This article first appeared in The Edge Malaysia Weekly, on April 11 - 17, 2016.

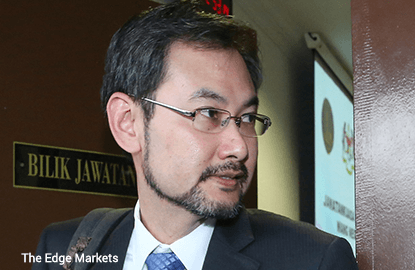

Datuk Shahrol Azral Ibrahim Halmi is a mild-mannered graduate of an Ivy League university — Stanford. Smart and personable, it seemed that the world would be his oyster when he started work at management consultancy Accenture.

Shahrol was in the public services group — essentially the team involved in working with government-linked companies. He was involved in the Employees Provident Fund’s (EPF) transformation programme and in the mega-merger of Sime Darby Bhd, Kumpulan Guthrie Bhd and Golden Hope Plantations Bhd in 2003.

People who know him say he was very excited when he was headhunted to be the CEO of Terengganu Investment Authority Bhd (TIA), which quickly evolved into 1Malaysia Development Bhd (1MDB) to drive strategic investment initiatives for the country.

Shahrol thought it was a great chance to serve the country.

“He firmly believed in bringing about positive change in government,” says a person who knows him.

But the soft-spoken Shahrol was soon to be caught in a complex combination of business, politics and financial dealings of a magnitude that he, and the country, could never have imagined back in August 2009 when TIA was started.

But Shahrol was not alone.

Joining him at 1MDB were other young professionals like ex-Hong Leong banker Casey Tang Keng Chee; Nik Faisal Ariff Kamil, who had worked in corporate finance at Aseambankers, RHB Bank and PNB; and lawyer Jasmine Loo Ai Swan.

Tang, Nik Faisal and Loo are now on the wanted list of Bank Negara Malaysia and the Malaysian Anti-Corruption Commission (MACC). They fled a year ago at the start of the investigations into 1MDB.

Shahrol, on the other hand, stayed behind and has been working in the energy unit of the Prime Minister’s Department since he stepped down as 1MDB CEO in 2013, but remained on the board.

While his former colleagues disappeared, he cooperated with investigators, including the Public Accounts Committee (PAC).

But if he thought that would be a mitigating factor, he was wrong. PAC, in its 106-page report tabled in Parliament last week, put the blame for all the troubles at 1MDB squarely on his shoulders.

“PAC is of the opinion that former chief executive of 1MDB Datuk Shahrol Azral Ibrahim Halmi must take responsibility for the weaknesses. As such, we request enforcement agencies to investigate (Shahrol) and others in management.”

Shahrol responded swiftly, saying emphatically, “I gave them (PAC) a full and honest account of my time as CEO of 1MDB. As explained to PAC, I wish to emphasise once again that there was no wrongdoing or illegal activity at the company under my watch.”

Strong and confident words from a mild-mannered individual.

So, why did PAC point the finger at him?

Going through the PAC report, the following are the instances when Shahrol, as the head of management, is said to have defied, misled or withheld critical information from the 1MDB board of directors (BOD) — actions for which he may now have to face the music.

The 2009 joint venture with PetroSaudi

According to PAC, Shahrol did not inform the 1MDB BOD of an Aug 28, 2009, letter from Prince Turki and Tarek Obaid to Prime Minister Datuk Seri Najib Razak, spelling out the proposed terms of the joint venture. Tarek had proposed that 1MDB inject US$1.0 billion cash for a 40% stake in the JV. Petro Saudi International Ltd (PSI) would inject US$2.0 billion in assets but give a US$0.50 billion discount to value its contribution as US$1.5 billion.

At a BOD meeting on Sept 18, 2009, a paper on the proposed JV was tabled and Tang (executive director for investments) briefed the board that the JV was a government-to-government initiative, and that PSI was a company owned by King Abdullah of Saudi and the Saudi government, and which was formed in 2000.

