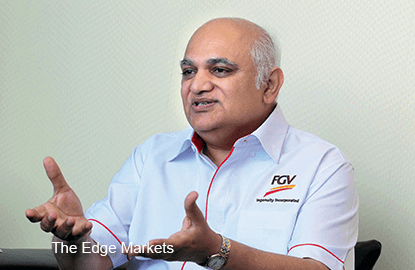

DATUK Mohd Emir Mavani Abdullah is no stranger to criticism as to how Felda Global Ventures Holdings Bhd (FGV) has been managed during his two-year tenure as CEO.

DATUK Mohd Emir Mavani Abdullah is no stranger to criticism as to how Felda Global Ventures Holdings Bhd (FGV) has been managed during his two-year tenure as CEO.

In spite of recent negative reactions to the palm oil company’s latest mega deal, he remains upbeat on the assets and is vigorously defending the proposed acquisition of a 37% stake in PT Eagle High Plantations Tbk.

In a no-holds-barred interview, Emir shares with The Edge his thoughts on the world’s largest producer of crude palm oil, its penchant for high-profile acquisitions and his own future with the company.

The Edge: Let’s be frank. What is your own take on FGV’s performance since listing in 2012?

Datuk Mohd Emir Mavani Abdullah: Let’s look at it from a bigger perspective. When this company went for listing, it was well known that its plantations were old. Number two, the plantations were on marginal land. The land actually belonged to the settlers.

Then we adopted a three-pronged approach. Number one, replanting has been very aggressive, at 15,000ha a year. Number two, we want to transform ourselves by focusing on where the customers’ demand is and to look at a more commercial way of doing things. Thirdly, we look at our internal businesses — where we are performing and where we are not performing. If they are not performing, let’s divest them.

Do not forget that the company is new, the FELDA group is old. Also, we were impacted by the downward trend of CPO (crude palm oil) prices. Unfortunately, it happened just after we were listed.

But you must have felt that the listing was done at the right time.

Yes, the right time. The direction of CPO prices is beyond our control, but the company has been very profitable, and we have never failed to pay dividends. The company has the money and the plantations are profitable. And along the way, we did divest some of our non-core assets.

I do realise that we have been impacted greatly by CPO pricing because of the way we are structured. We are 75% in upstream activities, but we have a very clear plan to move into non-commodity areas. Today, we are aggressively marketing our consumer products outside Malaysia. We are in the Philippines, Cambodia, Vietnam and so on. Demand for our products is increasing.

For upstream plantations, by 2019, we will have the best tree profile in the world. While others are ageing down, we are going up.

All these efforts will bear fruit in the very near future.

Assuming the Eagle High and Golden Land acquisitions go through, FGV would have made more than RM7 billion in acquisitions in three years. Do you stand by all the deals you have made?

We have been very busy in the past three years, you know that. But our positions were not large, just small parcels. We had in Pontian United Plantations about 13,000ha of land, then Asian Plantations, a young plantation of 20,000-odd ha. The Sabah acquisition (Golden Land) was also small. For us to really streamline our operations, we need to have a huge landbank.

When this deal (Eagle High) came along, we looked at it very seriously because you will not get this kind of chance anytime; it is an opportunity to secure a huge landbank. You cannot be just buying small parcels here and there. The cost may be lower but the operating cost will be much higher.

There are a lot of questions about Eagle High in particular. Do you feel that this acquisition is fairly valued?

The Rajawali asset is not just greenfield; there is brownfield as well. When Sime Darby took over New Britain Palm Oil, you all know that they paid an 85% premium. Why would a company pay that much? The price tag for the asset may be high, but it is compensated by the size of the land. Where can you get a landbank of this size and pay a similar price as you would for a 10,000ha parcel?

So, they are asking me: Why pay at two times premium to the share price? Look, every plantation stock is down these days. We evaluated the assets that they have. Another thing is the value that Rajawali will bring to FGV — access to the Indonesian market. We have not been in the Indonesian market at all.

What kind of access?

[Access to] Hundreds of millions of Indonesian consumers … that’s what people did not see. Now, we will be able to supply our margarine, cooking oil and fats. Number two, we go there to look at not only our palm oil value chain but also our sugar business potential.

There is just one lingering issue. The Rajawali group is said to be politically linked. Would this be an impediment?

Let me be honest. When I first took a look at the Rajawali group, I was not aware of this political thing. I looked at it purely on its commercial value, and my team is still looking at it on that basis. We are not interested in the political context of it.

After Eagle High, would you still be pursuing more acquisitions?

In the current context, I will not. I will look into the whole value chain of our oleochemicals after this, from downstream to upstream. So, we will consolidate all our investments and see where we want to grow.

There is continuing speculation about your position as chief executive, and your contract ends in July. Do you feel that you have done everything you intended to do during your time at FGV?

I just want to say that we work as a team at FGV. Whether I’m there or not, the entire team is focused on executing the strategic blueprint that we have.

There is an ongoing discussion between me and the board as to the status of my contract. We will see.

This article first appeared in The Edge Malaysia Weekly, on June 22 - 28, 2015.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.