KUALA LUMPUR: UMW Toyota Motor Sdn Bhd will pass on whatever savings it gains from the government’s implementation of the goods and services tax (GST) to consumers, pledged the company’s president Datuk Ismet Suki.

For now, however, it is uncertain how the GST will impact prices of its vehicles, given the weakened ringgit against the US dollar. Hence, it remains to be seen if any savings will be realised from the imposition of the consumption tax.

“At this point in time, we are not quite sure as to the savings of GST. We have to take into consideration a lot of other factors like the strong US dollar,” said Ismet at the launch of the Lexus NX models here yesterday.

Nevertheless, he assured that “whatever savings we get from GST, we will pass on to the consumers.”

Ismet also admitted that the stronger US dollar may “slightly” dampen UWM Toyota’s financial performance this year, but stressed that its sales performance would remain intact.

“There is still economic growth, so it won’t be detrimental to our sales performance,” he said.

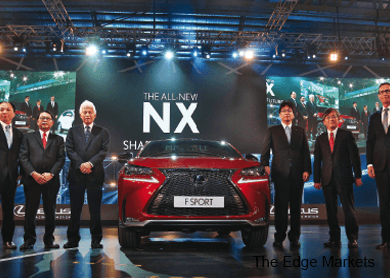

Yesterday, Lexus Malaysia — a division under UMW Toyota — unveiled the “All New Lexus NX” luxury compact for the Malaysian market.

The Lexus NX is offered in five variants that are priced between RM292,000 and RM375,000 per unit without insurance. This includes the top-of-the-range Lexus NX 300h at RM375,000.The other variants are the NX 200t, NX 200t Premium, NX 200t Luxury and NX 200t F Sport.

Ismet hopes the company can sell approximately 2,000 units of Lexus vehicles by the end of this year. He also aims to capture 50% of the market share for the small luxury SUV segment in the country. He said the new Lexus NX and the existing Lexus ES and Lexus RX vehicles will drive sales for the company this year through its strong network of eight outlets across the country.

“We are confident these three models will push us to achieve our target,” Ismet said.

Lexus Malaysia has received 600 orders since the order taking for the Lexus NX began in October last year.

On hybrid vehicles, Ismet told The Edge Financial Daily that automotive players are expected to request the government to extend the incentive period for the vehicles.

He said an extension would attract more players into the hybrid vehicle segment as it would help them recoup their investments. A hybrid car can run using either a petrol engine or an electronic one, both of which are built into the vehicle.

“I think what they [automotive players] want is for the government to deliver what is in the National Automotive Policy [NAP] 2014. Of course, for the hybrids, they expect the government to extend the incentive period. If you come in now, the duty exemption will expire in [end] 2015. So you need this gestation period to recoup the investments. Extension of the duty exemption will be welcomed by all industry players,” he said.

Ismet’s comments came ahead of the NAP 2014 status update today. International Trade and Industry Minister Datuk Seri Mustapa Mohamed is expected to be present at the meeting.

Under the NAP 2014, the government aims to transform Malaysia into a regional hub for energy-efficient vehicles to penetrate the regional and global markets by 2020.

The policy will be accomplished via strategic investments and adaptation of high technology in the domestic market.

UWM Toyota is a joint venture between UMW Corporation Sdn Bhd, Toyota Motor Corp Japan and Toyota Tsusho Corp Japan. UMW Corp is a subsidiary of listed diversified entity UMW Holdings Bhd (fundamental: 2.2; valuation score: 1.2).

Shares in UMW Holdings ended down four sen or 0.4% to RM10.80, giving the firm a market capitalisation of RM12.62 billion.

The Edge Research’s fundamental score reflects a company’s profitability and balance sheet strength, calculated based on historical numbers. The valuation score determines if a stock is attractively valued or not, also based on historical numbers. A score of 3 suggests strong fundamentals and attractive valuations. Go to www.theedgemarkets.com for more details on a company’s financial dashboard.

This article first appeared in The Edge Financial Daily, on January 30, 2015.