According to PAC, checks by the Auditor-General showed that PSI was formed only in 2005 and that it was a privately owned company with no links to the Saudi government.

“Tarek Obaid was the sole shareholder of PSI. Therefore, the presentation by Casey Tang was inaccurate,” said PAC.

At the same meeting, the BOD asked that three representatives of 1MDB be appointed to the board of the JV company but this was never implemented by management.

The 1MDB BOD also decided that PSI contribute at least US$1.0 billion and another 50% in assets to the JV. “However, the management did not implement the directive of the BOD but instead executed the proposal of Tarek Obaid,” said PAC.

The 1MDB BOD also decided that its chairman Tan Sri Mohd Bakke and Shahrol be the corporate representatives at all meetings of the JV, but management instead appointed Shahrol and Tang.

The 1MDB BOD also approved the JV to be with PSI but in the end, the JV was signed with PetroSaudi Holdings (Cayman) Ltd, which was formed only on Sept 18, 2009 — 10 days before the JV agreement was signed.

In the JV agreement, it was also stated that the JV company, 1MDB PetroSaudi Ltd, had on Sept 25, 2009, (three days before the JV was signed) received a US$700 million loan from PetroSaudi Holdings (Cayman) that had to be repaid before Sept 30, 2009 (two days after the JV was signed).

According to PAC, this US$700 million loan was never made known and discussed with the 1MDB BOD. Documents obtained by the Auditor-General showed that Tarek signed on behalf of both the lender and borrower.

Finally, on Sept 26, 2009, the 1MDB BOD approved the payment of US$1.0 billion to the bank account of the JV company. However, only US$300 million was transferred to the account while US$700 million was transferred to Good Star Ltd. The Auditor-General said the BOD never approved any payment to Good Star.

Although the PAC report made no mention of this, sources say Bakke resigned as 1MDB chairman a few weeks after this because the management had withheld information from the BOD and did not act on decisions made.

Another director, Tan Sri Azlan Zainol, left a few months later for the same reason.

But the unhappiness of the BOD was clearly spelt out by PAC, which cited the minutes of an Oct 3, 2009, meeting: “At this meeting, the 1MDB BOD voiced their unhappiness that their directives were ignored and funds were channelled to other parties without their knowledge.”

The BOD also raised concerns that they were not informed of a change in the bank account of the JV to JP Morgan (Suisse) Geneva from BSI-SA (Geneva), although there was a board resolution with their signatures.

The BOD also was concerned about the ownership and valuation of the assets that PSI was injecting into the JV and wanted information on them.

However, according to the PAC report, “Based on available documents and interviews with former members of the BOD, checks by the Auditor-General revealed that management did not comply with the directives of the BOD.”

But PAC went on to say that despite the fact that the CEO (Shahrol) “did not follow directives, guidelines and corporate governance, the 1MDB BOD did not take any action against him”.

TIA and the RM5 billion bond

Shahrol’s refusal to adhere to the directives of his BOD actually started at TIA, which later became 1MDB.

The PAC report shows that Shahrol proceeded with AmInvestment Bank Bhd to issue RM5 billion Islamic medium term notes (IMTN) despite an urgent and direct instruction from the BOD to abort the exercise.

TIA was set up by the Terengganu government with Putrajaya and had state representatives on the board. The state objected to the terms of the bonds, which it felt were too expensive and did not want to proceed.

Shahrol had argued that the board had no authority to halt the issuance. Instead, under Section 117 in TIA’s memorandum and articles of association, the authority fell solely to TIA’s shareholder — the Minister of Finance (Incorporated).

Interestingly, there is no mention of MoF Inc’s direct involvement in the issuance in the report. Instead, the PAC report highlights Jho Low and Datuk Abdul Aziz Mohd Akhir as two special advisers to TIA who pushed for the RM5 billion IMTN to be issued as swiftly as possible.

According to the report, Jho Low and Abdul Aziz were appointed as special advisers on April 8, 2009, less than two months after TIA was formed on Feb 27 the same year.

