Petra Energy Bhd

(Dec 18, RM1.67)

Maintain “outperform” with target price (TP) of RM2.40. Petra Energy (PE)’s wholly-owned subsidiary PE Ventures Sdn Bhd (PEV) has announced a proposal to dispose of its entire 51% equity interest in Bumi Subsea Sdn Bhd (BSSB).

The disposal is for a cash consideration of RM430,000, reflecting 312,245 ordinary shares of RM1 each in BSSB. The proposed disposal will allow PE to focus on its existing business, also noting that BSSB has yet to commence business operations and thus do not have any current contracts.

The disposal is expected to be completed by the fourth quarter of financial year 2014 (4QFY14). We do not view this disposal negatively, because we understand the group has taken calculated measures in planning for the growth of their subsea division.

BSSB’s disposal would not have any material effect on PE’s net assets and gearing, earnings and earnings per share (EPS) for FY14. To recall, the group had acquired the 51% stake in BSSB on Aug 27, 2013 at a cash consideration of RM340,000.

The proposed disposal will enable the group to divest its investment and to recover its cost of investment in BSSB. In addition, BSSB will pay PEV a success fee of 3% of the value of any contract awarded to BSSB pursuant to any bids, proposals or tenders submitted by BSSB as attached in the initial share sales agreement signed on Dec 17, 2014.

Drivers for 2015 include the early activation of the TMM contract by Petronas Carigali Sdn Bhd for the Sabah operations. Earnings realisation from the “call-out” basis award is expected by 2QFY15. Higher work orders are assumed for the Pan Malaysia contract; and the Kapal, Banang and Meranti cluster risk service contract sees Kapal and Banang fields collectively producing 20,000 barrels/day, with its capex to be fully reimbursed by end-2014/early-2015. The remuneration fee is expected to be recognised by 3QFY15.

The structure of RSC contracts guarantees remuneration fee to the operator; we are thus comforted that the impact of lower oil price would be minimal. Nonetheless, our estimates have accounted for US$70(RM243)/bbl.

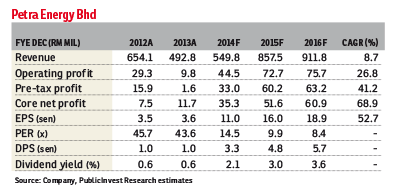

PE’s performance will be buoyed by higher contributions from its integrated brown field maintenance and engineering services and marine offshore support segments. We believe PE is undervalued at this price level, hence we continue to maintain our “outperform” recommendation. — Public Investment Bank, Dec 18

This article first appeared in The Edge Financial Daily, on December 19, 2014.