IN a challenging and frustratingly slow year for the country’s investment banks (IBs), many have been forced to re-look their strategies. Nevertheless, the IBs still see opportunities despite the competitive industry landscape.

An initial public offering (IPO) drought — there have been only three listings so far this year — and a slowdown in mergers and acquisitions (M&A) and other fundraising activities in the capital market since the second half of last year have left IBs considerably less busy.

“We’re seeing investment bankers clocking out [of the office] before nightfall ... a telling sign of how slow things are,” an official at one of the larger IBs tells The Edge.

The slowdown has affected the earnings of some of the major banks. And like many of the global IBs, some have resorted to retrenching staff or moving them to overseas offices that are still growing — instead of recruiting new workers — in a bid to contain costs.

CIMB Group Holdings Bhd, for example, which has one of the largest Asia-Pacific-based IB franchises, started cutting its workforce in the investment banking division in February. “The realities of today’s capital markets require us to recalibrate,” it had said then.

“It’s a case of too many IBs chasing too few deals. Fees are coming down because IBs are undercutting each other to clinch deals, which are not even large ones — those are rare these days — but more small-to-mid-sized ones,” says a veteran investment banker.

The slowdown, especially in deal value, is not unique to Malaysia, but seen throughout the region, bankers say.

In the first quarter of this year, net revenue from investment banking in Southeast Asia (SEA) dropped to US$238 million (RM893.4 million) from US$300 million in the previous corresponding quarter, according to Dealogic, a firm that tracks such data.

This followed a weak 2014 for investment banking in SEA, with net revenue falling to US$1.3 billion from US$1.7 billion in 2012, when the region was a hotbed for deals.

Bankers say the overall sentiment in the region has definitely been less upbeat, with investors and corporates affected by uncertainties in global markets and the volatility of regional currencies and commodity prices. Political risk also seems to be a common theme in Asean this year, notes Affin Hwang Capital group managing director (MD) Maimoonah Hussain.

“In Malaysia, IPO [activity] has declined considerably and secondary fundraising has also been down. Looking at the level of rights issues, capital-raising dropped more than 50% this year compared with last year. The only bright spot is M&A, which hasn’t dropped that much, but if you share the pie among the IBs, this is not big income. Fees for corporate advisory and M&A are generally non-big ticket unless it’s an M&A that comes with funding,” says Hong

Leong Investment Bank Bhd (HLIB) MD and CEO Lee Jim Leng.

The situation is not expected to improve any-time soon despite initial expectations that the capital markets will pick up in 2H2015.

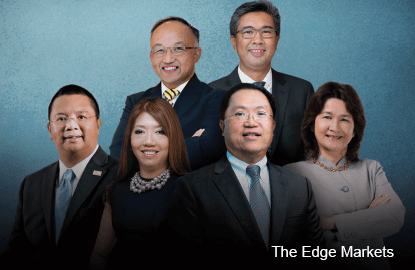

The Edge spoke to the heads of six of Malaysia’s 11 IBs — CIMB Investment Bank Bhd, Maybank Investment Bank, RHB Investment Bank Bhd, HLIB, Affin Hwang Capital and Kenanga Investment Bank Bhd — and was told that a pick-up in activity was not imminent.

They expect the capital markets to see a prolonged period of slow activity and soft sentiment.

“Looking at the indicators, the outlook for the second half of 2015 is not promising, especially for the cash equities business in the nearer term, as the market is going through a period of consolidation,” says Tengku Datuk Zafrul Aziz, CEO of CIMB IB.

“However, this will be partially offset by a better fixed income performance as the corporate bond market continued to trend positively in 1H2015 and will likely see a slightly stronger level of issuances across Asean this year.”

He says the capital market environment was subdued not just in Malaysia but across Asean in 1H2015 as investors generally viewed the region as one asset class.

“The slowdown in investment banking was perhaps more prominent in Malaysia and Singapore, given the relatively strong deal flows in recent years. Nevertheless, each Asean market has its own challenges and it will take time to address the issues. Having said that, we believe, as in all cycles, the Asean markets will return as economies grow and investments resume,” he adds.

Tweaking strategies

In the meantime, most of the IBs say they have to tweak their strategies to make the best of the longer-than-expected dry spell and position themselves better in anticipation of a recovery. Many are also striving to contain costs at this time.

“Obviously, the outlook isn’t promising, so we can’t rely on the traditional ways of doing business anymore. We’re reinventing the wheel ... doing more new things in the market like unrated debt papers. The big funds have a good appetite for such papers,” says Roslan Tik, Kenanga IB’s executive director and head of group investment banking and Islamic banking.

Non-bank-backed Kenanga IB is one of the smaller IBs in the country. “Our size actually works to our advantage because we are nimble and have the agility to adjust and respond more easily to market conditions,” says Roslan.

“Corporate activities like financing, IPOs and M&A in the small and mid-cap sectors are still quite vibrant. Kenanga IB is focused in this space. In fact, in recent times, some of the larger IBs have moved into this space because of the lack of deals in the big-cap sector.”

