This article first appeared in The Edge Financial Daily on June 27, 2019

KUALA LUMPUR: Analysts are rather mixed on their outlook on the country’s inflation for 2019, with some expecting it to trend higher towards the end of the year, while others forecast inflation growth to be slower than last year.

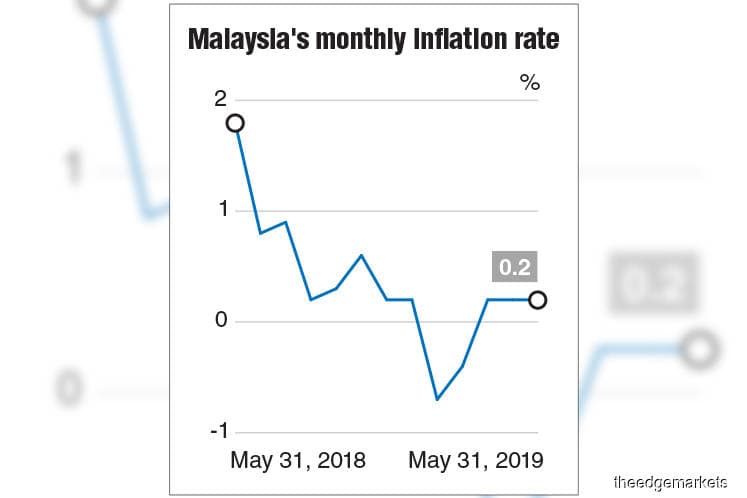

According to the Statistics Department, Malaysia’s inflation rate rose 0.2% in May, the same pace as seen in the previous two months.

On a month-on-month (m-o-m) basis, the consumer price index (CPI) grew 0.2% as compared with April 2019. The CPI for the January to May 2019 period, meanwhile, saw a 0.1% decrease compared with the same period last year.

MIDF Research said the prices of food, housing and utilities were the main contributors to the increase during the month, as compared to transport prices which continued to drop, albeit at a slightly slower pace.

It explained that food and non-alcoholic beverages, which account for 29.5% of the CPI’s weightage, saw a 1.2% year-on-year (y-o-y) increase, in line with higher demand amid the Ramadhan and Aidilfitri festivities.

The trend in food prices is expected to continue into June 2019, especially for fresh food items, amid the Aidilfitri celebrations.

Meanwhile, MIDF pointed out that the retail fuel prices for RON95 saw negative growth of 5.5% y-o-y for the second consecutive month and will continue to decline if prices remain capped at RM2.08.

“Looking ahead, Malaysia’s consumer inflation is likely to stay low following the lower capped prices of RON95 and diesel at RM2.08 and RM2.18 per litre respectively. Nevertheless, demand-pull factor remains firm amid a stable job market and steady wage growth,” it said.

The research house sees inflation averaging at 0.6% for 2019, versus last year’s 1%, as it expects slow growth in food and transport inflation. It does not expect any change in Bank Negara Malaysia’s (BNM) monetary stance.

On the other hand, CIMB Investment Bank economist Michelle Chia expects headline inflation to average 1% in 2019, as she sees inflation rising in June as the elevated base effect of the goods and services tax (GST) dissipates.

“Price pressure should remain benign, nonetheless, amid various policy measures and close monitoring by the government to reduce cost of living pressure. Note that the m-o-m change in CPI has not exceeded 0.5% since the Pakatan Harapan government assumed office in May 2018,” she wrote.

While most analysts expect no change in the central bank’s monetary policy, Chia expects another rate cut by BNM in the second half of 2019 (2H2019) to 2.75% as slowing global growth weakens Malaysia’s growth outlook going into 2020.

Similarly, UOB Malaysia senior economist Julia Goh expects headline inflation to trend higher in 2H2019, albeit at a benign level.

“Headline inflation is likely to trend higher in 2H2019 but at a measured pace, bringing the full-year headline inflation rate up to 1.5% from 1% in 2018,” said Goh.

One of the factors that could contribute to the forecasted increase in inflation rate include the sugar tax on soft drinks and juices effective July 1, although this is projected to be minimal and one-off.

The economist said the tax could lift headline inflation by 0.1 to 0.2 percentage points.

On the overnight policy rate, Goh does not see BNM cutting the rate in 2H2019, unless the domestic economy shows further signs of weakness and financial conditions tighten further.