This article first appeared in The Edge Financial Daily, on May 26, 2016.

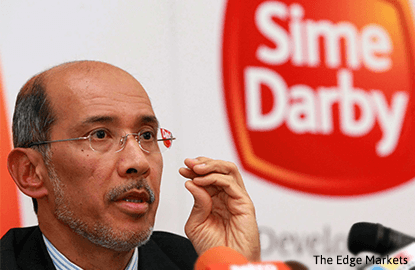

KUALA LUMPUR: The dry weather in the past few months due to the El Nino phenomenon has severely affected the yields of Sime Darby Bhd’s plantations, said its president and group chief executive Tan Sri Mohd Bakke Salleh.

Speaking at financial results briefing yesterday, Bakke said expectations are rife for crude palm oil (CPO) prices to trade upwards, following a drop in production among planters. He said so far, the increase in prices is not commensurate with the drop in production.

“Competing oils such as soybean have been doing very well in terms of production, although latest reports coming out of Brazil and Argentina say that harvesting may be affected by the wet weather,” he said.

Consequently, the conglomerate’s earnings, which are heavily dependent on oil palm plantation, did not fare well in the third financial quarter ended March 31, 2016 (3QFY16).

The plantation division recorded a 32% drop in profit before interest and tax (PBIT) of RM91.9 million in 3QFY16 from RM134.7 million in 3QFY15 as a result of poor harvest.

Sime Darby Bhd’s net profit surged 60% to RM663.44 million or 10.5 sen a share in 1QFY16 from RM414.62 million or 6.68 sen a share a year ago, boosted by divestment gains from the sale of two assets in Singapore.

Revenue grew 2.3% to RM10.23 billion in 1QFY16 from RM10 billion in 3QFY15.

Its operating profit came in at RM835.7 million in 3QFY16 compared with RM831 million in the previous corresponding quarter. However, excluding disposal gains of RM406.3 million, the conglomerate’s quarterly operating profit would be substantially lower at RM429.4 million.

For the nine-month period ended March 31, net profit declined 11.2% to RM1.27 billion or 20.35 sen a share from RM1.43 billion or 23.33 sen a share previously. Revenue increased 4.44% to RM32.23 billion from RM30.86 billion.

The fresh fruit bunch (FFB) production in Malaysia and Indonesia declined by 13% and 5% respectively in 3QFY16 against that in the previous corresponding quarter, according to Mohd Bakke.

However, the group’s overall FFB production increased by 3% for 3QFY16 with New Britain Palm Oil Ltd contributing a FFB production of 0.4 million tonnes.

The average CPO price of RM2,200 per tonne realised in 3QFY16 was marginally lower compared with RM2,209 a year ago.

Mohd Bakke said looking at a three-month window period, the group is expecting CPO prices to trade between RM2,500 per tonne and RM2,700 per tonne.

“Overall demand has been affected because consuming countries’ economy is facing challenges or going through consolidation,” he explained.

Nonetheless, Sime Darby is seeing higher demand for its sustainable palm oil supplies from multinational companies (MNCs), following the suspension and withdrawal of two peers from the Roundtable for Sustainable Palm Oil (RSPO).

“There has been an increase [in demand] ... in terms of demand coming from large MNCs, we are certainly able to provide certifiable oil,” said Mohd Bakke.

He noted that the disputes over the RSPO had also pushed up the premium for crude palm kernel oil (CPKO).

IOI Corp Bhd saw its RSPO certificates suspended on April 4, following a complaint from Aid Environment on April 3 last year regarding its plantation subsidiaries in Indonesia — PT Sukses Karya Sawit, PT Berkat Nabati Sawit and PT Bumi Sawit Sejahtera — for allegedly violating several RSPO principles and criteria.

Felda Global Ventures Holdings Bhd, the world’s largest CPO producer, also withdrew its RSPO principles and criteria certificates at its 58 palm oil mills, citing sustainability issues that needed to be tackled among its smallholders.