This article first appeared in The Edge Malaysia Weekly on April 29, 2019 - May 5, 2019

THE banking industry is lobbying the Ministry of Finance (MoF) to allow loan loss provisions to be fully tax deductible as per the old MFRS 139 accounting standard.

According to sources, the Association of Banks in Malaysia (ABM) and the Association of Islamic Banking and Financial Institutions Malaysia (AIBIM) have recently written to the MoF on the matter.

It is understood that the banking associations have already had a few consultative sessions with the MoF and the Inland Revenue Board of Malaysia (IRB).

“The MoF and IRB are still deliberating the matter. They’ve been listening to and engaging with the industry, which is a good thing. And IRB has asked for more data so they can analyse the situation. So yes, they’ve been quite engaging,” an industry source tells The Edge.

The source says it will be the MoF that decides on the matter, after seeking views from IRB and Bank Negara Malaysia.

But why does the industry want to revert to the old tax treatment? It affects the banks’ cashflow and raises costs, among other reasons.

Recall that a new accounting standard governing financial assets, MFRS 9, replaced MFRS 139 on Jan 1 last year. MFRS 9 changes the way banks book provisions on financial assets like loans and bonds.

It required banks to make provisions in anticipation of future potential losses, as opposed to the previous practice under MFRS 139 of making provisions only when losses are incurred. This meant that lenders have to make provision for any new loan they extend.

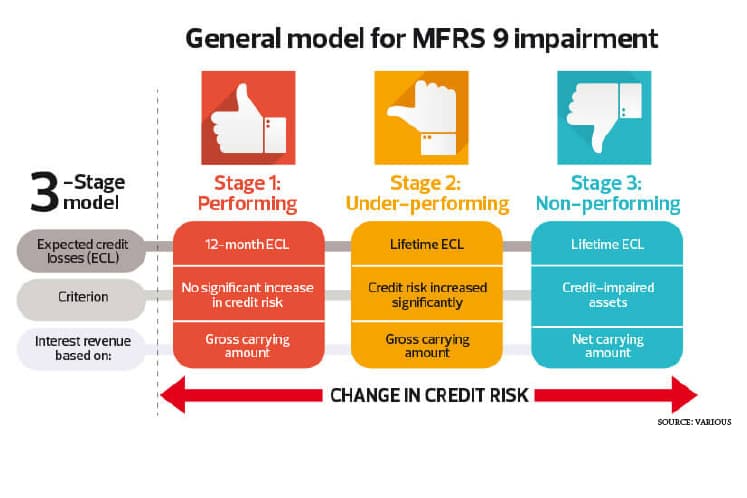

Given the accounting overhaul, banks were required to switch to an expected loss model from the incurred loss model under MFRS 139. Assets move through any of three stages as credit quality changes and the stages dictate how a bank measures impairment losses at each reporting date. (See chart)

“Under the present situation, Stage 1 provisions are not tax deductible, Stage 2 provisions are 50% deductible, whereas Stage 3 are fully deductible. Under MFRS 139, because the concept of expected credit loss was not there, banks were allowed full tax deductions for provisions ... so the accounting treatment and the tax treatment were the same.

“With MFRS 9, it’s not a question of not paying taxes but just a timing difference. It affects a bank’s cash flow,” explains an industry source.

When asked why banks are lobbying for a return to the tax treatment under MFRS 139, another source says: “It’s more for monitoring, so that there’s no divergence between accounting and tax treatment. If there’s no divergence, it means there is no requirement to do monitoring of what is an expense in the P&L [profit and loss], whether that is a deductible expense from a tax return perspective. Hence, reducing monitoring requirements would reduce compliance efforts for banks.

“Secondly, it’s purely a timing difference issue.”

According to other sources, the UK allows full tax deduction while Hong Kong is lobbying for convergence of the accounting and tax treatment. In Singapore, it is understood there is full deduction for credit impaired losses, while non-credit impaired losses are allowed tax deduction based on a formula.

While Malaysian banks may have valid reasons for wanting to revert to the old tax treatment, it remains to be seen whether the MoF will allow them to. “I would think, given the government’s need to raise revenue, the IRB would want to receive taxes now rather than later,” an industry observer points out.

Recent news reports say IRB has set an internal tax collection target of RM150 billion this year compared with RM147 billion originally. RM147 billion is the target stipulated in Budget 2019.

Last year, most banks reported sizeably lower provisions in their income statements, which helped lift profitability.

CIMB Research, in a March 15 report, said it expects to see an increase in provisions for the banking sector this year. “We forecast a 14.9% increase in banks’ LLP in 2019 due to the lower base at end-2018, following an 18.6% decline in 2018.”

International Financial Reporting Standard 9 — MFRS 9 is the Malaysian equivalent — was designed to address the “too little too late” criticism that followed the 2008/09 global financial crisis that banks were not able to account for losses until they were incurred, even when it was apparent that they were coming.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.