Datuk Abdul Farid Alias

Group president and CEO, Maybank Group

Datuk Abdul Farid Alias, 47, was appointed group president and CEO of Maybank Group in August 2013. He was formerly Maybank deputy president and head of global banking and has over 20 years’ experience in investment banking and capital markets, having served with various merchant and investment banks such as Aseambankers Malaysia (1992 to 1994), Schroders (1994 to 1995), Malaysia International Merchant Bankers Bhd (1996 to 1997) and JPMorgan (1997 to 2005). An accountant by training, Abdul Farid was director of Investments at Khazanah Nasional Bhd from 2005 to 2008, and sat on the boards of several public-listed companies.

The Edge: What are the changes you hope to see in 2016?

Datuk Abdul Farid Alias: I am hoping there will be more certainty in the operating environment, be it in the economic, financial market, currency or political sphere. This will provide the much-needed impetus for greater confidence in the country, improve external demand and lift local private investments and consumer demand, thus helping propel economic growth onto a more steady and sustained path.

What are your biggest fears for 2016?

Among them are prolonged economic uncertainties that would impact overall growth and external demand, faster than expected hikes in US interest rates as well as a continued decline in the price of commodities, especially oil.

How would you describe year 2016? Do you expect the new year to be worse or more challenging for Malaysia (be it politics or the economy) than 2015?

It would be really hard to make a call here, given that there are so many factors at play that are impacting the operating environment as well as the social lives of the people. Perhaps the best description I can give for 2016 is that like 2015, it will continue to be a year of change, presenting new challenges whether in the form of operating environment, interest rates, currency movements, shifts in technology or consumer trends.

What are your biggest takeaways from 2015?

Some of the key takeaways from 2015 are the realisation that there are opportunities for growth even in the most difficult of times, and the importance of building a foundation for sustainable growth, both of which, thankfully, Maybank has successfully done as demonstrated by our results so far.

Another key takeaway is that it is crucial for us to remain nimble so that we can respond to changes quickly and remain ahead of the curve no matter what obstacles may arise.

On how 2015 has been for the banking industry and for Maybank Group, I would say that it has been an extremely challenging year for the banking industry. We saw a significant level of uncertainties in the global economic environment, which were exacerbated by the sharp decline in commodity prices as well as heightened forex volatility. These of course affected the local industry as we saw some impact from the weaker ringgit as well as moderation in loan and deposit growth, consumer spending, and capital market activities, among others. The industry also experienced pressure on interest margins and saw an uptick in some asset impairment, although this was in no way systemic but confined to particular accounts in specific segments.

We were nevertheless fortunate that the economy continued to grow, albeit slower, on the back of infrastructure and investment spending, which in turn supported the financial services industry.

For Maybank Group, it has been a mixed year so far. We saw better growth in top line year on year as at September 2015, which grew over 16% and continued to deliver value to our stakeholders. We have also carefully managed our risk-reward balance to sustain profit growth while maintaining a disciplined focus on Asean and Greater China, where we saw continued opportunities for business growth. However, given the volatile environment, we saw some impact on certain segments of our business such as global banking as a result of much slower capital market activities in this region.

On the outlook for the banking sector and the group in 2016, generally, we expect the Malaysian banking system to remain steady, safe and possibly leaner in 2016, supported by financial stability and continued private and public sector investments, which are the prerequisites for solid and sustainable growth. This is in line with the development of the general Malaysian economy, which is expected to stay on a growth path with our forecast of real GDP growth of 4.5% led by domestic demand. Private sector expenditure will remain the key driver of growth, with private consumption and investment expected to grow 5.3% and 6% respectively, according to our forecast.

Notwithstanding this, we see key challenges for the financial sector remaining, such as tighter liquidity and greater competition for deposits. We also expect some slowdown in loan growth as a result of slight moderation in the country’s overall economy. This development could impact asset quality as NPLs pick up.

For the group, we expect to contend with moderation in consumer demand as well as scarcer liquidity. Key challenges for us would be managing continued pressure on net interest margins as well as preserving asset quality, ensuring top-line growth, while at the same time managing costs judiciously.

Our priorities would be to expand Maybank’s breadth and depth in the Asean and growth markets by choosing well the segments, markets, customers and assets that we take on. In addition, we expect to further tap growth opportunities, for example, in asset management, private banking, insurance and Islamic banking, where we see growing potential. On the consumer side, we want to be able to manage the continuous shifts in the banking industry, especially the rapid changes in consumer behaviour, and build on our strengths, particularly in the digital sphere, to gain competitive advantage as well as boost efficiency and productivity.

Wan Saiful Wan Jan

CEO, Institute for Democracy and Economic Affairs (IDEAS)

Wan Saiful Wan Jan, 40, is CEO of IDEAS, a Malaysian public policy think tank he co-founded with two others in early 2006 under another name. It was relaunched on Feb 8, 2010, under its current name in conjunction with the 107th birthday of Tunku Abdul Rahman, Malaysia’s first prime minister.

