issues in Hong Kong raised more money than those in New York and London; and China overtook Japan in research spending, according to the Financial Times.

Back home, despite the robust growth in output and wages, Malaysia’s economy remained on a balanced growth path. The Ninth Malaysia Plan was launched in April. In October, Mongolian model Altantuya Shaariibuu was blown up using military-grade explosives, a case that set Malaysian tongues wagging about a cover-up at the highest levels and speculating about who killed her and why.

The Malaysian economy grew, with real GDP expanding 5.9%, outpacing the world GDP growth of 4.38%. Inflation was kept in check at 1.7% and the ringgit appreciated to 3.53 against the US dollar. The KLCI shot up 21% to 1,096.24 points.

2007

Fire Pig

The Year of the Pig saw Malaysians feasting on plenty while the rest of the world started to writhe in turmoil. The US was already suffering from the collapse of the housing bubble, but it was generally a stellar year for the local economy. The global financial crisis may have started to brew with defaults on subprime mortgages up 93% from the previous year, but Malaysia’s economy actually expanded 6.3%, driven by robust domestic demand, against the world’s economic growth of 5.7%.

Financial institutions, mainly in the US, undertook write-downs on subprime-related securities and sought to repair their balance sheets by recapitalisation exercises. There were two especially bright spots coming from the US — the launch of the first iPhone by Steve Jobs (which saw one million units sold within the first 74 days of its release and went on to be named Time magazine’s Best Invention of the Year) and the start of the 2008 presidential campaign of Barack Obama, which paved the way for the junior senator from Illinois to be the first African-American president.

Back home, all was not quiet on the political front. Growing dissatisfaction among the people resulted in two rallies within a short space of each other towards the end of the year. The first Bersih rally was held on Nov 10, calling for electoral reform. Some 15 days later, the Hindu Rights Action Force (Hindraf) held their own march to protest against discriminatory practices based on race.

It was also a year for flight and the opening of regional economic corridors. April saw the launch of Firefly, the country’s second low-cost carrier. The first Malaysian astronaut, Sheikh Muszaphar Shukor, returned to earth aboard the Soyuz TMA-11 in October. A total of three regional corridors — Nusajaya, the newly planned city that was to be part of the South Johor economic region, Northern Corridor Economic Region and East Coast Economic Region — were launched.

Despite some political dissatisfaction, it seemed as if the country had turned the corner economically. The construction sector, which had contracted three years in a row, recorded positive growth of 4.6%, driven mainly by projects brought about by the 9th Malaysia Plan.

One reason the Malaysian economy performed so well was the increase in the prices of major export commodities. Crude palm oil

prices shot up 62.6% to reach a historic average high of RM2,472 per tonne and the Tapis Blend, Malaysia’s light sweet crude oil, which opened the year at US$57.44 per barrel, increased to close the year at its highest level of US$99.57 per barrel. Because of this, the country’s current account surplus increased to RM99.3 billion or 15.8% of gross national income while net international reserves increased RM45.3 billion to RM335.7 billion. Inflation moderated to 2%.

In December, the US economy entered a recession that saw several large financial firms experiencing financial distress, and many financial markets experienced great turbulence. The KLCI, however, had a banner year. After passing the psychological 1,200-mark hurdle in February, it fell 72.40 points over the course of a few days amid fears of capital controls. But it ended the year 31% up at 1,445.03 points.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.