This article first appeared in The Edge Financial Daily on July 1, 2019

KUALA LUMPUR: The sharp uptrend in Bermaz Auto Bhd’s (BAuto) share price over the past few months has been hard to miss.

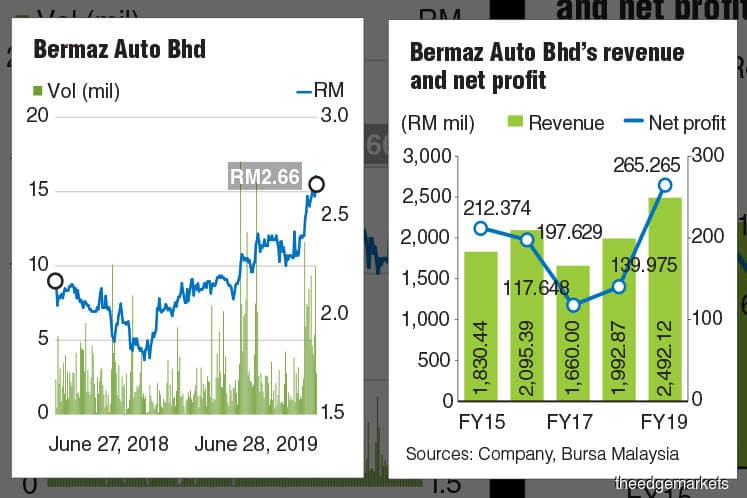

The stock has been on a wild ride, surging nearly 30% in less than four months to hit a historical high of RM2.70 last Thursday, before ending the week at RM2.66. At its current level, BAuto — the sole distributor of Mazda vehicles in Malaysia — is worth some RM3.09 billion.

Investors who bought the stock last year at around a low of RM1.70 would be up an impressive 50%.

Analysts believe the stock is only in mid-acceleration and that there may be more upside to its stellar share price run.

A check on Bloomberg shows BAuto remains a 100% ‘buy’ with a consensus target price of RM3.07 among 14 analysts tracking the stock.

The counter sparked a flurry of target-price increases after it announced on June 12 that its latest annual net profit had surged nearly 90% year-on-year (y-o-y) to a record RM265.27 million for the financial year ended April 30, 2019 (FY19) on the back of a 25% increase in revenue to RM2.49 billion.

“BAuto is undervalued with a 10% yield. Enough said,” said Ivan Yap, research analyst at Maybank IB Research, who assigned the stock a target price of RM3.65 in his June 13 report — the highest among the market recommendations.

“At 9.6 times price-to-earnings ratio (PER) for 2019, BAuto is considered undervalued given its earnings growth and dividend potential. BAuto is a high dividend-yield stock (9.7% for financial year 2020), which should be especially appealing to equity income fund investors like the government-linked investment companies and insurance funds,” Yap explained.

Concurring that BAuto’s valuation appears attractive, Affin Hwang Capital raised its target price on the stock to RM3.20 from RM3.05, with a reaffirmed ‘buy’ call.

“On the whole, FY19 results were within our but above consensus full-year estimates at 102% and 108% respectively. We maintain our earnings forecasts and roll forward our valuation base to CY20E to arrive at a higher target price of RM3.20. At 11 times FY20E PER/6% yield, BAuto valuation looks attractive,” said its analyst Brian Yeoh.

On a full-year basis, BAuto sold a total of 15,800 vehicles in the local market, which AmInvestment Bank observed is an “impressive” 40% y-o-y rise compared with 11,300 units in FY18.

The gains were attributed to the tax holiday months in 2018, and the group’s promotional offers to absorb the sales and services tax for bookings placed before September.

The group declared a total all-time high dividend of 21.3 sen per share for FY19, including a special dividend of seven sen, translating into a payout ratio of 94%. Its balance sheet remained healthy with a net cash position of RM320.17 million as at end-April.

CGS CIMB research analyst Mohd Shanaz Noor Azam pointed out that BAuto could still chart robust growth going forward, driven by multiple new model launches.

The analyst raised his target price on the stock — his top sector pick — to RM3.30 per share from RM2.85 previously, because of its growth prospects, proxy to export growth, and attractive yield.

“We expect the group to deliver 5% volume growth in FY20F, driven by new model 15.0 launches such as Mazda 3, CX-8, CX-30 and new facelift model for CX-5 that will include a 2.5cc Turbo variant in Malaysia in the second half of 2019.

“Moreover, the group is cautiously optimistic of higher sales delivery in the Philippines, driven by new models,” he wrote.

He also highlighted that BAuto is exploring the possibility of expanding its assembly capacity at the Inokom plant, in order to meet export demand for CX-8 and potentially a third localisation programme, and planning to add new centres nationwide to improve its sales an service network for better customer retention.

“We raise our FY20-21F earnings per share by 15%-17% to reflect higher margin expansion due to better cost control from lower advertising and promotion expense and stronger contribution from (30%-owned associate company) Mazda Malaysia Sdn Bhd (MMSB).

BAuto, formerly known as Berjaya Auto Bhd, was listed on the Main Market of Bursa Malaysia in November 2013 at an issue price of 70 sen.

The group is principally involved in the distribution and retailing of Mazda vehicles and the provision of after-sales services for Mazda vehicles in Malaysia, as well as the distribution of Mazda vehicles and spare parts in the Philippines through appointed dealers.