IDEAS is inspired by Tunku’s vision as stated in the 1957 Proclamation of Independence, that this nation should “be forever a sovereign democratic and independent State founded upon the principles of liberty and justice and ever seeking the welfare and happiness of its people and the maintenance of a just peace among all nations”.

In August 2015, Wan Saiful was appointed a member of the National Consultative Committee on Political Financing, which was set up following a proposal by the prime minister.

Wan Saiful, who lived in the UK between August 1993 and October 2009, served on several organisations there, including the Commonwealth Policy Studies Unit, the British Conservative Party’s Research Department, and Social Enterprise London.

He is also director of the Southeast Asia Network for Development and chairman of the Istanbul Network for Liberty and sits on the advisory board of Laureate International Malaysia and the University of Nottingham’s School of Politics, History and International Relations.

The Edge: What are the changes you hope to see in 2016?

Wan Saiful Wan Jan: Well, there would not be enough space if I were to list everything here!

But if I can only have one thing, then I hope 2016 will mark the beginning of an era where we stop being so dependent on politicians from all parties. For decades, our society has been waiting for a saviour politician whom we think will change everything. It is as if when the “right” person takes over, then all our problems will be solved. This is wrong and we must change this attitude. Instead, we must realise that we as a society are the ones who hold true power and the politicians are nothing but people whose salaries we pay. We should demand that they behave like our workers and stop behaving like our masters. For them to change, we must change the way we view them first.

What are your biggest fears for 2016?

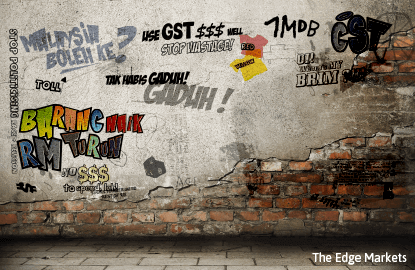

My biggest is that we might stay in the trajectory set in 2015. If you look at what happened during 2015, so many things have been moving in the wrong direction. The liberalisation agenda stipulated in the New Economic Model has almost been forgotten. Umno as the main party in government seems to have worked hard to prove that the 1Malaysia unity concept cannot work. Our top leadership showed that if you are criticised, then you should silence your critics instead of dealing with the issue. Laws with potentially draconian uses have been bulldozed through Parliament. Constitutional concepts have been wrecked, for example, when dealing with the issues in the vape sector, because of a vacuum in leadership. More people are questioning the credibility of important institutions like the office of the Attorney General and others. If we continue on this trajectory, I really fear that we could go down the Zimbabwe way under Robert Mugabe.

How would you describe year 2016? Do you expect the new year to be worse or more challenging for Malaysia (be it politics or the economy) than 2015?

It will certainly be more challenging. In early 2016, we will have to deal with the Trans-Pacific Partnership (TPP) agreement. The government so far has miserably failed to explain why the deal it has worked on for the last five years is the best for the country. I mean, five years of hard work, how can you not plan for this most crucial stage?

But that is only one challenge. I expect to see greater uncertainty. It does not seem like Prime Minister Datuk Seri Najib Razak will be able to convincingly solve the donationgate or the 1MDB saga. With the economy and politics being so intertwined, these issues are bound to make things more challenging, not just politically but economically too.

What are your biggest takeaways from 2015?

That politicians are only interested in their own survival and we would be foolish if we buy into their “I serve the nation” rhetoric.

This year, there have been so many examples of that. Pas and its selfish hudud agenda. DAP and its vehement public attacks on Pas at the expense of the coalition’s harmony. The Public Accounts Committee members who with great joy accepted their promotions despite knowing full well that it would derail the committee’s important work (notably on 1MDB). The Cabinet reshuffle to reward loyal people at the expense of the better ones. The sacking of the Attorney General, which we are supposed to believe is on health grounds. I can probably go on with more examples. But they all have one common denominator — these are all cases of politicians ensuring their own survival.

Malaysia took a blow in terms of newsflow in 2015, so much so that it is said that we have a perception problem. How can we win back favour on the global stage?

We do indeed have a perception problem. It is so bad, to the extent that it has created a massive trust deficit. I visited many countries in 2015 and in almost all of them, I was asked what happened to Malaysia.

To be frank, I don’t think we can regain that credibility unless we provide credible answers to the predicaments. And heads must roll too. If we don’t undergo that tough process, we will not be able to regain the true respect that we once had.

Liew Chin Tong

MP for Kluang

Liew Chin Tong, 38, has been Member of Parliament for Kluang, Johor, since May 2013. He is political education director and a central executive council member of the Democratic Action Party (DAP). He has served the party in various capacities since 1999, and was a political strategist prior to the 2008 election. It was then that he became MP for Bukit Bendera, Penang, at the age of 31.

A political science and Asian studies graduate of the Australian National University, Liew has a master’s in regional integration from Universiti Malaya’s Asia-Europe Institute. He has authored several books and contributed to academic journals. A former visiting Research Fellow at the Institute of Southeast Asian Studies in Singapore, Liew was also executive director of Penang Institute (formerly the

Socio-Economic and Environmental Research Institute) from 2009 to 2012, and at Research for Social Advancement from 2007 to 2011.

