This article first appeared in The Edge Financial Daily, on October 23, 2015.

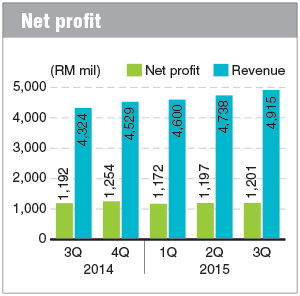

KUALA LUMPUR: Public Bank Bhd’s net profit grew by a marginal 0.8% to RM1.2 billion or 31.11 sen a share in the third quarter ended Sept 30, 2015 (3QFY15) from RM1.19 billion or 31.88 sen a share a year earlier, amid a more challenging operating environment, and subdued sentiment and confidence.

In a filing with Bursa Malaysia yesterday, Public Bank attributed the improved earnings to higher net interest income, foreign exchange income, and net fee and commission income, partially offset by increased operating expenses and loan impairment allowances.

Revenue for 3QFY15 rose 13.7% to RM4.91 billion from RM4.32 billion in 3QFY14.

For the nine-month period (9MFY15), Public Bank saw its net profit rise 9.3% to RM3.57 billion or 92.44 sen a share from RM3.26 billion or 91.16 sen a share a year earlier.

Revenue for 9MFY15 was up 15.6% at RM14.25 billion compared with RM12.33 billion in 9MFY14.

Public Bank said gross loans grew by 12.9% to RM268 billion as at Sept 30 compared with RM237.5 billion as at Sept 30, 2014, driven by growth in property financing, financing of passenger vehicles and lending to small and medium enterprises.

Customers’ deposits climbed 10.4% for the last 12 months to RM296.3 billion as at Sept 30, which partly contributed to the higher net interest income for the current quarter under review. The group’s impaired loan ratio also further improved to 0.53%.

Going forward, the group expects the banking sector to remain strong and supportive of economic activities for the remaining part of this year.

It is of the view that the sector is well-positioned to withstand the current market uncertainty despite the cautious business and consumer sentiment, falling commodity prices, weakening ringgit, and uneven global growth.

“We will continue to ensure that the group’s capital position remains healthy in support of the group’s business growth strategies by balancing the need for higher capital retention in view of the requirements under the Basel III capital regime while maximising our shareholders’ return,” said Public Bank founder and chairman Tan Sri Dr Teh Hong Piow in a statement.

“Our strategies for the Public Bank group is to remain focused on its core retail banking and financing business, while maintaining its prudent credit policies, as well as upholding strong corporate governance,” he added.

Public Bank shares closed unchanged at RM18.64 yesterday, valuing the group at RM71.97 billion.