This article first appeared in The Edge Financial Daily, on April 11, 2016.

PERTH: Time is running out for Sona Petroleum Bhd to secure its proposed qualifying asset (QA). The company is now going all out to convince its shareholders to vote for the deal.

The special-purpose acquisition company (SPAC) was listed on July 30, 2013. This means the deadline for the company to complete its QA is on July 30 this year. If it fails to do so, Sona will have to be liquidated and return all the money in the trust account — amounting to RM495 million as at Dec 31, 2015 — to its shareholders in accordance with Securities Commission Malaysia’s (SC) Equity Guidelines.

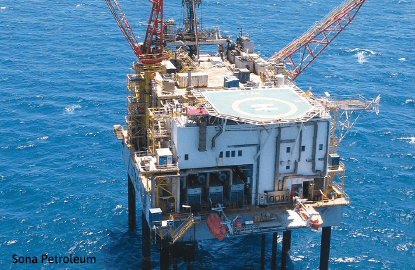

The QA that the SPAC is trying to get its shareholders to approve is the Stag oilfield assets in Western Australia. It proposes to acquire a 100% stake in Stag from Quadrant Northwest Pty Ltd and Santos Offshore Pty Ltd for US$25 million (RM98 million).

“There are messages that were not conveyed in the same means to the shareholders,” Sona managing director Datuk Seri Hadian Hashim told the press during a media trip to the Stag oilfield last week.

“We are continuously engaged with them and explaining to them why we are doing this (acquiring the assets),” he said.

“However, I would like to stress that we will not emphasise any specific shareholders, but are looking at every single shareholders at large,” he added.

On March 30, Sona adjourned its extraordinary general meeting (EGM) at the 11th hour, saying shareholders were unclear about the company’s proposed capital repayment of RM80 million.

Hadian said Sona will reconvene the EGM on April 26 for shareholders to decide on the QA deal.

It certainly is a major challenge for the company as the proposal requires 75% shareholder approval. Shareholders who do not support the resolution will be given back their cash value per share.

Certain factions have voiced concerns about the QA’s quality and the company’s ability to secure an extension of the licence for the Stag oilfield after the current term expires in 2018.

Brushing off these concerns, Hadian said: “The equity investment return ratio of more than 15% from the assets to be acquired far exceeds the current cash yield … they could get based on today’s market price.”

Mark Robertson, the managing director of Sona’s subsidiary Sona E&P (Perth) Pty Ltd, said the Stag oilfield is currently producing 4,000 barrels of oil per day (bpd), which he thinks can provide the company guaranteed immediate earnings. He explained that the Stag oilfield is located in shallow waters, which helps keep its cost of production low.

“Our (current) cost of production of US$30 is a reasonable margin below the Brent crude price of US$40, even before pricing in the premium over Brent of about US$1.50 given Stag oilfield’s higher quality oil.

“Additionally, we are cautiously optimistic that oil prices will rise, and we will be developing the asset to reduce cost of production by a further 10% to 20%” he said.

According to Robertson, the total operating cost last year stood at US$52.5 million and the company is targeting to reduce the amount by 10% this year and a further 5% to 10% in 2017.

Going forward, Robertson said the company intends to undertake infill development, estimated to cost US$110 million.

This is to be implemented from 2016 to 2018 and is expected to increase reserves and total production by over 35%.

Robertson said the infill development will increase production to 4,400 bpd and 5,300 bpd in 2017 and 2018 respectively. On the extension of operating licence, Robertson is optimistic about a renewal being approved, as to date there have been no cases of the Australian regulators rejecting an application for extension. “We have the expertise and we are complying with all criteria set by the authority ... I don’t think that is a problem,” he said.

Stag Crude is a heavy (API 19), low-sulphur (0.14%), low pour point crude oil with over 50% distillate content. It is usually traded at US$4 or US$5 premium against the Brent Crude.

Sona in 2013 raised a total of RM550 million in the retail and institutional offering through the public issue of 1.1 billion new shares with warrants on the basis of one warrant to every one public-issue share. In June 2014, it proposed to acquire two oil and gas blocks from London-listed oil exploration and production firm Salamander Energy plc in the Gulf of Thailand for US$280 million.

But the plan was later scrapped following London-listed Ophir Energy plc’s proposal to buy Salamander via a share swap. Subsequently, it proposed the purchase of Stag oilfield for US$50 million, which independent valuation firm Gaffney, Cline and Associates (Consultants) Pte Ltd and the SC deemed as overpriced. Sona then brought the deal back to drawing board and successfully slashed the acquisition price by half to US$25 million.

Shares in Sona Petroleum closed trading last Friday at 45 sen, bringing its market capitalisation to RM634.82 million. The current price represents a five sen discount to its initial public offering price of 50 sen a share.