KUALA LUMPUR (June 9): The automotive, plantation and property sectors are some of the winners from the Economic Recovery Plan (Penjana) announced by Prime Minister Tan Sri Muhyiddin Yassin.

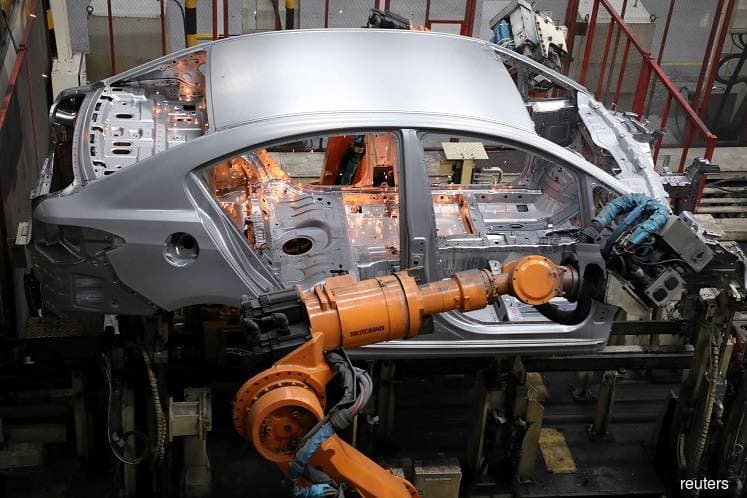

In a note, Hong Leong Investment Bank (HLIB) Research said that the auto sector is set to benefit from the 100% sales tax exemption for completely knocked-down cars and 50% sales tax exemption for completely built-up units that are imported.

Furthermore, the plantation sector is also set to benefit from the complete export duty exemption on crude and refined palm oil and palm kernel oil. With the reintroduction of the Home Ownership Campaign, exemption on real property gains tax and the 70% max financing on a third property acquired lifted, the property sector could also be a beneficiary.

The tourism sector also saw measures, such as tourist tax exemption, an extension of sales and service tax exemption for hotels, the extension of personal income tax relief of up to RM1,000 for tourism expenses and the extension for the deferment of tax instalment payments for the tourism industry.

As such, the incentives put in place to revive the tourism sector do augur well for the aviation sector, as well as Genting Malaysia Bhd. They are also mildly positive about real estate investment trusts, which will help clients such as hotel operators survive.

"With RM9 billion allocated to combat unemployment and protect jobs, the consumer sector is a possible beneficiary. Still, we must bear in mind that this is unlikely to be a consumption booster, but rather to cushion the slowdown caused by Covid-19 (ie loss of income, weak consumer sentiment, lower discretionary spending, etc)," it said.

That said, market valuations for the economic recovery play are now at the higher end after the FBM KLCI's 27.6% rebound from its year-to-date low of 1,220 points on March 19. The index is only 1.2% above its pre-Covid 19 level.

"Along with earnings cut post 'partial 1Q20 (first quarter of 2020) results', the KLCI's PE (one-year forward rolling earnings) is now at +1.5SD (standard deviation) above its long-term mean. Arguably, liquidity-driven factors such as unlimited QE (quantitative eashing) by the Fed (US Federal Reserve) and decade-high domestic retail participation have resulted to 'more generous' valuations accorded than would normally be.

"Still, even after accounting for this liquidity flush (expressed by our applied mean valuation for the KLCI despite a recession), it is increasingly hard to justify such levels. Our KLCI target of 1,450 is based on 16.1 [times] PE (long-term mean) tagged to 2021 EPS," it said.