The Edge: What are the changes you hope to see in 2016?

Liew Chin Tong: Ultimately, the challenges faced by Malaysia boil down to the question of leadership and the confidence the market and the people place in that leadership.

Speaking from the perspective of an opposition MP, it’s about time Prime Minister Datuk Seri Najib Razak planned an orderly exit as he is very much the source of declining confidence in the national leadership.

But if Najib is not prepared to exit, he must lead instead of just rearranging chairs on the deck of the Titanic. He must not allow the economy to “auto-pilot” into a free fall.

I hope that Najib feels secure enough to relinquish the position of finance minister and hand over the position to a senior minister with strong economic background, for instance, Trade Minister Mustapha Mohamad.

Hopefully, 2016 will see more political clarity. 2015 was the year of a once-in-a-generation political earthquake, which saw Pas split into two and Umno split into one and a half. The earthquake triggered a series of realignments, which are still murky works-in-progress. Once clarity prevails, the line will be drawn more clearly between conservative forces and progressive movements.

What are your biggest fears for 2016?

I fear that Malaysia will be hit by a “perfect storm” crisis. I first used the term in a piece in The Edge in December 2013. In Parliament, I have repeatedly called on the government to recognise that the Malaysian economy has entered a prolonged crisis mode. Abdul Wahid Omar was the only minister who agreed that we might face such a crisis. The rest buried their heads in the sand.

A perfect storm comes when everything that could go wrong does indeed go wrong all at once.

The emerging markets are already grappling with the full impact of the tapering of the US Fed’s unconventional monetary policies, in particular quantitative easing. The prices of oil and commodities have fallen substantially, triggering a fiscal crisis in countries heavily dependent on oil revenue, such as Malaysia.

The falling oil prices have also put pressure on the ringgit, which has fallen by nearly a quarter vis-à-vis the US dollar. Of course, the ringgit has also fallen due to a lack of confidence in Malaysia’s political situation.

The ultimate impact of the implementation of GST, the removal of subsidies, toll hikes, changes to the electricity tariff and so on is that the ordinary working people are suffering further cuts in their already limited disposable income as wages are not rising as much. Consequently, the domestic market is deprived of the consumption it badly needs.

As the household debt level is very high, one prays that there will be no sudden loss of jobs. The combined effect of a struggling domestic market and potential loss of jobs could result in higher non-performing loans. And, as more than 60% of household debt is property-related, even if there is no crash, the property sector will not be rosy for quite a while.

At the same time, exports may not be able to come to Malaysia’s rescue as the global economy slows. Even if the US economy is holding up reasonably well, Malaysia’s past two decades of low skills, low wages and low productivity have led to a premature de-industrialisation milieu, hence we have a limited range of products to export anyway.

I do not wish to be a doomsayer but I am just appalled that no one in the government is looking at these issues in a serious manner. We may or may not hit a big iceberg but the indifference on the part of those who steer the Titanic is scary.

How would you describe 2016. Do you expect the new year to be worse or more challenging for Malaysia (be it politics or the economy) than 2015?

More cracks in Umno will appear if general economic conditions worsen. Umno will resort to harsher racial messages. It is a test of whether those who are opposed to Umno can rise to the occasion to offer a vision that is inspiring and capture the imagination of the wider population.

Najib probably thinks that his lifeline is a marriage with Pas in the name of Malay-Muslim supremacy and unity. But that will lead to a further split in Pas, as a main objective of most Pas members and leaders in joining the party was to oppose Umno.

DAP, PKR and Amanah have to buck up to come up with a convincing economic agenda that addresses insecurity during economic difficulties. The line is drawn between the old racial politics of Umno-Pas and new progressive ideas that haven’t surfaced as yet. A set of leaders who can communicate those ideas would need to come forward at a much faster pace too.

What are your biggest takeaways from 2015?

For Malaysia, if 2014 was bad with the plane crashes and all the bad news, I am sure most would feel that 2015 was no better.

My biggest takeaway from the year is that Malaysians have realised that nothing is static, and the previous “normal” which they assumed could be counted on, can just change so swiftly and with far-reaching consequences.

For instance, oil prices halved in a matter of months and have not recovered. In terms of politics as well, the situation has gone from bad to worse. A year ago, when I spoke about a possible split in Pas, no one took it seriously. Also, the slide in Najib’s fortunes and popularity has been unprecedented.

Malaysia took a blow in terms of newsflow in 2015, so much so that it is said we have a perception problem. How can we win back favour on the global stage?

It is not merely negative perception that Malaysia has a problem with.

The year 1996 was the last happy one when most Malaysians genuinely felt that the nation and their own upward mobility and progress were unstoppable. The Asian financial crisis in 1997 shattered the collective sense of pride, purpose and destiny. A generation has passed. Malaysia is still in perpetual crisis, stagnation and decay, a scenario that continues to plague us until today.

Only a fundamental rethinking of our politics and economics can propel Malaysia back to the world stage as a respectable middle power.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.