This article first appeared in Personal Wealth, The Edge Malaysia Weekly, on Feb 8 - 14, 2016.

In the spirit of the Lunar Year of the Fire Monkey, Personal Wealth looks back on the last 12 years, highlighting the key events that helped shape today’s global economic and investing landscape.

The last zodiac cycle, from the Wood Monkey to Fire Monkey, was far from a time of peace and plenty. Everything seems to have escalated from economic and political turmoil to natural disasters. This was the time when the world experienced the devastation of the Indian Ocean tsunami as well as the global financial crisis.

In Malaysia, the ruling coalition's stranglehold on the nation was shaken for the first time, when on March 8, 2008, it lost five states to the opposition. Since then, political uncertainty has escalated, eating away at investor confidence, which resulted in a fall in foreign direct investment as well as a battering of the ringgit which, after a few good years, is back to Asian financial crisis levels.

Oil prices have been on a roller-coaster ride, peaking at US$145 per barrel in July 2008 at the height of the global financial crisis to as low as

US$26 per barrel, and according to economists and analysts, it's not done falling yet. As an oil-producing nation, Malaysia, which was riding high on the exorbitant oil prices, has a major cause for concern.

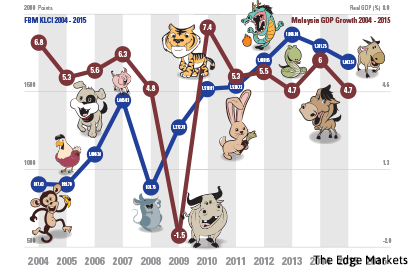

Despite the global and local turmoil, for most of these years, the Malaysian economy performed well, with its growth outstripping world growth, sometimes by more than twice, and inflation kept at low levels. Overall, the benchmark FBM KLCI more than doubled from 788.49 points at the start of 2004 to 1,692.51 at end-2015. The ringgit, however, which was pegged at RM3.80 at the beginning of 2004 and strengthened to below RM3 in 2012, fell to RM4.29 at the end of last year.

2016

Fire Monkey

If investors are expecting a respite from the tumultousness of the last couple of years, they may have to wait a little longer. Even as 2015 came to an end and 2016 began, the signs that emerged were not good, indicating more treacherous waters ahead.

China’s slowdown, which so far has been more severe than expected, and the crash in crude oil prices sent jitters across the global economy and financial markets went into a tailspin for the most part of January.

Now, as the Lunar Year of the Fire Monkey swings in, it isn’t about to bring good tidings either, at least insofar as the economy and stock markets are concerned.

If we go back to the previous Year of the Monkey in 2004, it was a year that saw a major natural catastrophy — the Dec 26 tsunami devastated many parts of Asia. But in terms of the global and domestic economy, it was a good year with commodity prices on an uptrend, buoyed mainly by strong demand by China. Most parts of the world posted strong growth.

The same cannot be said of the economic and financial environment today. Most market observers and economists aren’t upbeat about the economic outlook for 2016, with China in a slowdown mode and the sluggish recovery in Europe and the US.

Externally, the US could provide some respite, but its growth performance in the last quarter of 2015, at just 0.7%, has given cause for worry. Indeed, for the whole of last year, its economy grew just 2.4%, at about the same rate as in 2014.

Meanwhile, the Malaysian economy continues to face its own set of challenges. Growth is slowing as the rising cost of living, weaker ringgit, falling crude oil prices, governance issues in the public sector and political uncertainties hurt consumer sentiment. This year, gross domestic product (GDP) is seen slowing to around 4%, while the more bearish views put growth at 3.7%.

Given the fiscal constraints, a view is that the government has few policy options if the global environment turns really hostile. As could be seen from the revised Budget 2016, pump-priming options are already limited and will come largely from the people. The 3% cut in contributions to the Employees Provident Fund, for example, is envisaged to put more money in people’s pockets.

Monetary policy is also constrained. Most industry players say the cut in the statutory reserve requirement (SRR) is a short-term move to ease the tight liquidity situation in the banking system. If Bank Negara Malaysia cuts interest rates, it could lead to a further weakening of the ringgit. At the same time, the rising cost of living has led to a spike in inflation.

What of the stock market?

Against the backdrop of slowing growth and a sluggish global environment, analysts aren’t upbeat about the stock market and the performance of the corporate sector. Most of them are projecting single-digit growth, at best, for corporate earnings in 2016. Major sectors like banking, oil and gas and plantations will continue to come under pressure as a slower growth takes its toll on domestic demand.

By all indications, 2016 is another tough year, testing the resilience of the economy and the mettle of policymakers. For investors, though, as the downturn continues, bargain-hunting opportunities have come up, not just in the stock market but also in real estate. Going by the investing philosophy practised by some of the most successful investors in the world, it is time to buy when everyone is selling.

2004

Wood Monkey

The previous two Wood Monkey years are remembered for notable events, both good and bad. In 1944, there was D-Day, when the Allied forces landed in Normandy and liberated Western Europe from Nazi control.

Some 60 years later, on Dec 26, the “earth heaved, the sea rose and the world changed” when the Indian Ocean tsunami wreaked a trail of destruction on 17 countries, claiming 230,273 lives and causing total losses of US$9.93 billion in five countries — Indonesia, Thailand, India, Sri Lanka and the Maldives.

Malaysia may have been luckier than most, but it was not entirely spared from the tide of devastation. Some 68 people lost their lives.

The stock markets of the affected countries, however, failed to react, with the bourses in Indonesia and India inching up 1% at the end of the trading week following the tsunami.

This was the year US President George W Bush was re-elected, oil prices hit what was then an all-time high (light sweet crude hit US$55.67 a barrel), driven by the almost insatiable demand from China. It was not the only commodity on the up and up. In fact, on Dec 1, the Reuters-CRB index, a basket of 17 commodity futures tracked by investors, hit a 23-year high. Gold reached US$450 per ounce for the first time since 1988.

In May, eight countries — the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Slovakia and Slovenia — became members of the European Union.

It was also the year Datuk Seri Najib Razak was appointed deputy prime minister, two months before the general election, during which Barisan Nasional regained Terengganu from PAS.

It was a significant year for the transport sector in Malaysia. The electronic payment system, Touch ’n Go and Smart TAG, was introduced at Malaysian expressways and the RapidKL bus and transit services were launched. In August, the first phase of the East Coast Expressway from Karak to Kuantan was opened.

Malaysia experienced its most rapid growth in four years, with the economy expanding 7.1% (against 5.1% growth in the global economy, a 30-year high) as the result of robust growth in global trade and domestic demand. The growth was led by private sector investment as the government continued its policy of fiscal consolidation and succeeded in lowering the fiscal deficit to 4.3% of GDP from 5.3% the year before. The CPI and core inflation, however, only expanded marginally at 1.4% and 1% respectively.

This was also the year the Malaysian stock exchange, hitherto known as the Kuala Lumpur Stock Exchange, was renamed Bursa Malaysia, following a demutualisation exercise. It ended the year at 907.43 points.

Malaysia’s current account surplus increased to RM56.6 billion, equivalent to 13.4% of gross national product (GNP). The ringgit, which was still pegged to the US dollar, ended the year at 3.80. The peg would be lifted a year later.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.