This article first appeared in The Edge Financial Daily, on May 13, 2016.

KUALA LUMPUR: RHB Capital Bhd (RHBCap) wants to venture into commercial banking in Indonesia despite the current tough operating environment that its peers Malayan Banking Bhd and CIMB Group Holdings Bhd are facing there.

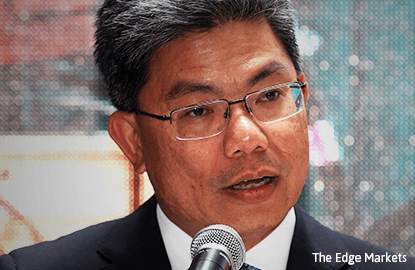

The country’s fourth largest lender by assets is eyeing merger and acquisition (M&A) opportunities to start its commercial banking business in Indonesia, according to its managing director Datuk Khairussaleh Ramli.

However, the banking group has yet to find a M&A candidate. “We look at opportunities etc ... but nothing that we can be seriously excited about at the moment,” said Khairussaleh.

“We have investment bank, asset management, so potentially the big piece missing is commercial [banking business in Indonesia],” Khairussaleh told the reporters after RHBCap’s annual general meeting yesterday.

“We are still very keen [on Indonesia], priority-wise to go to Indonesia,” he said, adding that this is also in line with the Asean Economic Community and Asean Banking Integration Framework themes.

Currently, he said RHBCap has securities and asset management business in Indonesia, making profits of about RM5 million last year, which he described as “still relatively small” to the group’s earnings.

“We have not really been able to do domestic commercial banking business, so that’s one area we will be focusing on. Of course, it’s not for us to go in a hurry. We have our base and our requirements to meet before we can start,” said Khairussaleh, adding that Indonesia constitutes one third of the Asean gross domestic product and its population.

Khairussaleh said overseas business contributed 14% to its revenue, which translated into about RM866.74 million. RHB Cap posted a revenue of RM6.19 billion in the financial year ended Dec 31, 2015 (FY15).

“For commercial banks, we have a presence in Singapore, Thailand and Cambodia. As for investment banks and securities, the group has a presence in Indonesia, Singapore, Cambodia, Thailand and Hong Kong,” he said.

Domestically, Khairussaleh expects loan growth to moderate further this year compared with last year’s.

“For us the loan growth is not the main focus especially in this challenging environment. We focus on asset quality, making sure that we have sufficient capital to go through [a] challenging environment as well as improving productivity and efficiency,” he noted.

He foresees that the small and medium business and mortgage loans to see positive growth while corporate business to slow down.

“Basically a lot [of the mortgage loans] were from previous stocks. We have been approving progressive loans [from] quite a bit few years back. These are all first-time buyers from developers. As the houses are completing, progressive payments come in,” he explained.

Mortgage loans constitute 24% of the bank’s total portfolio.

RHBCap completed the transfer of its entire stake in its subsidiaries to RHB Bank Bhd in April. With the completion of the internal reorganisation, RHB Bank is effectively the new group holding company.

The transfer of the listing status from RHBCap to RHB Bank is expected to be completed by mid-July.