This article first appeared in Enterprise, The Edge Malaysia Weekly on July 9, 2018 - July 15, 2018

Most small and medium enterprises (SMEs) welcome the implementation of the Sales and Services Tax (SST) in September.

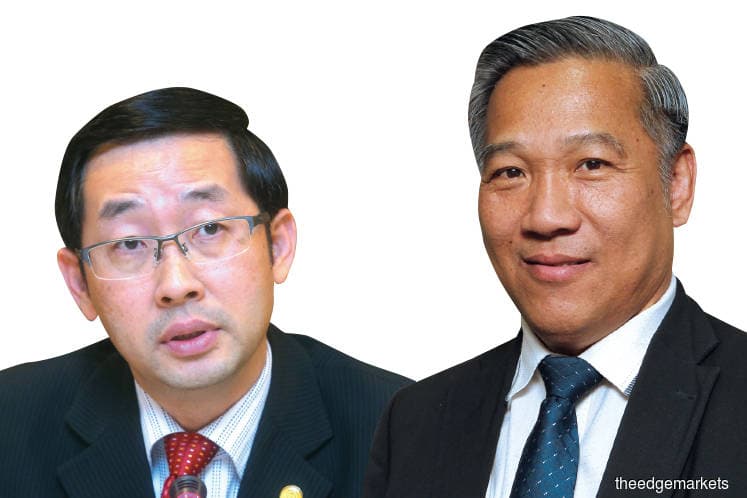

SST could reduce the cost of doing business as it is a less complicated tax system than the Goods and Services Tax (GST), says Koong Lin Loong, chairman of the SMEs and human resources development committee at the Associated Chinese Chambers of Commerce and Industry of Malaysia (ACCCIM). “The reduction in the cost of doing business will mainly come from the lower compliance costs,” he adds.

Koong says business owners will be able to record transactions easily without the input and output tax mechanism under GST. Even companies that make unintentional mistakes could be penalised by the Royal Malaysian Customs Department under the previous tax regime.

“Business owners will be able to do it [record the business transactions] in an accounting book. They could do it manually if they wanted, without any software. It will be much simpler,” he says.

Distributors and retailers will be excluded from SST as the tax will only be imposed on manufacturers and importers. “The SME industry has a lot of distributors and retailers. So, it is good news for them,” says Koong.

Small businesses with annual sales of less than RM500,000, which are not required to register for GST, will also benefit from the change in tax regime.

“The 6% GST was borne by two parties — businesses that had not registered for GST and the end-consumer. The former had to bear the cost because they could not get a refund for their input tax. But under SST, small businesses will not have to pay input tax. Thus, it reduces their cost of doing business,” says Koong.

Datuk Michael Kang, national president of the SME Association of Malaysia, concurs. He says SST could help reduce SMEs’ compliance costs as it is more straightforward than GST.

“You had to hire a consultant and extra employees [to keep track of the input and output tax] with GST. These made up the extra costs. Then, when you did not get the numbers right, even if it was unintentional, you got penalised,” he points out.

Kang says the previous government came out with clear guidelines and directives regarding how the tax should be recorded, paid and refunded under the GST regime. “But many SMEs did not fully understand how it worked. They approached the customs officers, but the officers were not sure. Then, they approached consultants and accountants, but received different answers. In general, SMEs are glad that the new government is replacing GST with SST.”

Same tax rate

While small businesses will benefit from SST, some of the downside will be borne by the government, says Kang. “The government’s tax revenue will fall. The tax system will also be less transparent than before, which could allow businesses to avoid tax more easily.”

Koong says that at its peak, about RM17.2 billion was collected per year under SST while about RM40 billion was collected under GST. This is despite the fact that SST had a rate of 5% to 10% while GST was only 6%. “That is because under GST, businesses at every level of the supply chain were taxed,” he adds.

Kang urges the government to announce the details of SST so that SMEs can prepare accordingly. “We hope the details will be announced by early July. It could be more challenging if they are announced in August as SMEs have a lot of stock and they have to calculate their costs and do the pricing. They will also need time to update their computer system, among others.”

Koong, who has met with the Ministry of Finance on behalf of ACCCIM, hopes that the government will implement a transition period of three to six months after Sept 1 so that SMEs can meet the SST requirements. “We hope there will be no penalty imposed on SMEs during the transition period as they will be adapting to the new tax regime. Businesses have many things to adjust,” he says.

Both Koong and Kang hope the government will maintain the SST rate at about 6% in the near future so that businesses will not need to make huge changes to their product pricing and software system. They say the government could raise or lower the tax rate later, depending on its policies and the economic situation.

Kang hopes the government will simplify the tax regime when SST is reintroduced. “It will be great if we can have only two rates instead of three or more. GST had exempted supply, zero-rated supply and supply that was charged a 6% tax rate. It was complicated and confusing. We hope SST can be simple.”

No profiteering

Koong urges the government, particularly the Ministry of Domestic Trade, Cooperatives and Consumerism, to monitor the prices of goods and services before implementing SST. He says some business owners could anticipate an increase in the tax rate and hike prices, which is unethical and unacceptable. “The ministry should use the Anti-profiteering Act to penalise this group of people,” he adds.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's AppStore and Androids' Google Play.