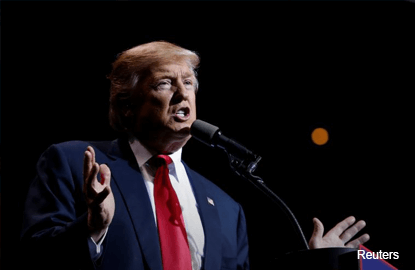

US president Donald Trump seems determined to start a fight with China over trade. He has appointed notable China sceptics to his economic team, badgered companies like Apple Inc to stop making products in the mainland, and threatened tariffs of 45% on Chinese goods.

He hopes to get companies to move their manufacturing operations back home and create jobs in American factories. It will not work. In fact, it is likely to hurt the very voters he has promised to protect.

China’s factories now compete less on cheap labour and more on advanced technology. China has top-notch infrastructure, a skilled workforce, and factories that thrive on process innovation — the ability to rethink how products are assembled to maximise efficiency and flexibility. They are embedded in the vast supply chain known as Factory Asia, which means they can smoothly synthesise components and raw material from around the world and quickly respond to the fickle tastes of global consumers.

Increasingly, they are moving from assembly work to higher-value pursuits, such as engineering, design and branding. Outbound direct investment surged by 44% last year as Chinese firms acquired technology companies overseas. Investment in automation has soared: China is now the world’s biggest market for industrial robots, with sales growing by about 20% a year (see chart — Automation Inclination).

By and large, US manufacturers have not responded to this competition by becoming more innovative in their own right. One recent study found that, faced with rising Chinese imports, they have cut spending on research and development and filed far fewer patents. A bigger problem, as Apple’s Tim Cook recently noted, is that the US labour force lacks the skills required for large-scale advanced manufacturing.

Conceivably, many Chinese factories could outcompete their American peers even with Trump’s tariffs in place. What production does return to American shores — as a result of tariffs, blandishments or threats — is more likely to be done by robots than by Trump voters, as automation continues its relentless advance.

If the benefits of these policies are illusory, however, the drawbacks will be real. For a start, prices will rise and living standards will fall. By one estimate, the cost of making an iPhone would increase by US$30 (RM132.90) to US$40 if Apple were made to assemble its devices in the US, and by US$100 if it also tried to make the components domestically. When the Barack Obama administration placed a 35% tariff on Chinese tyres in 2009, the result was US$1.1 billion in added costs to consumers. The burden of such price increases falls most heavily on the poor, who have benefited hugely from cheap Chinese-made goods.

Another consequence is that these policies are likely to invite retaliation. China has already suggested it might step up tax and antitrust scrutiny of US businesses, initiate anti-dumping investigations, or reduce government purchases of American goods. It could easily erect more tariffs of its own, on everything from airplanes to agriculture. US companies doing business there are rightly concerned.

A better way to level the playing field is to push China to open more of its markets to US products and to protect intellectual property. A better way to boost American competitiveness is to invest in upgrading the workforce for the age of automation. A larger lesson is that global trade is not a zero-sum affair — and that harming China’s economy, far from helping Americans, will only make everyone worse off. — Bloomberg