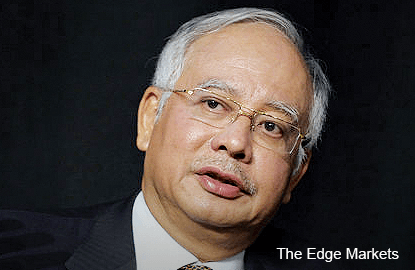

KUALA LUMPUR (March 13): The withdrawal of the Employees Provident Fund (EPF) savings to pay off credit card debts or loan sharks goes against the pension fund's principle of providing retirement savings for its members, said Prime Minister Datuk Seri Najib Razak.

Najib, who is also finance minister, said allowing members to withdraw their EPF savings to settle off such debts will only defeat EPF’s purpose in ensuring members have sufficient savings to cover their commitments, post-retirement.

“The purpose of EPF is to allocate sufficient savings for its members after retirement. The proposal to allow members to take out their savings to repay credit card debts or loan sharks, goes against its objective as a social security organisation to provide retirement savings,” he said in a written reply dated March 9 to a parliamentary question by Batu Kawan member of Parliament Kasthuriraani Patto.

“Additionally, such withdrawals will only lessen one’s total savings and affect the depositor’s plans,” Najib added.

Kasthuriraani had asked if EPF were to allow its members to withdraw a small portion of their savings in accordance with the fund’s guideline, to repay credit card debts and “Ah Long”.

This is not the first time the issue has been raised in Parliament.

In December 2015, Deputy International Trade and Industry Minister Chua Tee Yong — who was then deputy finance minister — had said the government had not decided on allowing contributors to withdraw their EPF savings to pay off credit card debts.

Meanwhile, Najib — quoting official data from the Department of Insolvency — said a total of 119,656 Malaysians were declared bankrupt from 2010 to 2015.

The data also showed the number of indebted Malaysians were rising by an average of 5% per year from 2010 (18,119 Malaysians), to 2014 (22,351 Malaysians), before declining 17.4% in 2015 (18,457 Malaysians).