Indeed, industry sources say the small IBs are coping better in this slow period because they are able to continue to tap the small corporates that big IBs had ignored in better times.

But the big regional IBs also have an advantage in that they are able to pursue deals in other markets like Thailand and Indonesia, where deal flows are relatively better, especially in the IPO space.

Roslan says Kenanga IB has adequate deal flows in the pipeline to keep it busy in the next 12 months. “Our pipeline is very much equity driven. We are still optimistic about the market. The liquidity is there, but what has been missing in the last six months was investor confidence and trust. It goes back to the basic requirement of integrity and credibility of the issuer.”

CIMB IB, which regularly tops the investment banking league table, says it is important that it retains its leadership position in these tough times.

“Our focus is to ensure that we continue to retain our position so that when the markets turn bullish, we are there to capture the opportunities. Hence, as the markets slow down, we will pursue revenues from non-capital market activities and increase regional and cross-border M&A activities in view of moderating valuations and distressed situations. At the same time, we are also actively containing our costs and reviewing our operating cost base,” CIMB IB’s Tengku Zafrul says.

HLIB’s Lee doesn’t think IBs should focus on being the best in all business segments in these difficult times. “It’s no longer relevant to be everything to everyone in these times of declining market revenue. Increasingly, people are concentrating on things that they do best. They’re looking for niches that they can build on rather than being a leader of everything. They need to reinvent themselves.”

She says product innovation is important for HLIB. “Products work based on different environments, different cycles. We have to be innovative and look at what works best for our clients.”

RHB IB CEO Mike Chan points out that no matter the market cycle, investment banking is a long-haul business. He says IBs should use this downtime to “refocus”.

“For RHB, we take this year to basically look through our internal structure, do some cost optimisation and relook at the business model to make us more efficient. We’ve tweaked our business model slightly to focus more on coverage as one of the pillars, giving more emphasis to relationship management. All the capital market activities like ECM (equity capital market), DCM (debt capital market), institutional and retail equities, asset management, sales and trading and advisory ... these are the key pillars that we will deepen our capabilities in across the region.”

Affin Hwang Capital says it has always positioned its business for the long term. “We do not believe in second-guessing short-term cycles and macroeconomic gyrations nor do we build our strategy around short-term goals or market conditions. Our overall strategy is about revenue growth and cost control over a period of five years,” says Maimoonah.

“The theme is to build resilience across our businesses, to position [them] such that whether it’s a good year or a bad year, we keep our seat at the table.”

Silver lining

Despite the current gloomy environment, bankers say there are still opportunities.

“There are some bright spots in capital-raising, particularly to fund infrastructure projects. We expect many of these projects to be financed through the debt capital market, sukuk issuances, project financing or loan syndication,” says Maybank IB CEO John Chong, who is also CEO of Maybank Kim Eng.

Some of the group’s clients have managed to lock in rates successfully for Islamic and conventional bonds, he says. “It is a matter of identifying potential windows for pricing and launching the transactions.”

Overall, the group still has a healthy pipeline of potential deals, he adds. “Having said that, the conversion of these deals will depend very much on the issuers’ decision, market condition and timing.”

CIMB IB, too, notes that there has been continued growth in infrastructure investments across Asean, which will translate into fundraising opportunities for IBs.

“The demand for sovereign and corporate debt issuances remains strong, and CIMB has been involved in several landmark sukuk issuances by Malaysia and Indonesia as well as corporate issuers like Petronas,” says Tengku Zafrul. Despite the weak market outlook, CIMB IB’s deal pipeline remains “relatively healthy”, he adds.

The big IBs believe M&A activity will pick up, given that valuation levels have come down somewhat.

“M&A is something that we see is going to ramp up in Asean, so we have strengthened the team that focuses on that business. There’s a lot of demand in the areas of education, healthcare, fast-moving goods and oil and gas downstream activities, which are infrastructure-related, like tank farms and so on,” says RHB IB’s Chan.

He notes that as global IBs cut back in the region, there are opportunities for Malaysia’s top three regional banks — CIMB IB, Maybank IB and RHB IB — to grab big M&A deals that global players used to dominate.

As for IPOs, the outlook remains uncertain, but Thailand and Indonesia seem to be bucking the trend. Maimoonah notes that Thailand saw eight IPOs in the first quarter alone. And although Indonesia has had only three so far this year, 32 others are in the pipeline. “Whether these materialise or not, given that we are already halfway through the year, it remains to be seen.”

Malaysia and Singapore are among the weakest in terms of IPO volumes. Malaysia has two slated for listing this week, bringing the total to just five so far this year. These include last month’s listing of Malakoff Corp Bhd — the biggest — which raised RM2.7 billion and was heavily oversubscribed by institutional investors. However, the stock failed to shine upon listing.

Singapore had only two listings this year — crushed limestone producer GCCP Resources Ltd and property management group LHN Ltd — which raised just RM110 million in total. The performance of both counters have been poor, having declined over 30% since their listings, says Maimoonah.

This article first appeared in The Edge Malaysia Weekly, on June 29 - July 5, 2015.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.