KUALA LUMPUR (Dec 2): Starting Dec 5 this year, CIMB Bank Bhd, together with CIMB Islamic Bank Bhd, will be doing away with its SMS TAC authorisation for online banking transactions.

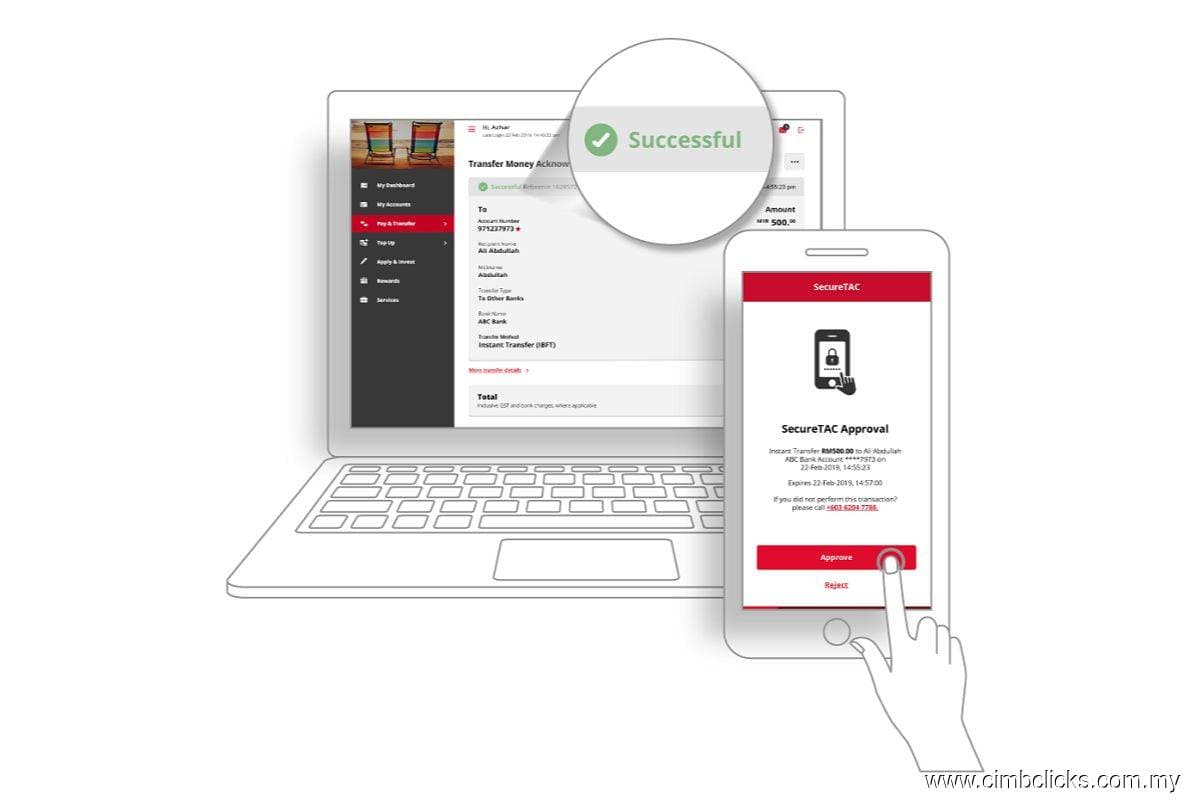

In its place, it will be implementing a mandatory SecureTAC authorisation for CIMB Clicks Web transactions of RM100 and above, including non-favourite fund transfers, bill payments and prepaid top-ups.

"Customers will no longer be able to receive SMS TACs for these transactions. Instead, they will need to install the CIMB Clicks App and approve the transactions via SecureTAC. The bank intends to extend SecureTAC authentication to include any transactions valued RM100 and below, as well as non-monetary transactions, by the first half of 2023.

"In the meantime, CIMB urges all customers who have yet to install CIMB Clicks App to download the app from official app stores and turn on notification in Settings to receive SecureTAC," it said in a statement.

On top of that, beginning Dec 26, new users or existing users who are logging in to the CIMB Clicks and CIMB OCTO Apps on a new device will undergo a call verification process to ensure that any first-time login attempt or device change is initiated by the account holders.

"Once a first-time login is performed, customers will be required to call CIMB’s Consumer Contact Centre which is available 24/7 at +603-6204 7788 to verify their registration on the new device and to maintain their access. Alternatively, the bank will also strive to reach customers for verification within 24 hours since the first access from a new device," it said.

If a customer is not contactable within 24 hours of their first-time login, or if the verification process cannot be completed, their CIMB Clicks ID will be deactivated as a safety precaution. "The bank plans to enhance the verification process further by the first half of 2023 by implementing a compulsory requirement for customers to call the bank to activate their account first before they can begin using it," the banking group added.

“CIMB is committed to implementing stringent security measures to protect our customers against scams, in line with Bank Negara Malaysia’s direction on additional measures to strengthen banking security to combat fraudulent activities. While these new measures may initially affect banking convenience, we believe they are necessary steps towards creating a safer banking environment," said group chief executive officer Datuk Abdul Rahman Ahmad.

"We will continue to introduce additional measures progressively in order to further reduce the risk of fraud and ensure customers can transact with peace of mind,” he said.

At the time of writing on Friday, CIMB’s share price was trading 1.74% lower at RM5.65, giving the bank a market value of RM60.26 billion. The stock has advanced 9.5% in the past one year from RM5.16.