This article first appeared in Corporate, The Edge Malaysia Weekly, on July 4 - 10, 2016.

LOW-COST carrier group AirAsia Bhd has big plans for its venture into the food and beverage business and its recent acquisition of an 80% stake in T & Co Coffee Sdn Bhd (T&CO) seems to be only the tip of the iceberg.

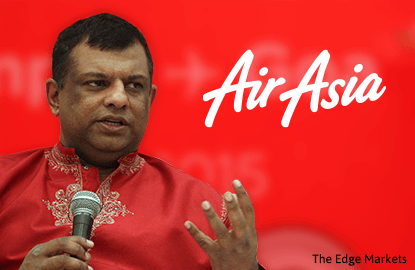

“We want to create an Asean brand for coffee and invest in it,” says group chief executive Tan Sri Tony Fernandes.

“We want to make coffee that is as good as Starbucks and Coffee Bean for on the ground and in the air. We are working on how to dispense coffee from the cart to everywhere. To do this, the business idea needs a bigger corporate driving the platform. Hence, [that is] why we took it (T&CO) over and we are in talks with a big international F&B player for a partnership,” he tells The Edge.

The group’s captain shares that AirAsia is looking to divest 40% of T&CO to the international F&B brand as it has the expertise, distribution and knowledge in the segment. Last Monday, AirAsia announced the acquisition of the stake in T&Co for RM914,000 from its founder Datin Charlene Yeo Ming Ling. T&CO has been supplying inflight coffee and tea solutions on AirAsia flights since December 2013.

“So, the big picture is, there will be three partners in this business parked under T&CO. There is AirAsia, which has access to 60 million customers, a big international F&B player that understands food and drinks and Charlene, the entrepreneurial force who started it,” he says.

The purchase of the T&CO stake will be satisfied by cash of RM814,000 and the remaining RM100,000 by AirAsia credit shell, which may be used to pay for flights on all carriers within the AirAsia Group.

The airline also entered into a shareholders’ agreement with Yeo, her husband Datuk Douglas Cheng Heng Lee and T&CO to govern the parties’ positions as shareholders of T&CO.

Yeo, a University of Melbourne graduate in business and commerce, started T&CO in 2013 and opened its first standalone outlet at Mid Valley Megamall in June 2014, followed by another at klia2 in November last year.

Fernandes says the group is “not far” from building an Asean coffee brand. “We have been talking to some big F&B people. The talks with the international F&B partner are quite detailed already. It is a big Asean conglomerate in F&B. We also plan to bring tea into this,” he adds, declining to name the partner for now.

“I’m all about the Asean brand. We produce the greatest beans here and we don’t have an Asean brand. That’s our idea. There are mixed reviews on where good coffee comes from. We believe the best coffee comes from Asean — Indonesia, Vietnam … We want to create an Asean brand of coffee and invest in it.

“Yes, we have some local coffee brands but no one has taken the brand and made it Asean. AirAsia can be a conduit to it. That is our extra income,” he says.

Fernandes also shares that the bigger idea and plan is for the brand to have its own outlets. “We are also exploring the franchising concept. We will have a strong partner for that. If we can build an F&B business that can tap the franchise business model … that will be great.”

When asked about the timeline for these plans, Fernandes says it is likely to pan out this year. “There is a method to AirAsia’s madness and mind,” he laughs.

Fernandes believes there is a huge upside from ancillary income derived from F&B. “How many in the world can say they have access to 60 million people? We have that captive market.”

“The RM3 sales per customer from food currently can increase to RM10 per passenger if we can provide great coffee and great sandwiches,” he adds.

AirAsia’s food operation on the plane is split into two distinct categories: gourmet inflight menu from its “restaurant in the sky” Santan, and snacks and beverages from T&CO.

For the last few years, Fernandes has been pushing ancillary income per customer dramatically. “From RM20, we said we were going for RM40 and everybody laughed at me. We are there now and I’m currently pushing for RM60.”

“Where do we make money from our customers? They are going to spend it somewhere. Duty free is a big push, foreign exchange as well. We are also working on that.”

Revenue from AirAsia’s ancillary services has been rising steadily over the years. In FY2015 ended Dec 31, revenue increased 11.2% year on year (y-o-y) to RM1.14 billion, representing 18% of AirAsia’s total revenue. The group has three earnings platforms — from its airline passengers, ancillary services and private equity.

In FY2015, AirAsia saw its revenue increase 16% y-o-y to RM6.3 billion, driven by a 10% growth in the number of passengers flown — it reached 24.25 million — as well as an increase in ancillary income per passenger to RM47 from RM46.

Ancillary services is an important source of earnings for airlines as it serves as a buffer against uncertainties in the industry such as fuel price and currency exchange movements.

AirAsia has set up dedicated teams to develop attractive ancillary offerings and ensure good take-up rates.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.