This article first appeared in Personal Wealth, The Edge Malaysia Weekly, on March 28 - April 3, 2016.

Security, transparency and traceability are some of the promises of the blockchain technology. Banks the world over are looking to use it to create value for themselves, their customers and the entire industry. Local players give their views on the technology’s potential.

Banks the world over are looking to tap the growing potential of blockchain technology, which is said to be able to create more efficient processes, lower incidences of fraud and result in cheaper services.

Blockchain — the distributed ledger technology that underpins cryptocurrencies such as bitcoin — would allow banks to increase operational efficiency levels and cut costs. It would also allow banks to track the ownership of assets digitally, thus aiding the process of identity management and lowering the risk of fraud.

In January, CNBC reported that Bank of America had submitted filings for 15 blockchain-related patents with the US Patents and Trademark Office. According to the report, the filings included patents for a “cryptocurrency risk detection system” and “suspicious user alert system”.

On March 3, blockchain start-up R3CEV — which now leads a consortium of more than 40 banks — announced that it had completed a trial of five blockchain technologies, which “represented the trading of fixed-income assets between 40 of the world’s largest banks across the blockchains, using multiple cloud technology providers within R3’s Global Collaborative Lab”. “The trial marked an unprecedented scale of institutional collaboration between the financial and technology communities exploring how distributed ledgers can be applied to global financial markets,” it said in a press release.

Blockchain is not only generating interest in the US and Europe. In June last year, the Monetary Authority of Singapore announced that it would fund a blockchain-based record-keeping system as part of a five-year S$225 million investment plan. According to its statement, the plan is aimed at growing the financial technology sector further.

Local players see benefits

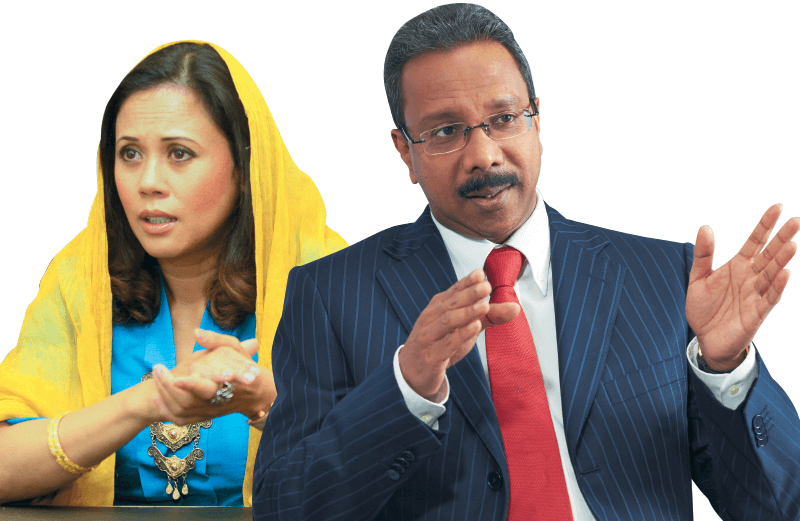

The ingenuity of blockchain lies in its simplicity and cost-effectiveness, says CIMB group chief information and operations officer Datuk Iswaraan Suppiah, adding that the disruptive potential of the technology is due to its features.

“We can see that the current status is self-regulated by the participants in the scenario. It can only be changed by consensus of all or a majority of the participants. The complete trail of past changes is easily accessible,” he explains.

“Also, unlike physical ledgers or a typical centralised database, this ledger can be distributed across several computers in a network, hence reducing the cost to set up and maintain. The technology has proven to be capable of working flawlessly and securely despite being a radically democratised and cost-effective technology.”

The implications of these features, Iswaraan says, are that any trading or transactional ecosystem of participating partners using blockchain does not need to trust each other as the “trust” is embedded in the blockchain-based solution. There is no need for a middle man, including banks, to play the role of a trusted third party that manages transactions.

“If Malaysia’s financial industry were to take a leaf from the book of open source and consider this collaboratively, instead of from the perspective of merely gaining individual competitive advantage, we could create tremendous value for the participating banks and customers.

