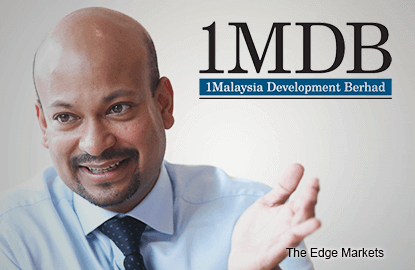

KUALA LUMPUR (April 13): 1Malaysia Development Bhd president and chief executive Arul Kanda Kandasamy today denied having prior knowledge that British Virgin Islands-registered Aabar Investments PJS Ltd (Aabar BVI) was liquidated.

In a statement refuting Petaling Jaya Utara MP Tony Pua's accusation that Arul Kanda had deliberately hid knowledge about Aabar BVI and its link to Abu Dhabi's Aabar Investments PJS (Aabar), Arul Kanda today instead called on Pua to stop "cherry picking" and challenged the DAP national publicity secretary to provide proof to his accusation.

"With reference to a statement by YB Tony Pua this morning, I categorically and unequivocally deny any prior knowledge that Aabar BVI has been liquidated, apart from what I have read in recent press reports," said Arul Kanda.

"The PAC Report, which he collectively approved, has now been tabled and PDRM (police) [has] confirmed investigations are ongoing.

"YB Tony should stop cherry picking and let the authorities do their job," he added.

Earlier today, Pua had accused Arul Kanda of playing an "undeniable role" in covering up the multi-billion dollar scam involving 1MDB and Aabar BVI, saying Arul Kanda would not, during questioning by Parliament's Public Accounts Committee (PAC), affirm that Aabar BVI was related to Aabar of Abu Dhabi.

The MP had also said Arul Kanda's appointment was in January 2015, six months before Aabar BVI was liquidated.

It raised questions if the 1MDB head honcho was indeed not aware of the company being wound up and the reasons for his apparent need to hide the information, the statement read.

"How can Arul Kanda not know that the US$1.367 billion of 'refundable security deposit', (the) US$993 million of 'refundable options termination payment' and an additional US$1.15 billion of 'top-up security deposit' have been paid to a company which [had] already ceased to exist!" said Pua.

This follows the public admission by the International Petroleum Investment Corp (IPIC) and its unit Aabar that it did not own Aabar BVI, and that neither has received payments from Aabar BVI nor has IPIC or Aabar assumed any liabilities on behalf of Aabar BVI, to which 1MDB had made RM3.5 billion in payments.

IPIC and Aabar had also said publicly available records showed that Aabar BVI was wound up and dissolved in June 2015.

Arul Kanda reiterated today given the recent denial by IPIC and the announcement by the Office of the Attorney-General of Switzerland "indicating that 1MDB could be a victim of fraud", 1MDB is exploring all avenues open to the troubled state investment fund, which has racked up RM50 billion of debt as at January 2016.

(Editor's Note: There was a typo in the earlier headline which should have read as above. We apologise for the error.)