This article first appeared in The Edge Financial Daily, on June 23, 2016.

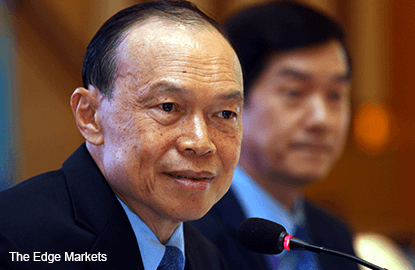

KUALA LUMPUR: Tan Sri Lim Wee Chai is confident that Top Glove Corp Bhd will have another record-breaking year in the financial year ending Aug 31, 2016 (FY16).

In fact, the group’s accumulated profit for the nine-month period ended May 30, 2016 (9MFY16) had already exceeded last year’s annual figure.

However, the share price of the world’s largest rubber glove maker seems to contradict its stellar financial performance. Top Glove’s share price has been on a downward slope, declining almost one-third since the start of the year.

Its share price has slid from its peak of RM6.94 in January to RM4.61 last Friday.

“For the first nine months of this year, our net profit had already exceeded last year’s total, and we still have one more quarter to add to that. So, compared to last year, we will see at least 25% growth in terms of net profit.

“This year will be a record year for us,” said Lim, the single-largest shareholder holding a 29.44% stake in Top Glove at the financial results briefing on Tuesday. Lim expects a net profit growth of over 25% year-on-year in FY16, despite reporting lower-than-expected results for 3QFY16.

In FY15, Top Glove achieved a record-high net profit of RM279.8 million, up 55% from RM180.5 million in FY14. Its annual revenue grew 10% to RM2.51 billion from RM2.28 billion.

For 3QFY16, its net profit fell 14% to RM63.5 million from RM72.7 million in the previous year. The group reported net profits of RM104.6 million and RM128.3 million for 2QFY16 and 1QFY16 respectively.

Analysts noted that the disappointing earnings figures for 3QFY16, which were released last week, had added to selling pressure on Top Glove shares, although most investment analysts, who track the stock, had it on their recommendation list.

Top Glove shares are trading at a price-earnings ratio (PER) in the mid-teen, which some quarters may view attractive.

Top Glove’s historical valuation at peak earnings averaged at between 23 and 27 times PER, according to Kenanga Research. The PER valuation of Top Glove is at 14.7 times, based on forecast earnings for FY17, which has lagged behind Hartalega that is trading at about 20 times forecast earnings for the financial year ending March 31, 2017. “We consider the underperformance unwarranted. The valuation gap should narrow when we consider that Top Glove has higher levels of total capacity and net profit compared to Hartalega,” commented Kenanga Research.

Nonetheless, Maybank IB Research, which has cut its earnings forecast, commented that the earnings figures for 3QFY16 were “exceptionally weak and below expectations on a convergence of negative factors”.

“The results are below expectations as we do not expect earnings to significantly strengthen in 4QFY16. The first interim DPS (dividend per share) of six sen declared (versus eight sen in FY15) was below expectations,” wrote Maybank IB Research in its review of Top Glove’s financial earnings in 3QFY16, noting that the glove maker’s earnings before interest, taxes, depreciation and amortisation margin has shrunk sharply to 14% from 18.3% a year ago.

Meanwhile, TA Securities analyst Wilson Loo said: “The group was making good profits in 4QFY15, 1QFY16 and 2QFY16, but a confluence of negative factors in 3QFY16, such as a weaker US dollar, [a] rise in natural latex prices and the natural gas price hike in January had profoundly affected their performance and affected the sentiment on the stock.

“Also note that Top Glove has a very heavy latex product mix. With its natural latex procured [with] the ringgit, there was no natural hedge to rising latex prices in 3QFY16,” Loo added, noting that the good results seen in the first two financial quarters were boosted by a stronger US dollar during the period.

However, he expects the group to perform better in the coming quarters, with the commencement of operations for an additional 28 lines it is adding to its F27 and F6 factories in Port Dickson, Negeri Sembilan, and Phuket, Thailand, respectively.

The group will also complete its new factory, F30, in Klang by February 2017. Upon completion of the expansion exercise, the group will have an additional production capacity of 7.8 billion pieces per year, bringing its total capacity to RM52.4 billion.

“[The] next quarter will be better for Top Glove, as the group will have better plants and demand is expected to be healthy. However, there will be some impact due to a hike in the minimum wage effective July, as well as the natural gas cost hike, which could affect performance,” said Loo, adding that Top Glove’s earnings are expected to normalise going forward.