This article first appeared in The Edge Financial Daily, on April 19, 2016.

KUALA LUMPUR: Malaysia Marine and Heavy Engineering Holdings Bhd (MHB), a 66.5%-owned subsidiary of MISC Bhd, is shifting gears and will start focusing on its marine business this year, amid a slowdown in the offshore oil and gas (O&G) sector.

KUALA LUMPUR: Malaysia Marine and Heavy Engineering Holdings Bhd (MHB), a 66.5%-owned subsidiary of MISC Bhd, is shifting gears and will start focusing on its marine business this year, amid a slowdown in the offshore oil and gas (O&G) sector.

The group posted a net profit of RM43.89 million for the financial year ended Dec 31, 2015 (FY15), almost three times lower than the RM129.93 million recorded in FY14, dragged down by lower contribution from its offshore segment.

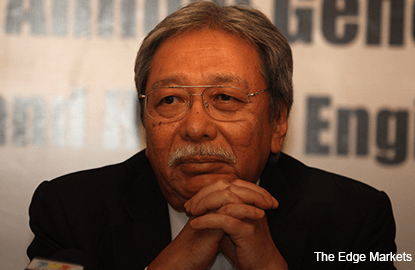

MHB chairman Datuk Nasarudin Md Idris said it is targeting revenue of RM640 million from the marine segment in FY16, up 37% from the RM466.7 million recorded in FY15.

“Certainly, the marine business is something that we wish to expand further [this year]. In fact, the board, together with the management, is looking at the economic feasibility of constructing and operating a third dry dock,” Nasarudin told a press conference after the group’s annual general meeting yesterday.

He said MHB is currently assessing the economic feasibility of building a third dry dock, whether it will provide the kind of returns the group wants.

It was reported that MHB plans to spend RM500 million in capital expenditure for its third dry dock over the next few years.

In FY15, the group saw revenue from its marine segment grow 46% from RM320.8 million in FY14 on the back of higher value of work per project achieved. The marine segment’s operating profit stood at RM77 million, accounting for 63% of the group’s operating profit of RM123.7 million.

As for the group’s manpower, MHB saw a decrease to 3,200 employees in FY15 from 4,200 in FY14.

“The hiring model in the group is based on projects and depends on the workload. Majority of the workforce are on contract basis,” Nasarudin said.

Meanwhile, Nasarudin said the downturn in the O&G industry is expected to prolong and this will impact the group’s offshore segment as clients re-evaluate the viability of new projects and continue to drive costs down.

Replenishment of the group’s order book will be a huge challenge moving forward.

“Large projects will be few and far in between while small projects would be highly contested.

“The tough operating environment in the upstream segment is projected to persist well into 2017 as national and international oil companies continue to reduce their spending on capital and operating expenditure. This will continue to impact offshore business,” he said.

For FY16, Nasarudin said it is difficult to forecast whether the group needs to make further impairment provision if oil prices continue pointing south.

“Some of the impairment can be written back if the outlook improves. If the situation worsens, more impairment might be made,” he added.

“The group’s effort to diversify has borne results with the recent awards of works in the refinery and petrochemical integrated development project [in Johor],” said managing director and chief executive officer Abu Fitri Abdul Jalil.

“MHB remains committed to executing the strategic plan and initiatives laid out earlier to weather this challenging period,” he added.

MHB shares closed down five sen or 3.97% at RM1.21 yesterday, with a market capitalisation of RM1.94 billion.