This article first appeared in Corporate, The Edge Malaysia Weekly, on April 18 - 24, 2016.

THE recent social media backlash against Maxis’ data plan could not have happened at a worse time.

Last week, Telekom Malaysia Bhd’s subsidiary, Packet One Networks (M) Sdn Bhd, rebranded itself as webe — a new digital mobility service provider — that is currently in the final stage of user testing and is on track for a commercial launch soon.

Meanwhile, U Mobile Sdn Bhd, the fourth largest mobile network operator in Malaysia with an 8% market share, continues to roll out innovative data plans, such as U Data Roam and Data Backpack, to achieve its targeted double-digit market share.

When a smallish player like U Mobile and a new entrant like webe are striving to challenge the Big Three telecommunications companies — Maxis Bhd, DiGi.Com Bhd and Celcom Axiata Bhd — can they protect their attractive profit margins and defend their market share?

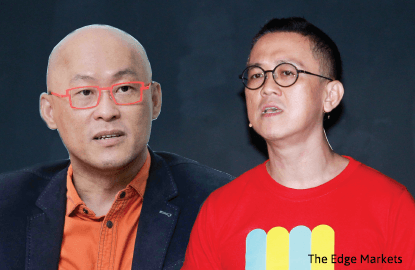

webe CEO Puan Chan Cheong tells The Edge that foreign telcos in Asia reinvest about 15% to 20% of their revenue in capital expenditure to upgrade their networks. Hence, their Ebitda (earnings before interest, taxes, depreciation and amortisation) margins are only around 30%.

“But looking at the mobility space in Malaysia, our telcos are reinvesting only around 10% [of revenue] in capex. [That’s why] they are still enjoying decent margins. I think there is room for improvement [in reinvestment].”

While Puan does not spell out that the Big Three can no longer sustain their profit margins, he appears to hint that this will happen in the coming years.

U Mobile CEO Wong Heang Tuck also acknowledges that the country’s telecommunications industry enjoys one of the highest Ebitda margins — ranging from 45% to 50% — in the region.

“The key thing for telcos now is to maintain a lean cost structure to ensure the maximisation of profitability in a competitive environment, something Malaysia’s telcos have been able to do successfully over the years,” he tells The Edge.

A telecoms analyst points out that while DiGi and U Mobile have been taking market share from Maxis and Celcom over the years, the combined market share of the Big Three stabilised at 84% to 85% in 2015 (see chart).

“Maxis may have had some issues recently but I don’t see a massive exodus because its customers are less price-sensitive. I think it will be a long time before there is a big drop [in the Big Three’s combined market share]. In any case, it could be 83% but certainly not 80%,” he says.

A senior equity analyst observes that as the market becomes saturated and more competitive, the Big Three are experiencing a decline in Ebitda margins but adds that the squeeze has not been as severe as expected.

“Most telcos are slashing prices and offering attractive plans but their cost has not been badly affected because the reality is that the data they are offering is actually more than enough for the consumers. To put it bluntly, most people are overpaying for data. So, the telcos’ margins will not drop significantly.

“Yes, their Ebitda margin might decline by between 1% and 1.5% but it will still be very decent, at more than 40%. I don’t see it going down to 35%.”

Puan opines that local mobile network operators are starting to realise that they should do a better job at serving their customers, which is a positive development for the Malaysian telecoms industry.

“In the past, all telcos, including us, thumped our chests and talked about the fastest speed and widest coverage, cheaper plans and more data instead of looking at what the consumer really wanted and needed.

“But today, users are moving among the service providers. Do you think Malaysians need another telco? Probably not, right? So, we are not interested in being just the fifth telco. What we want is not just a small refresh but a big leap forward in the telecoms space.”

Certainly, some Maxis users responded to the telco’s new plan for Sabah and Sarawak by threatening to port out. In the ensuing social media uproar, Maxis relented by offering subscribers of the MaxisOne plan an automatic upgrade to higher data quotas.

U Mobile’s Wong believes that there is still a lot of potential for growth as the number of Malaysians who need mobile data will only grow with smartphones and tablets becoming increasingly accessible.

“We are constantly innovating and aggressively expanding our network so that our customers may maximise their data experience,” he comments.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.