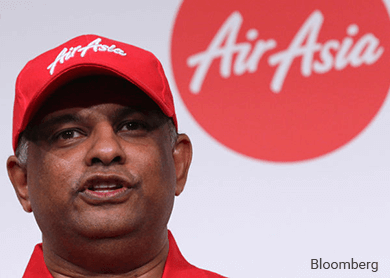

PARIS, France (June 16): AirAsia Bhd group chief executive officer Tan Sri Tony Fernandes has denied the budget airline was rushed into issuing bonds after a report by Hong Kong-based firm GMT Research spooked investors and sent AirAsia shares falling to five-year lows.

Yesterday, Reuters reported Fernandes as saying in a letter to investors that the airline plans to issue as much as US$300 million in convertible bonds at its loss-making Philippine and Indonesian associates.

Fernandes said the airline is already in talks with certain parties for the US$300 million bonds issue that is expected to happen within three months, and plans to use half of the proceeds to reduce debts at its Philippine and Indonesian associates.

He also said he is confident of the proposed bond issue take up rate despite skepticism from analysts.

"We may capitalise some of it before their initial public offerings (IPOs) to maintain our 49% stake (in both Philippines AirAsia and Indonesia AirAsia)," he told Malaysian journalists at the Paris Air Show here today.

He added that Philippines AirAsia's and Indonesia AirAsia's listing plan remains intact, despite reported delays to 2017.

In his letter to investors seen by Reuters, Fernandes had also wrote that AirAsia may sell and lease back up to 20 aircraft in the group's fleet this year.

Fernandes also defended AirAsia's transparency in its financials and its business model, adding that he was "not overly concerned" about AirAsia's share price dip after GMT Research issued a report on June 10 questioning the airline's accounting practices.

"We stand by our accounts. We stand by our transparency. We stand by our business model. We stand by our strategic region of what we are trying to do," he said.

He added that the issues raised by GMT Research were not "something new" and had been discussed previously.

Shares in AirAsia (fundamental: 0.2; valuation: 1.4) extended losses to close down 8.38% at RM1.64 today, with 33.15 million shares traded. Its market capitalisation stood at RM4.56 billion.

Meanwhile, AirAsia has been named the World’s and Asia's Best Low Cost Airline for the seventh consecutive year at the Skytrax World’s Airline Awards held at the Paris Air Show today.

(Note: The Edge Research's fundamental score reflects a company's profitability and balance sheet strength, calculated based on historical numbers. The valuation score determines if a stock is attractively valued or not, also based on historical numbers. A score of 3 suggests strong fundamentals and attractive valuations.)