KUALA LUMPUR (Oct 23): An opposition lawmaker said Budget 2016 has failed to deal with the key issues which had "shattered" domestic and international confidence in the government, referring to the RM42 billion debt incurred by 1Malaysia Development Bhd (1MDB) and the RM2.6 billion donation that went to Prime Minister Datuk Seri Najib Razak's personal bank accounts.

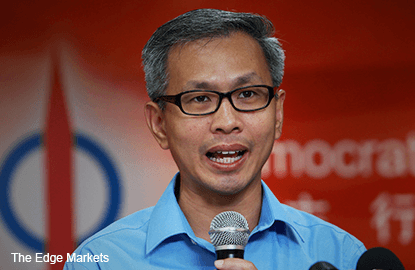

"The prime minister did not see it fit to take on the massive elephants in the room, that is the RM42 billion 1MDB scandal and the RM2.6 billion purported “donation” into his personal bank account which also involved a Finance Ministry subsidiary, SRC International Sdn Bhd," said DAP national publicity secretary and Member of Parliament for Petaling Jaya Utara Tony Pua in a statement today.

Pua warned that the inability of 1MDB to repay its debts and the realisation of contingent liabilities will have serious consequences to the government finances and will naturally create a negative domino effect to the rest of the Malaysian economy.

The federal government had earlier extended an emergency RM975 million to 1MDB in February this year, a letter of support to obtain a US$150 million loan from the Finance Ministry-owned Export-Import Bank and indemnified International Petroleum Investment Corp (IPIC) for a US$1 billion advance to 1MDB.

"The failure to tackle the extremely damning and damaging allegations against 1MDB and provide a credible plan for the government against all 1MDB contingencies, Budget 2016 will not only fail to lift local and international investor confidence, it will be another non-event," said Pua.

Pua also pointed out that the federal government has failed to increase its prudence on expenditure as the taxes paid by the man-on-the-street have increased drastically by RM22 billion from the RM39 billion collected from the goods and services tax (GST) compared with the sales and services tax collected amounting to RM17 billion in 2014.

He cited the budgeted expenditure for ‘supplies and services’ of RM36.3 billion for 2016 when it was RM20.8 billion in 2010. "Why has this provision increased by 75.4% in just 5-6 years?"

"The consequence in the failure of the federal government to be prudent in spending can be reflected in the increase in federal government debt from RM582.8 billion in 2014 to an expected RM627.5 billion by the end of 2015.

"The increase in federal government debt by 7.7% also significantly outpaced the growth of Malaysia’s gross domestic product of only 4-5% per year," he said.

Pua also noted that the government's efforts to cut budget deficit from 3.2% in 2015 to 3.1% in 2016, does not take into consideration the off-budget expenses funded by government guaranteed borrowings which will ultimately be borne by the federal government.

"Based on the Federal Government Financial Statements 2014, the contingent liability of the federal government arising from these government guarantees will increase from RM157.5 billion in 2014 to RM172 billion in 2015.

"The resulting 9.2% increase is at an even faster than the rising federal government debt. This shows that the government is shifting an even larger percentage of expenditure to “off-budget” to hide its inability to keep a lid on its expenditure," he said.