Jho Low’s involvement raises even more questions due to discrepancies in Shahrol’s statements to PAC. According to Shahrol, “the issuance of the IMTN was hastened under the request of the TIA’s special advisers for a development in Pulau Bidong, Terengganu, together with Abu Dhabi’s Mubadala Development Company in 2009”.

This statement was corroborated by AmInvestment Bank’s representatives. However, Mubadala on May 23 would deny any involvement in Malaysian projects other than in Iskandar Malaysia, Johor.

Did TIA’s special advisers mislead the company?

Note that PAC was unable to question Jho Low so his version of the events is not on record.

The board on March 25 passed a resolution that granted Shahrol the power to appoint AmInvestment Bank as the lead arranger and lead manager, and primary subscriber for the proposed RM5 billion IMTN. This was before the special advisers were appointed.

The intention for raising the funds was very different at the time. TIA was supposed to be a sovereign wealth fund under the purview of the Terengganu government via the state’s Menteri Besar Incorporated (MBI). Along with the debt of RM5 billion, the federal government was supposed to inject RM6 billion in outstanding oil royalty payments to the state.

Hence, during its first meeting on April 15, the TIA board approved the proposed RM5 billion IMTN with a tenure of 30 years. By May 13, the menteri besar of Terengganu would give written approval of the state for the issuance, but with several conditions, one of which was that the ownership of TIA be transferred to the state.

The conditions set by the state, however, were not met.

Hence, on May 22, the TIA board passed a resolution instructing Shahrol to halt the IMTN issuance on an “urgent basis”.

The board also suspended the authority given to Shahrol and all other directors with regard to the issuance. Keep in mind that Shahrol was also a director of TIA at the time, along with Ismee and the MBI’s representative, Tengku Rahimah Sultan Mahmud.

Despite the direct instruction and the withdrawal of authority, three days later, on May 25, Shahrol and the company secretary signed the subscription agreement for the bonds with AmInvestment Bank.

In the PAC report, Shahrol claimed he had no choice but to proceed with the issuance because of the short notice given by the board. The agreement for the bonds had already been signed on May 15. Halting the deal suddenly would have damaged the credibility of TIA, he claimed.

More interesting is his assertion that the board had no authority in the matter. Citing Section 117, he claimed that only the shareholder — MoF Inc — had the authority to decide.

There is no mention in the PAC report if Sharol was acting on direct instructions from the shareholder.

Subsequently, the board passed a resolution to sack Shahrol on May 27. MBI, unhappy with the turn of events, formally objected to the conduct of the company in relation to the IMTN issuance. Subsequently, the state’s representative on the board, Tengku Rahimah, would resign.

Oddly, Ismee and Shahrol would pass a resolution on the same day that reinstated the latter while resuming the issuance of the IMTN. By May 29, the RM5 billion issuance was completed.

TIA would only receive RM4.385 billion from the issuance because the debt was issued at a steep discount of 12.08%, or RM87.92 for every RM100.

This did not include the profit rate (the interest rate for Islamic instruments) of 5.75% per annum. Due to the discount, the effective profit rate is 6.68% per annum.

In total, 1MDB will have to spend RM13.625 billion on repaying the IMTN — RM5 billion in principal and RM8.625 billion in profit payments. On top of that, AmInvestment Bank charged RM11.25 million in arranger fees, and gets RM238,000 per annum in trustee fees, which works out to RM7.14 million over the 30-year tenure.

Ultimately, the funds did not go into the sovereign wealth fund that would aid the development of Terengganu. Instead the RM5 billion debt was repurposed under 1MDB, a strategic investment fund.

Shahrol would remain as CEO of 1MDB and the rest, as they say, is history. Under his watch, 1MDB went on to raise over RM40 billion in debt for an acquisition spree, including US$6.5 billion in bonds through Goldman Sachs, and the severe troubles it faced blew up in late-2014 when it had problems in paying some of the maturing debt.

The 1MDB saga has spread across the globe and it appears that the Stanford graduate, whose only previous working experience was as a consultant, may have bitten off more than he can chew, playing with the big boys.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.