This article first appeared in Digital Edge, The Edge Malaysia Weekly on April 12, 2021 - April 18, 2021

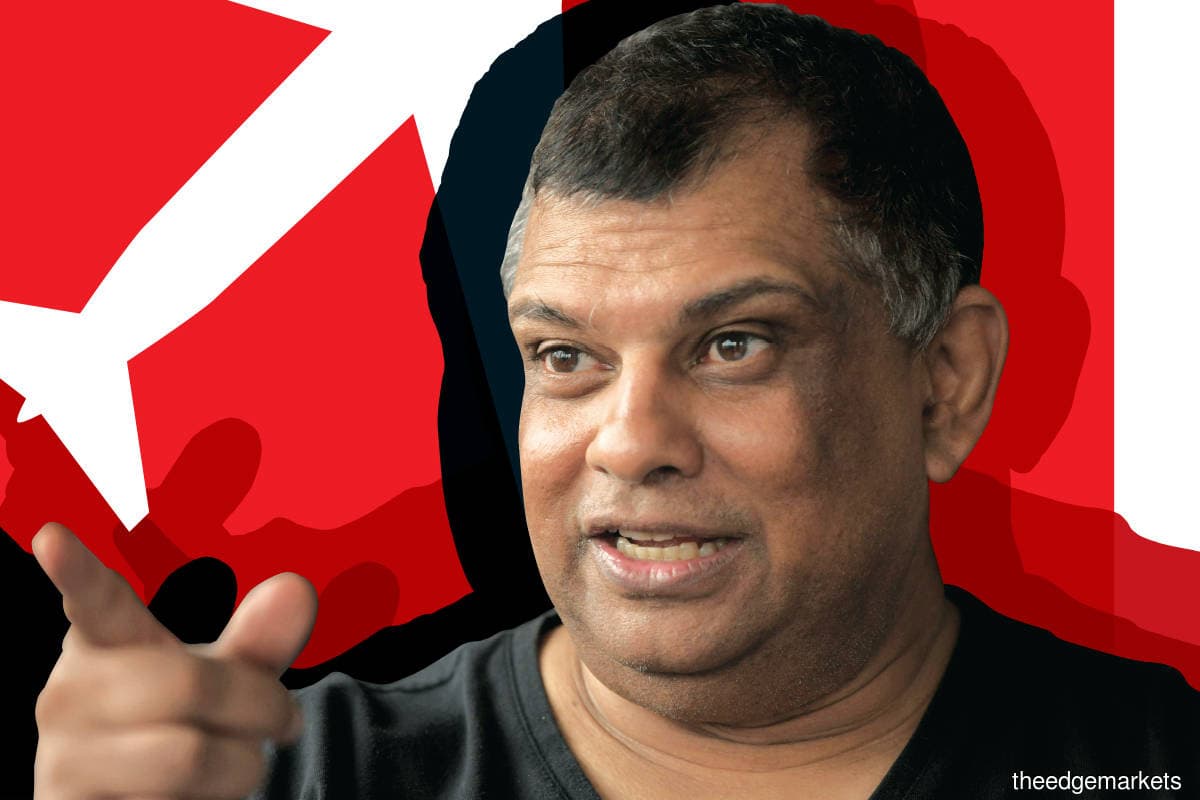

For Tony Fernandes, CEO of AirAsia Group Bhd, the pandemic was like the bird strike incident that the low-cost airlines group encountered in 2001, which he calls a defining moment.

An AirAsia plane — one of the two it had at the time — had run into a flock of birds en route to Kuching and suffered damage. When Fernandes received the news, he had just spent eight hours asking a government official to give him a route to Langkawi, he recalls.

“In the end, she gave it to me. When I was driving back, my chief pilot calls me and told me we had a bird strike. I said, ‘What can a bird do to our mighty 737 plane?’” Fernandes tells Digital Edge in an interview.

Quite a lot, it turned out. The plane had to be grounded for 12 days. But having just won the right to a coveted route and committed to turning around the airline, he had to make a decision.

“We only had one plane left. We’re not going to cancel any flights, and so that one plane flew 24 hours non-stop for around 10 days. We never cancelled any flights. But we obviously had delays,” says Fernandes.

The Covid-19 pandemic has resulted in even more grounded planes and painful losses. At this time, it only makes sense for the group to double down on its digital initiatives, says Fernandes. “We couldn’t fly, so I told the team that now is the perfect time to pivot. We have to move quickly. We really put our foot on the pedal during Covid-19 because we had no choice.”

Out of need, some old plans, like the Redbeat Academy, were sped up and launched in less than half a year by October. The academy is a digital skills training centre done in partnership with Google.

