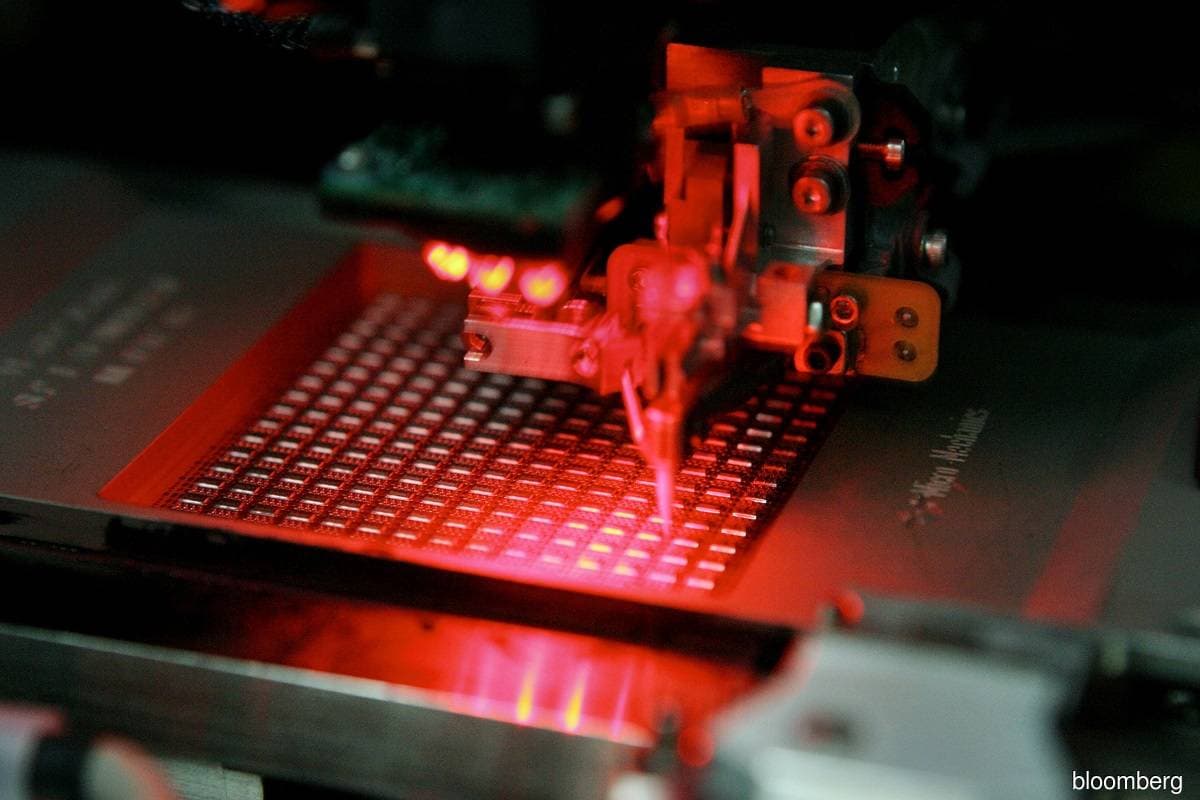

KUALA LUMPUR (June 25): The Malaysian technology sector is thriving on a rare twin supply-demand shock while additional impetus will also come from the progression of US-China trade diversion which results in electronic components production being relocated to other countries including Malaysia, according to UOB Kay Hian Private Ltd.

UOB Kay Hian analyst Desmond Chong wrote in a note today that plans for production relocation due to the US-China trade tension were initially delayed due to Covid-19-driven global movement restrictions.

"However, we understand that the enquiries have resumed as shown by individual corporate news and total approved investments reported by the Malaysian Investment Development Authority," Chong said.

He said this could continue to benefit Malaysia's supply chain over the medium to longer term as local outsourced semiconductor assembly and test (OSAT) and electronics manufacturing services (EMS) companies have received a lot of enquiries from existing and new customers for production transfers.

However, local companies are selective about new job opportunities due to resource constraints and will give priority to products with sustainable demand and profit margins, according to him.

"Amid the booming demand from new technologies alongside tight supply, the global chip giants/foundries, namely TSMC, Samsung and Intel had recently announced massive plans to increase foundry capacities. TSMC will spend US$100b

(about RM415.47 billion) over three years, Samsung will spend US$116b over a decade, and Intel will spend US$20b with construction to start this year.

"Note that this range of capex (capital expenditure) quantum is a few times higher than the normal expansion plan, which indicates that the structural demand could be here to stay," he said.

Chong said UOB Kay Hian maintained its "overweight" call for the Malaysian technology sector.

For OSAT exposure, Inari Amertron Bhd is UOB Kay Hian's top pick and for the EMS segment, UOB Kat Hian likes VS Industry Bhd (VSI), he said.

On Inari Amertron, he said further growth could be spearheaded by potential merger and acquisition activities.

"For EMS, we like VSI as it offers better investment proposition vs peers, with exposure to strategic customers alongside being the clear winner of the trade diversion," he said.

Chong said UOB Kay Hian has "buy" calls for Inari Amertron and VSI with target prices of RM4.30 and RM1.90 respectively.

On Bursa Malaysia today, Inari Amertron's share price rose one sen or 0.32% to RM3.15 at 2.43pm.

VSI increased three sen or 2.29% to RM1.34.