AirAsia X Bhd

(April 7, RM 0.455)

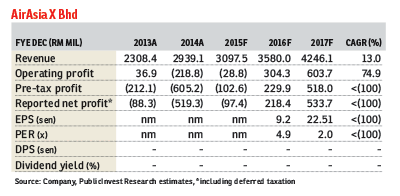

Maintain neutral with target price of 54 sen: AirAsia X Bhd (AAX) took the initiative to strengthen its charter and wet lease businesses to help improve its revenue. In its financial year ended Dec 31, 2014 (FY14), the charter/wet lease income was three times higher than in FY13, which mitigated lower income from scheduled flights. The group emphasises its strategy to boost its ancillary income, which has contributed 36% of revenue in FY14.

Ancillary income has grown from RM292.8 million in FY10 to RM1.05 billion in FY14 (four-year compound annual growth rate of 37.5%). We expect the first half ending June 30, 2015 (1HFY15) will still be a challenging period for the group due to seasonality factor. The group is in the midst of streamlining its costs by merging ground operations and engineering within the AirAsia group, terminating loss-making routes — Adelaide and Nagoya — and benefiting from lower fuel price.

AAX is currently exploring new routes to Europe and Hawaii. It was reported recently on the news that the routes are expected to commence in December. According to group chief executive Tan Sri Tony Fernandes, AAX had started the application process to fly to Hawaii. By having these new routes, we anticipate AAX to improve its yields.

AAX has proposed to raise up to RM395 million via rights issue. At this low price level, shareholders will likely subscribe to the rights issue to avoid any dilution of shareholding percentage. We expect the announcement for the entitlement will be in the near term following its estimated timeline.

Our “neutral” recommendation is maintained but at a lower target price of 54 sen, based on discounted cash flow valuation, as we roll over our valuation and adjust the fleet size accordingly for FY15 and FY16 as most aircraft deliveries will be deployed to its associates — Thailand AAX and Indonesia AAX. We expect AAX to benefit from lower fuel prices, better capacity management and gradual improvement in yields. — PublicInvest Research, April 7

This article first appeared in The Edge Financial Daily, on April 8, 2015.