AS the region prepares for the reality of a common market at the end of the year, sentiments run the gamut from trepidation to euphoria.

The 10 member nations of the Association of Southeast Asian Nations (Asean) boasts a population of more than 600 million, a combined 2013 gross domestic product of more than US$2.4 trillion and the world’s third largest workforce.

By the end of this year, the Asean Economic Community (AEC) will come into effect, creating a single market and production base with a free flow of goods, services, investment and skilled labour. Given Southeast Asia’s growth potential and burgeoning middle classes, multinationals are already jockeying for position and Southeast Asian companies are laying the groundwork for expansion by acquiring others at home and across the region.

In late 2013, when A T Kearney and J Walter Thompson jointly published a study of the AEC, Countdown to 2015: Creating Asean Champions, we received an enthusiastic response from company executives and government representatives. Since then, we have hosted or spoken at AEC-focused seminars and conferences around the region, including Kuala Lumpur, Bangkok, Singapore, Jakarta and Manila.

Here is what we have found since then:

• Concern that the AEC may hurt individuals and corporations due to foreign competition: This sentiment tended to be most prevalent among executives of small and medium enterprises (SMEs) as well as some government representatives from countries that have been more protected from competition, such as the Philippines.

• Scepticism that AEC reforms can be implemented by the deadline: There is a perception that Asean reforms typically proceed at a glacial pace, making the December 2015 launch date seem unlikely. Even so, it’s a matter of when, not if. Some individuals we spoke to expressed indifference about the impending reforms and a sense that their impact will be limited.

• Enthusiasm for the myriad opportunities that the AEC is expected to offer: Representatives from some of the more business-focused governments, such as Malaysia, Thailand and Singapore, believe the opportunities are significant, as do executives from larger corporations who are already making plans to expand in Southeast Asia. There is also a broad recognition of the economic rationale for the AEC, for Asean to present itself as an attractive investment and business destination compared with other large economic regions in the world.

Last year, Indonesia elected a new president, Thailand got a new military government and Malaysia took over the Asean chairmanship from Myanmar. We see these events as mostly neutral or positive to the implementation of AEC 2015, as most of the new administrations are still receptive to structural and policy initiatives that are investment-friendly.

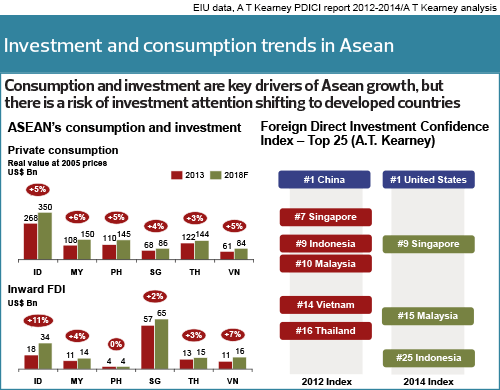

While economic indicators continue to show that investment and consumption will be the twin drivers of Asean growth, there is also a risk that investor attention will be diverted back to developed countries. Indeed, according to Kearney’s 2014 Foreign Direct Investment (FDI) Confidence Index Report, Asean countries have seen their FDI confidence ratings slip in the past two years (see chart).

Most developing countries, including China and India, have been affected by the global investment shift. This trend could continue for the regional grouping if it does not fully implement AEC 2015 initiatives and make itself attractive to investors as a region.

So, what do these changes mean for Asean governments and corporations? The following are our recommendations.

Governments

• Stay the course and move forward with the implementation of AEC 2015 reforms and initiatives: This includes removing non-trade barriers, harmonising regulations and opening up markets by lowering foreign investment limits. If the region moves too slowly towards an integrated AEC, it runs the risk of losing out to more established economic powerhouses.

• Invest in the necessary changes: Governments need to establish new platforms that facilitate cross-border transactions, whether in finance, trade, logistics, communications or e-commerce. Companies, especially SMEs, are likely to need government support to adapt to the upcoming changes and take advantage of new market opportunities, for example, through overseas trade missions and grants for effective branding.

• Educate regional players and citizens on the benefits of the AEC: Both ignorance and indifference have the potential to undermine the Asean community’s efforts. There is also a certain amount of fear among some workers and smaller companies. Governments will need to help people see the benefits of closer integration, including more and lower-cost goods and services, more rapid economic growth and an increase in job opportunities. A branding exercise focusing on AEC 2015 or even Asean as a whole will help drive a more distinct Asean identity and closer integration across the community.

Companies

• Create and develop a regional game plan by answering these three questions:

1. Where to enter? Deciding on what markets are the most favourable, based on market size and growth potential, product or service fit with target customers, customer buying behaviours, existing competition, and local laws and regulations.

2. How to enter? Potential market entry strategies include licensing, franchising, strategic alliances or joint ventures, independent operations and acquisition of an established player.

3. How to operate? The nuts and bolts of operating successfully in the region include a wide range of considerations such as product selection, pricing, organisational structure, supply chain and logistics practices, and information technology systems.

• Large regional corporations: Consider merger and acquisition (M&A) options. Even large regional players will need to consider inorganic M&A to scale up quickly enough to compete with the global multinational corporations. Although Asean is home to many consumer goods and food and beverage companies, such as Yeo Hiap Seng and Masan Foods, that appear quite sizeable, they are typically 10 to 500 times smaller than global giants such as Nestlé and Coca Cola. Industries where growth is in the double digits and where we expect significant M&A activity include fast-moving consumer goods, agribusiness, banking and finance, as well as online and e-commerce.

• SMEs: Begin preparations for the AEC as soon as possible. Our recent research with the CIMB Asean Research Institute has shown that new technologies, particularly those supporting e-commerce, are allowing SMEs to sell across borders, potentially at a lower cost than they would be able to do by establishing local operations. But it will require some amount of education and upfront investment for these SMEs to fully realise the potential of Asean. They will also need to be as entrepreneurial and creative as possible, bearing in mind that many of the region’s larger companies, including San Miguel, CP Foods and AirAsia, started out small.

Some local companies are already well on the way to defending their position in the region, such as Thailand’s Mahaphant Group. This 30-year-old maker of construction materials, such as tiles, siding and roofing, has transformed itself from a Thailand-based manufacturer exporting to adjacent markets into a truly regional player with manufacturing and distribution in various Asean countries.

The company also unified its range of products under Mahaphant’s core Shera brand. It is now targeting regional sales of US$5 billion in the next three to five years, according to Khun Sarat Khiatbanlue, Mahaphant’s Asean president. It is also well prepared for competition from Europe and the US.

Whether or not the AEC takes off by December 2015, it is only a matter of time before it becomes a reality. We take heart that many companies, large and small, are showing intense interest in AEC 2015, and that some large companies, including CIMB, AirAsia and Lippo, are taking on the role of informal ambassadors of Asean, championing more rapid integration.

Speed is truly of the essence. Asean governments need to up their game and integrate faster or the region will be left behind as an investment and business destination. Likewise, Asean companies, particularly SMEs, need to have a regional game plan or they will lose out to foreign players with deeper pockets.

Soon Ghee Chua is head of the Southeast Asia unit at A T Kearney and Bob Hekkelman is Southeast Asia CEO of J Walter Thompson

This article first appeared in Forum, The Edge Malaysia Weekly, on April 27 - May 3, 2015.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.