“We can look forward to reducing the risks and costs associated with financial ecosystems — for example, in a wholesale cross-border payments ecosystem, the banks’ provision of capital for counter-party risk (as they do not fully trust that the party they are dealing with will always honour the transaction). But in the case of a blockchain-based payment ecosystem, transactions can be instantly cleared and settled, thus removing the need to provide capital for counter-party risk.”

For retail remittances, Iswaraan says, costs can come down as the burden of know-your-client and anti-money-laundering checks are minimised because of the transparency of the blockchain-based ecosystem. “In trade finance, we can simplify and speed up the entire supply chain financing through the coming together of not just counter-party banks but also logistics providers that adopt blockchain. Customers of financial services that migrate to blockchain can expect significantly reduced time frames, ranging from an instant to a fraction of the current time, to avail themselves of the financial service, better security and lower fees.”

As the blockchain technology operates at the back end, Iswaraan notes, banking clients would not notice major changes. However, processing time would be reduced and any cost savings due to the reduced risk of fraud or other factors could be passed on to the consumers.

Iswaraan says upfront investments will be needed to drive the change from existing infrastructure to the blockchain-based solution. Nevertheless, the operational cost of the blockchain will help drive down costs in the long run.

Meanwhile, Hong Leong Islamic Bank Bhd managing director and CEO Raja Teh Maimunah Raja Abdul Aziz says blockchain will disrupt the banking industry. “Blockchain is not just about bitcoin. It is a disruptive technology. If you look at our banking industry, the banks’ DNA is very private — think private cloud. We are not even talking about public cloud, but I believe that if we keep an open mind, we can utilise the blockchain technology to enhance banks’ business performance and competitiveness.”

As an industry, the banking players have not discussed the blockchain technology openly, says Raja Teh Maimunah, so it is difficult to assess the technology from an industry point of view. But as a blockchain enthusiast, she recognises that the technology can benefit the banking industry in many ways.

“For instance, if we use the tamper-proof blockchain technology in trade financing, we can display all the records kept in the ledgers, thus relying less on third-party providers,” she points out.

Currently, banks already invest heavily in fraud management. But with a blockchain-based solution that provides transparency, security and traceability, operational cost would be reduced. This would reflect on pricing and benefit customers. The solution would also help in counter-terrorism as it helps track money flow, says Raja Teh Maimunah.

Challenges ahead

While the benefits of blockchain technology sound promising, Raja Teh Maimunah points out that it is still early days and none of the banks has integrated the technology into their operations yet. “The furthest banks have gone with blockchain is the consortium with R3CEV, which recently announced the completion of a distributed ledger test. I don’t think any banking player has gone beyond R3CEV.”

She says the main challenge when it comes to using blockchain technology in the local banking industry is how quickly the market is open to disruption. Also, the technology is closely associated with bitcoin, so some banks may prefer to steer clear of it due to its association with crypto-currencies. This happens even when the blockchain enthusiast’s interest has nothing to do with crypto-currencies.

“The technology needs to have a big enough network to make sense. This is something that we need to do collectively as an industry. I hope people will move on from the stigma and really explore the blockchain technology,” she adds.

“We [the banks] have started the journey towards digital innovation. But in terms of blockchain technology, I feel that the interest is not very high at the moment. Not all banks are investing in digital technology as heavily as some of our counter-parties in different parts of the world.”

According to a PricewaterhouseCoopers (PwC) report titled Blurred lines: How fintech is shaping

financial services, which was released this month, the blockchain technology may result in a radically different competitive future for the financial services industry, where current profit pools are disrupted and redistributed toward the owners of new, highly efficient blockchain platforms.

The report says that while 56% of respondents, recognise the importance of blockchain, 57% say they are unsure or unlikely to respond to this trend. This may be explained by the fact that 83% of respondents are at best “moderately” familiar with the technology and only a few consider themselves experts. Respondents included banks, wealth management firms, insurers and fintech companies.

“We believe the lack of understanding of the technology and its potential for disruption poses significant risks to the existing profit pools and business models. Therefore, we recommend a proactive approach to identify and respond to the various threats and opportunities that this transformative technology presents,” the report says.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.