This article first appeared in Personal Wealth, The Edge Malaysia Weekly on March 27, 2017 - April 2, 2017

Need to transfer money abroad, but worry about the hidden fees that a bank may charge? TransferWise could be the solution as the application allows users to remit funds easily, securely and at a low cost.

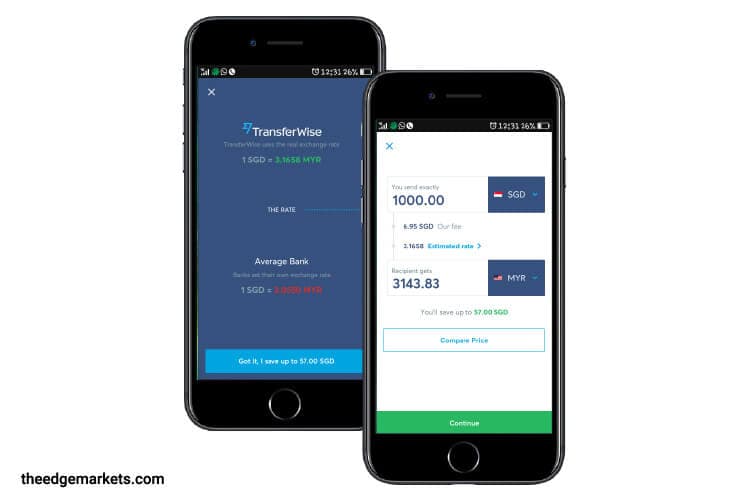

According to its website, the exchange rates used by banks and money changers have been marked up, so you could be paying more than you should. On the other hand, TransferWise uses real exchange rates, or mid-market rates.

“By using real exchange rates, there are no sneaky hidden charges. You pay the lowest possible fee, which is clearly shown up front. It is smarter than the old world banking system and completely transparent,” says the website.

How does the service work? TransferWise has bank accounts all over the world linked together by its technology. So, to send money from, say, Singapore to Malaysia, just log on to the service and deposit your money into TransferWise’s bank account in Singapore. A fee of S$6 or 0.7% of the amount to be transferred is charged for the transaction. Then, TransferWise’s bank account in Malaysia sends ringgit to the recipient.

According to the website, data obtained independently by US-based leading market research company TNS show that TransferWise’s service could be up to eight times cheaper than that of the average bank. Users can send 19 currencies and receive 41, including the ringgit, pound sterling, Swiss franc, Swedish krona, yen, Australian, Canadian, Hong Kong, New Zealand, Singapore and US dollars.

TransferWise currently has more than a million users worldwide and some £800 million is transferred each month. The app can be downloaded for free from the App Store or Google Play. The service can also be accessed via its website, transferwise.com.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.