This article first appeared in Corporate, The Edge Malaysia Weekly, on April 18 - 24, 2016.

INTERNATIONAL investigations into the billions of dollars of transactions involving 1Malaysia Development Bhd appears to be picking up, going by the newsflow in the past two weeks.

The open spat between 1MDB and two of its partners over a missing US$3.5 billion has spiced things up further.

Here we recap and explain the newsflow of the past week or so:

1. April 7: The CEO of Switzerland’s Financial Market Supervisory Authority Mark Branson said investigations into Brazil’s Petrobras and Malaysia’s 1MDB point to “clear cases of corruption” and money laundering. “The extent of the cases and the sums involved are vast. We are talking about cash flows amounting to several billion US dollars, with individual transactions running into hundreds of millions,” he said.

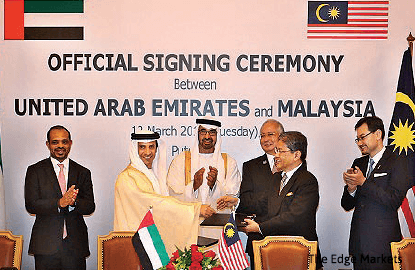

2. April 11: Abu Dhabi’s International Petroleum Investment Corp (1PIC) and its subsidiary Aabar Investments PJS (Aabar) denied that they had received US$3.5 billion from 1MDB. They said Aabar Investments PJS (Aabar BVI), which 1MDB said the money was paid to, was not part of IPIC.

In an immediate response, 1MDB expressed surprise at what 1PIC had said.

The money was a security deposit to be paid to IPIC for co-guaranteeing two bonds totalling US$3.5 billion that Goldman Sachs raised for 1MDB to buy power plants from Genting Group and Tanjong Plc in March, 2012. Also in March, 2012, 1MDB and Aabar signed a US$5.0 billion strategic investment agreement. In the same month, the imitation company, Aabar BVI, was also set up.

3. April 12: The Office of the Attorney-General of Switzerland (OAG) said that it suspects that money paid for the guarantee of the bonds had benefited “two public officials” and a motion picture company. The OAG added that it has extended criminal proceedings against two former officials in charge of Abu Dhabi’s sovereign funds on suspicion of embezzlement.

Although OAG did not name them, the two are believed to be former IPIC CEO/Aabar chairman Khadem Al Qubaisi and former Aaabar CEO Mohamed Badawy Al Husseiny. They are believed to have started Aabar BVI.

Khadem is a close friend of Low Taek Jho (Jho Low).

The movie company is said to be Red Granite Pictures, which produced The Wolf of Wall Street. Red Granite had previously said that the movie was financed by Mohamed Badawy.

4. April 13: 1MDB president and group executive director Arul Kanda Kandasamy conceded that there could have been fraud in the payment of the US$3.5 billion to Aabar BVI. He had previously insisted that 1MDB’s woes were due to a wrong business model rather than wrongdoings.

International investigators are also said to be closing in on other 1MDB transactions including US$1.83 billion that were invested with the Saudi company PetroSaudi International Ltd between 2008 and 2012. Although 1MDB had insisted that the original sum grew to US$2.3 billion that was eventually invested in funds managed out of the Cayman Islands, there have been serious doubts about the actual value of the funds.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.