This article first appeared in The Edge Financial Daily on January 3, 2019

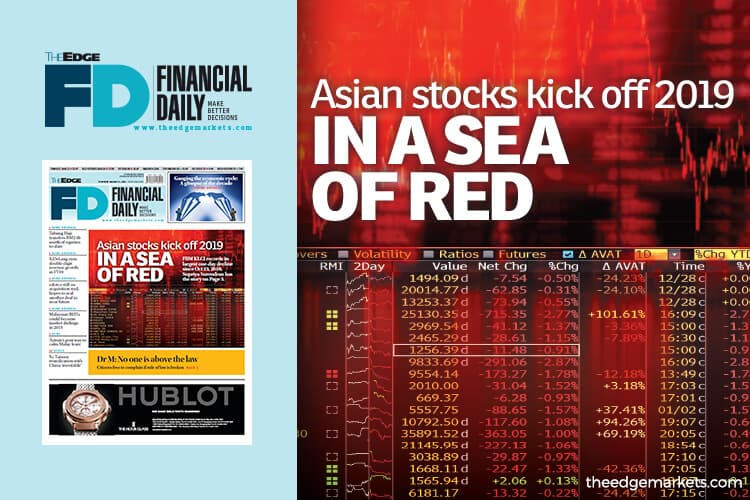

KUALA LUMPUR: Shaken by concerns about the prospects of the global economy, Asia kicked off 2019 yesterday in a sea of red.

China’s Shanghai Composite Index was down 28.61 points or 1.15% to 2,465.29 points, while Hong Kong’s Hang Seng Index fell 715.35 points or 2.77% to 25,130.35 points; the South Korean Kospi declined 31.04 points or 1.52% to 2,010 points, while the Jakarta Stock Exchange Composite Index was down 13.32 points or 0.22% to 6,181.17. Singapore’s Straits Times Index sank 29.87 points or 0.97% to 3,038.89.

In Malaysia, the bellwether FBM KLCI fell 22.47 points or 1.33% to close at 1,668.11 points, its largest one-day decline since Oct 23, 2018.

Asian shares were sent careening following a weak set of manufacturing activity data from China. The Caixin China manufacturing Purchasing Managers’ Index (PMI) fell to 49.7 in December from 50.2 in November. Though only a slight decline, it was the first time that the health of China’s manufacturing sector worsened since May 2017.

The weaker China manufacturing data, coupled with a fall in France’s PMI in December for the first time in two years amid declining oil prices and lower bond yields, sent world shares tumbling, Reuters reported yesterday. At the time of writing, Brent Crude retreated 0.7% to US$53.44 (RM221.24), from US$53.80 on Dec 31.

Back on Bursa Malaysia, decliners outweighed gainers as the sentiment turned bearish, with 475 counters down and only 247 up, while 363 counters were unchanged. Plantation and oil and gas counters were among the hardest hit, with Sime Darby Plantation Bhd declining 4.41% to RM4.55, and Dialog Group Bhd down 3.54% to RM3.

Put warrants linked to the Hang Seng Index and S&P 500 Index dominated the top 15 gainers on the local stock exchange. Put warrants are investors’ cup of tea during a market downtrend.

It was also revealed yesterday that Malaysia’s manufacturing PMI fell to 46.8 in December from 48.2 in November, the strongest contraction seen in the Malaysian manufacturing sector since the survey began six-and-a-half years ago.

MIDF Research head Mohd Redza Abdul Rahman said the PMI affects market sentiment as these are indicators on the health of the manufacturing and services sector. “Also, Brent Crude oil prices keep hovering below US$63 per barrel, and that affects [sentiment] considering the Budget 2019 assumption of US$70 per barrel,” he told The Edge Financial Daily.

It does not help that there has been no material development to lift the cloud of negativity among investors, said Fortress Capital Asset Management director Geoffrey Ng.

“In fact, the negative sentiment has been further affected by weak economic data from China, which confirms the reality that the ongoing trade war is biting and exacting pain, without much real progress in trade discussions between China and the US,” he said.

Areca Capital chief executive officer Danny Wong said he is not surprised the local stock market started off the new year on a decline.

“After high hopes on the year-end window dressing, which did not happen, and given that there are no new catalysts for the market, investors would [probably] dispose of the high beta stocks [in lieu] of more defensive stocks.

“However, we look forward to new catalysts, such as a resolution to the US-China trade war,” he said.

Inter-Pacific Securities head of research Pong Teng Siew concurred with Wong’s view. “We were not anticipating an exciting first day of trading. This is pretty much in line with the mood of caution carried forward from last year, which is expected given the chain of events that took place last year,” he said.

2018 was a tumultuous year for the Malaysian stock market, headlined by a change in government, declining commodity prices, a weak ringgit against the US dollar and trade war concerns.

All eyes will now be on the trade meeting between the US and China that is set to take place this month. For Malaysia in particular, investors will also be looking for indicators from its November export numbers, which are scheduled to be released tomorrow.