The AirAsia superapp — a rebranding of airasia.com — was launched in the same month, offering e-commerce services beyond flights and hotels. This is underpinned by Teleport, AirAsia’s logistics venture, which also had to transform to become a last-mile delivery provider as border closures impacted cargo capacity. AirAsia’s food delivery service began operations last April.

Meanwhile, new plans such as an air taxi service were developed in three months. Fernandes expects trials for the air taxi service to begin later this year. Drone deliveries, ride hailing and micro-credit services under AirAsia Digital are expected to be launched this year as well.

“We had daily meetings, and keeping everyone motivated was my job. We are lucky that we came up with this digital strategy. If not, it’d be depressing,” says Fernandes.

It was not an easy time, as the group had to retrench 10% of its staff last year. That’s why he rushed the launch of Redbeat Academy, says Fernandes. The academy offers courses in data analytics, software engineering and other areas to reskill its staff. It is now open to the public.

“We had the idea to launch the Academy before Covid-19 because I thought that a lot of people were going to lose their jobs from digitalisation. I had prepared for this because I didn’t want to lose good, loyal staff due to Industrial Revolution 4.0,” says Fernandes. He estimates that the academy has reskilled around 600 internal staff and trained over 3,000 individuals.

“We have many staff members now who have moved from their operational jobs, whether it’s cabin crew, pilots or ground staff, into data science or data engineering jobs.”

Focusing on its strengths

AirAsia Digital’s strategy spans three areas: the superapp platform, which is branded as an all-in-one lifestyle and travel app; fintech, which is done through BigPay; and Teleport, its logistics arms that covers cargo logistics, last-mile delivery services and e-commerce marketplaces for AirAsia Food, Fresh and Shop.

These initiatives cover a wide area, but a few things tie them together. One is the reliance on AirAsia’s huge bank of customer data, given that those who fly with the airline would already have the app. According to the company, the app had over 75 million users and 40 million downloads as at October 2020.

BigPay, which is integrated with the app and has over a million users, allows its users to pay for online purchases and send money abroad at a lower rate. Last November, BigPay received a community credit licence to offer online loans or microcredit.

“I looked at our infrastructure and figured out what we can do. How can we convert our customers’ loyalty with AirAsia and give them more value through our app?” says Fernandes.

Adding e-commerce and fintech functions to the app made sense, as this allows AirAsia customers to purchase services and products beyond those related to travel. The group can also rely on the data bank to understand its customers’ preferences.

Secondly, due to the company’s wide network of flights locally and regionally, it has a powerful logistics infrastructure. Teleport was able to leverage this to offer a cargo logistics service.

During the pandemic, Teleport transformed to also provide end-to-end delivery infrastructure, including first and last- mile deliveries and digital customs clearance. It converted some passenger aircrafts to cargo-only freight planes to meet the demand for e-commerce.

In April, it launched Freightchain, which the group says is the world’s first digital air cargo network run on blockchain. This feature allows shippers or freight forwarders to instantly book planes to carry cargo.

“We are great movers of people. So, I thought, can we build a business to move boxes like we move people? No one has 15 flights a day to Kuching. We can deliver products the fastest by plane. And when you need someone to pick you up from the airport, we can offer you a car ride [through the ride-hailing service],” says Fernandes.

How to innovate in a short time?

It is interesting to note how quickly AirAsia transformed its existing initiatives and plans to launch its new drone delivery, ride hailing and air taxi services, which are all expected to come online or conduct trials this year.

This required the company to develop the ideas in a short amount of time, find the right talent and obtain regulatory approvals. On the last item, Fernandes laughs, saying “… don’t forget that we’re the regulatory kings. Opening AirAsia Food in Singapore was a lot easier than applying for the route to fly to Singapore.”

The company also deployed its grounded staff to manage the new initiatives. The drone delivery, for instance, is steered by AirAsia pilots. Fernandes is hoping to launch the service in December.

“It costs three times more than a normal delivery. But for someone who wants something really quickly, they’ll pay for it. It can cover up to 25km but it depends on the weight. The cost will eventually come down,” he says.

The air taxi service, meanwhile, is run by AirAsia’s chief pilot of safety. It is working with two companies that are furthest ahead in getting regulatory approvals for this service.

“Imagine that you can take a helicopter from the airport after your flight lands to wherever you live. Eventually, this will be autonomous. I hope to conduct our first trial in December,” says Fernandes.

This highlights another element of his strategy: partnerships with companies that are already in the space.

“You’re going to see a lot of mergers and acquisitions happen under AirAsia. A lot of small companies will join up with us, whether they are food or delivery companies,” he adds.

Fernandes hopes to launch the ride hailing service by end-April, and conduct a soft launch of the microcredit service under BigPay in two months’ time. Meanwhile, a new e-commerce experience for AirAsia’s food and grocery delivery services is expected to go live this month.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.